Calling it a ticking bomb is generous. Palantir is trading at a valuation no other stock on Wall Street comes close to. NO OTHER.

Investors are desperate for the next Nvidia, but paying sky-high prices today for possible gains in 4-5 years? That’s a bold bet.

- Price-to-sales? An absurd 50x.

- Price-to-earnings? A wild 168x. The S&P 500? A chill 27x.

- Revenue growth? A modest 20% — nowhere near Nvidia’s stratospheric rise.

Yet in less than three months, Palantir has added $90 billion in market value. Since Trump’s election win, it’s up 94%, making it a retail favorite with a $177 billion market cap.

For this valuation to make even a little sense, Palantir needs to triple revenue to nearly $9 billion — which, at this growth rate, won’t happen before 2028. Even then at 20x sales, it would still be one of the most expensive stocks on the S&P 500.

And that’s just to hold at its current price.

Analysts predict 20-26% annual revenue growth through 2028, with a sudden 67% spike in 2027 — sure, okay. But Jefferies warns that any slowdown could crush the stock’s narrative and trigger brutal valuation compression.

The analyst sentiment? Not great.

- Only three out of 21 analysts rate it a “buy.”

- Five say sell.

- The average 12-month target? $52.11 — a 36% drop.

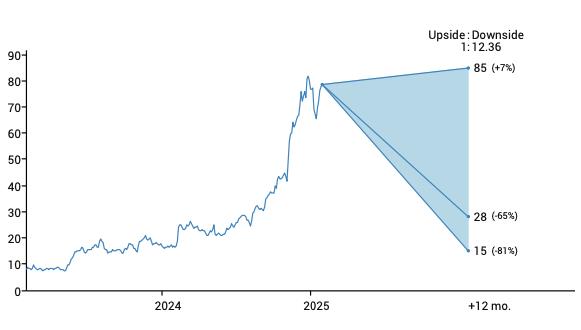

Jefferies’ bear case? $28. That’s a potential 65% wipeout. Just take a look at this chart:

The business itself isn’t bad. Government contracts brought in $320 million last quarter, up 40% over the last year. The commercial side is booming too, with US revenue jumping 54% to $179 million.

But reliance on government money is risky — one budget shift could wreck growth.

Palantir is already locked in as the US government’s AI darling, and Elon Musk’s DOGE initiative could bring even more opportunities. But CEO Alex Karp needs to keep playing the Washington game to stay in favor.

Earnings are coming on 4 February. The bar is way higher now, and Jefferies warns that keeping up this pace is only going to get tougher.

Bottom line: Palantir’s business is solid. Its stock price is completely unhinged.

Edited by Ankush Chibber. If you have any tips, ideas or feedback, please get in touch: talk-to-us@moniify.com