The swoosh has dusted off its former executive and sent him back into the game as its captain. His mission? Revive a brand that’s lost its stride.

But here’s the play-by-play: slowing revenue, faster competition, and a Wall Street crowd that’s far from cheering.

Hill had retired in 2020 as president of consumer and marketplace. And he’s walking into a very unlike Nike situation: Shares are down almost 30% this year. Only the second time they’ve fallen so much in the last 30 years.

It has “lost its edge,” says Neil Saunders, managing director of research firm GlobalData. A turnaround seems like a hard climb, he adds.

The numbers back him up. Nike’s revenue is forecast to fall 10% this year, with tepid growth of 1.8% expected next — well below its usual 5%-plus.

Tie-up the laces

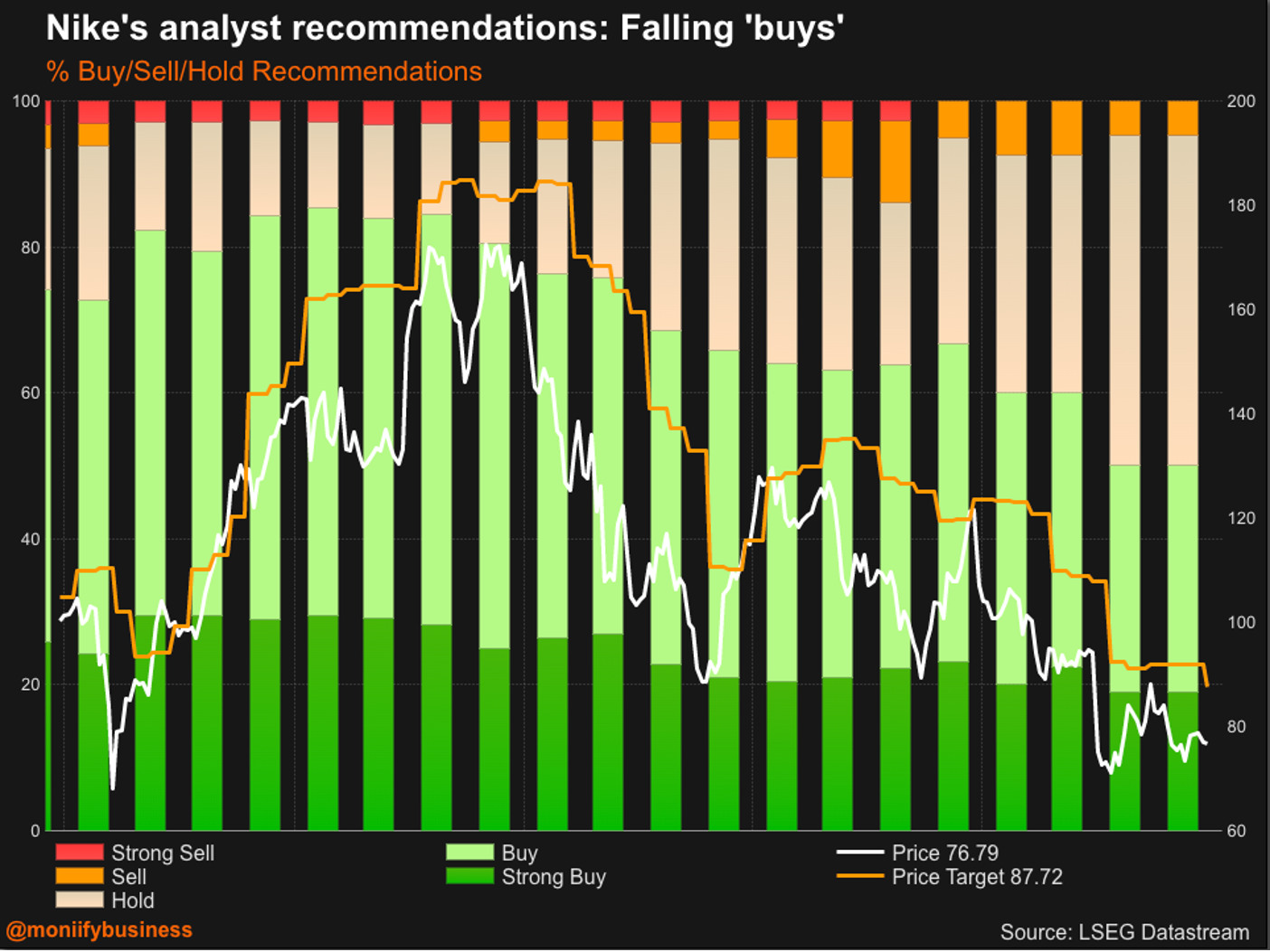

Analysts aren’t entirely out on Nike, though. Half of the 42 analysts covering the stock say “buy,” while most of the rest recommend holding. Only two are bearish, per LSEG data.

But investors aren’t flocking back yet. Missteps in product innovation and a direct-to-consumer strategy under its last CEO flopped hard.

Meanwhile, upstarts like Roger Federer-backed On Holding and Hoka have laced up and sprinted past, stealing shelf space and market share.

Scoreboard: On Holding +101% versus Nike –29%.

Hill isn’t sugarcoating things. He admits Nike “lost their obsession with sport” and is pledging to get back to basics: basketball, running, and premium-priced products that made Nike Nike in the first place.

Patience with a capital P

Things might get worse before they get better. Thomas Hayes of Great Hill Capital says a full turnaround could take 2-4 years, with analysts predicting a rebound only in the second half of 2026.

Why the delay? Clearing unsold inventory, investing in fresh products, and rebuilding brand momentum.

Bank of America’s Lorraine Hutchinson says Nike is “ripping off the band-aid” to fix its inventory issues, especially in North America and Greater China.

All this still doesn’t scream buy. Even as it resets, the stock isn’t cheap, trading at 33 times forward earnings — on par with Adidas, which is just coming out of its own crisis.

Despite the setbacks, Nike isn’t fading anytime soon. For decades, it has set trends and kept athletes ahead of the game. With its massive global brand power and fiercely loyal fanbase, the swoosh isn’t going anywhere.

Hutchinson sees signs of life: summer order books are down only slightly, and there’s buzz around new products in running and training.

Hill has a mountain to climb, but Nike’s been here before. Betting against the swoosh? Risky move.

Edited by Ankush Chibber. If you have any tips, ideas or feedback, please get in touch: talk-to-us@moniify.com