Feeding your ChatGPT addiction isn’t cheap — every query burns 10 times more electricity than a Google search.

Yeah, AI is hungry, and it’s feeding a surprising surge in one old skool segment of the market.

Big Tech might be the face of AI, but without power producers, all those data centers would be just big, useless boxes. They’re the real MVPs of 2024, raking in the returns, and the setup for 2025 looks just as electrifying.

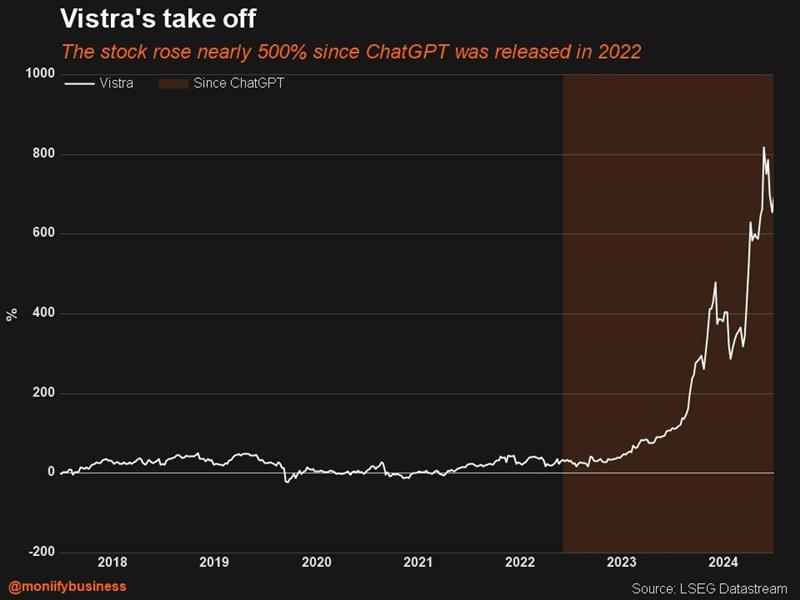

Need proof? Nvidia, the undisputed AI chip king, was dethroned as the S&P 500’s top performer this year by none other than Vistra, a Texas-based power producer.

Its stock has surged over 270% since January, outpacing Nvidia’s 180% gain. It is now the second-biggest gainer on the S&P 500 this year after Palantir, another AI play we wrote all about here.

And Vistra isn’t alone: Constellation Energy and GE Vernova are also lighting it up, with gains of nearly 100% and 160%, respectively. There’s a clear and present trend here.

Read more: Nuclear energy is having a (booming) moment

Bank of America says in its year ahead report that the AI revolution could fuel the first major surge in electricity demand since the early 2000s.

Ready to rage?

Utility stocks — often seen as boring and undervalued — are suddenly hot commodities.

Vistra, the cheapest of all when it comes to power generation, has a forward price-to-earnings ratio of near 20x compared to Constellation Energy’s 25x and GE Vernova’s 50x.

This the power play: cash in on the AI boom without breaking the bank on Nvidia and other big chipmakers. The “old economy” is back and with enviable price tags.

With data center energy demand expected to grow 160% by 2030, Goldman Sachs predicts the biggest expansion in electricity production in decades.

That’s got hedge funds piling in, with Vistra, Evergy and NiSource ranking among their top 20 holdings, according to data from BofA.

Read more: #SnapShot: Oklo is riding the AI wave. Wait, who?

The bigger picture

Even Big Tech isn’t taking chances.

Microsoft and Amazon are doubling down on nuclear power, driving uranium ETFs to new heights. It’s a clear signal: whoever controls the energy controls its AI destiny.

But here’s the catch: after a blockbuster 2024, much of the good news is already baked into these stocks. If Big Tech cuts AI spending or a recession hits, these surging power plays could short-circuit fast.

Profit growth for Vistra and Constellation is already expected to slow after 2025, according to LSEG data, so tread carefully.

Look, power stocks are unsung heroes, fueling the AI and tech revolution one kilowatt at a time. But like any surge, timing is everything. Keep an eye on the fuse.

Edited by Ankush Chibber and Thyagu Adinarayan. If you have any tips, ideas or feedback, please get in touch: talk-to-us@moniify.com