Reddit’s beloved Snoo is living its best life – 18 years in and the little mascot just scored the ultimate gift: a red-hot stock market debut! ![]() It rocketed 40% on Day 1 in March, then shot up another mind-boggling 220%. Not bad for a platform that has mostly lurked in the shadows since 2005.

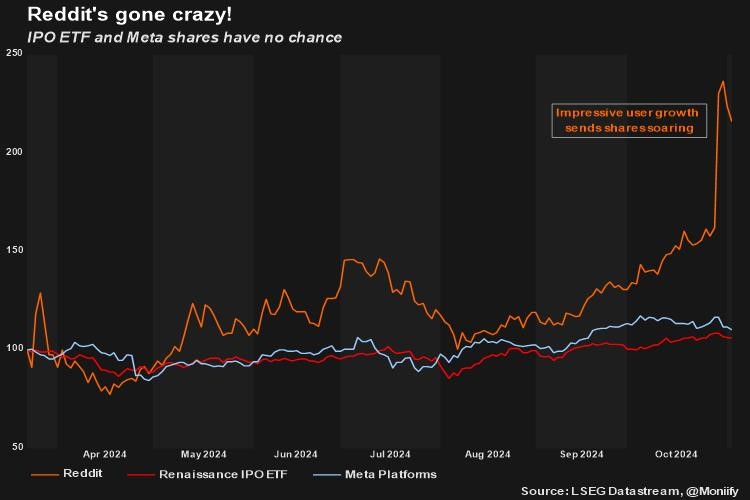

It rocketed 40% on Day 1 in March, then shot up another mind-boggling 220%. Not bad for a platform that has mostly lurked in the shadows since 2005.

Reddit stayed low-key for years until Covid-19 lockdowns launched it into the mainstream. With Facebook feeling old and Quora out of touch, Reddit became the new hangout spot for, well, everyone.

What sparked this rise out of obscurity? TLDR: the GameStop chaos. A flood of users shared stock wins, trading tips and FOMO-fueled moves. Suddenly, a crowd of regular joe traders were teaming up and making Wall Street sweat.

Morgan Stanley calls it a “community of communities,” and that’s exactly what makes Reddit tick. The platform sees its 97 million daily users as “under-monetized”. Translation: there’s plenty more cash to squeeze out of ’em.

A massive 1.5 billion monthly user base? That’s an ad revenue goldmine.

StartledCats and Interesting AF

What makes Reddit different? Few platforms let users dive into hyper-specific groups tailored to their quirks, which is why its user growth tripled between 2018 and last year. By comparison, Quora and Facebook barely managed a 33% boost in five years, according to numbers crunched by Demandsage.

Reddit’s got it all: dogecoin, science, documentaries, cooking, sneakers. Need stock tips? Hit up WallStreetBets. Killing time? Dive into StartledCats or interestingasf**k for endless cat videos and airplane pictures with hijackers. (Yes, that’s real – here’s the proof.)

Welcome to the ultimate rabbit hole.

The ad game’s heating up and with Reddit’s wildly diverse crowd, it might just be the hottest property on the market.

- Reddit’s ad revenue soared 52% last quarter to $315 million, and is now over 90% of its total revenue.

- It became profitable for the first time ever in the third quarter, and revenue and profit growth are expected to rise into next year.

With ad spaces still untapped in comments, search and video, Bank of America’s Justin Post says Reddit’s growth runway looks strong.

Pick or Pass?

Reddit’s stock blew past analyst estimates in just one session last week, but their projections say the next 12 months might be a relative snooze fest – though this could shift following recent earnings numbers. Of the analysts covering Reddit, 11 rate it as a “buy”, five suggest “holding” on, and only one recommends “selling” it.

With a forward price-to-sales ratio of 12.2, Reddit isn’t exactly a bargain. There is no room for slacking, and it’s going to need bigger revenue surprises to keep that momentum going.