Why? Here’s how chipmaking goes:

- ASML makes the machines that create chips.

- TSMC uses ASML machines to manufacture high-end chips.

- Nvidia – and other tech giants – design and sell final products that power AI, gaming and more.

MOST importantly, neither have any real competitors. ASML has a complete monopoly on cutting-edge tech, almost no competition, and keeps selling bigger, pricier machines, says William de Gale, portfolio manager from BlueBox Asset Management. “It’s set to do great for years to come.”

A steal

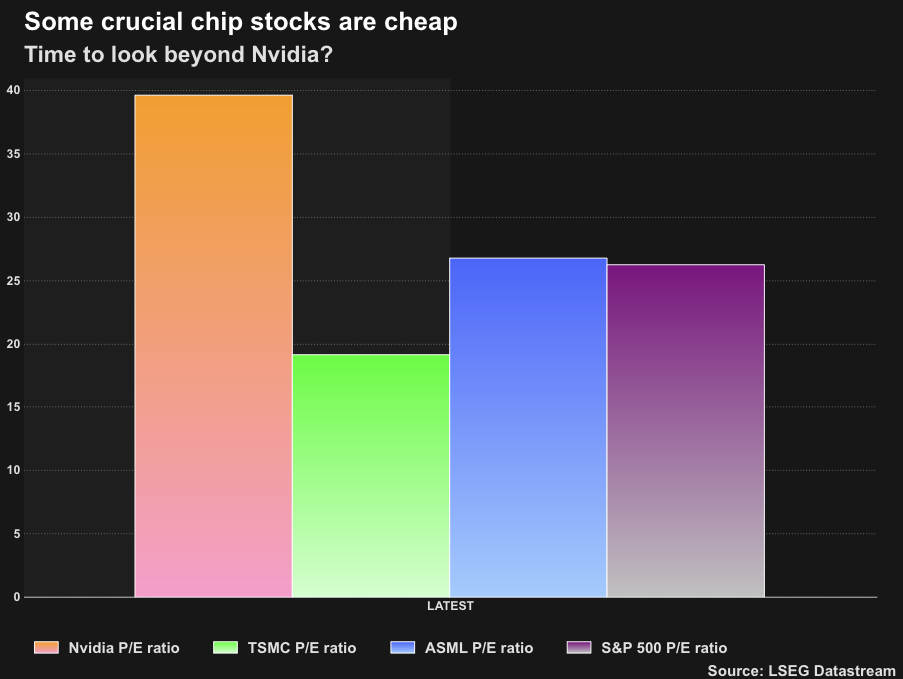

Not only that but compared to Nvidia – these stocks are a steal. Both ASML and TSMC are trading at 30% to 50% below Nvidia’s valuation on a price-to-earnings basis, a measure of the stock’s value against its earnings.

The golden rule for chip stocks? Steer clear if a slowdown is looming. But here’s the twist: while many industries could be bracing for a potential economic slowdown next year, TSMC and ASML aren’t even sweating it.

Why? They’ve got sky-high demand with limited capacity, a good problem to have rn.

The big picture

- The global semiconductor market size is seen doubling to around $1.13 trillion by 2033. That means revenue growth at a faster clip for both ASML and TSMC.

- Last year, TSMC made about two-thirds of its profit from North America. It also held around 56% of the global market share in advanced and specialty chip packaging tech.

YT Boon from Neuberger Berman has TSMC high on his “buy” list for its strong pricing power and growing ties with global tech giants. It’s “one of our favorites,” the senior portfolio manager for Asia, told MONIIFY.

‘Golden Triangle’

When it comes to semiconductors, Asia’s “Golden Triangle” is the backbone of the industry. Taiwan handles chip and server production, Japan supplies critical semiconductor equipment, and South Korea leads in high-bandwidth memory.

These countries are cashing in on growing demand and major foreign investment, Boon adds. “With rising geopolitical tensions, the importance of this Golden Triangle is only increasing.”

And while risks like Taiwan-China tensions remain, TSMC is so essential to the global tech ecosystem that it can weather these storms.

Trump and tariffs? It is a risk, but it would be too costly a blow to the US to tighten the screws on these AI engines. Still, that’s not a given. The president-elect is going to be very unpredictable.

Taiwan produces more than 60% of the semiconductors that power everything from mobile phones, cars to televisions.

If Trump were to impose new tariffs, it would significantly impact the global economy, given that companies like Nvidia, which have driven trillions in wealth through AI and technology sectors, heavily rely on Taiwanese manufacturing. Any disruption could shake markets worldwide.

ASML also faces risks as it counts Asia as one of its fast-growing markets.