The frenzy around Stargate, the Donald Trump administration’s AI megaproject, has been so crazy that even an obscure biotech stock got mistakenly swept up in the hype.

Metagenomi, which has the ticker $MGX, soared 11% as investors mistook it for the UAE tech fund MGX, one of the initial equity funders for the project to develop artificial intelligence infrastructure in the US.

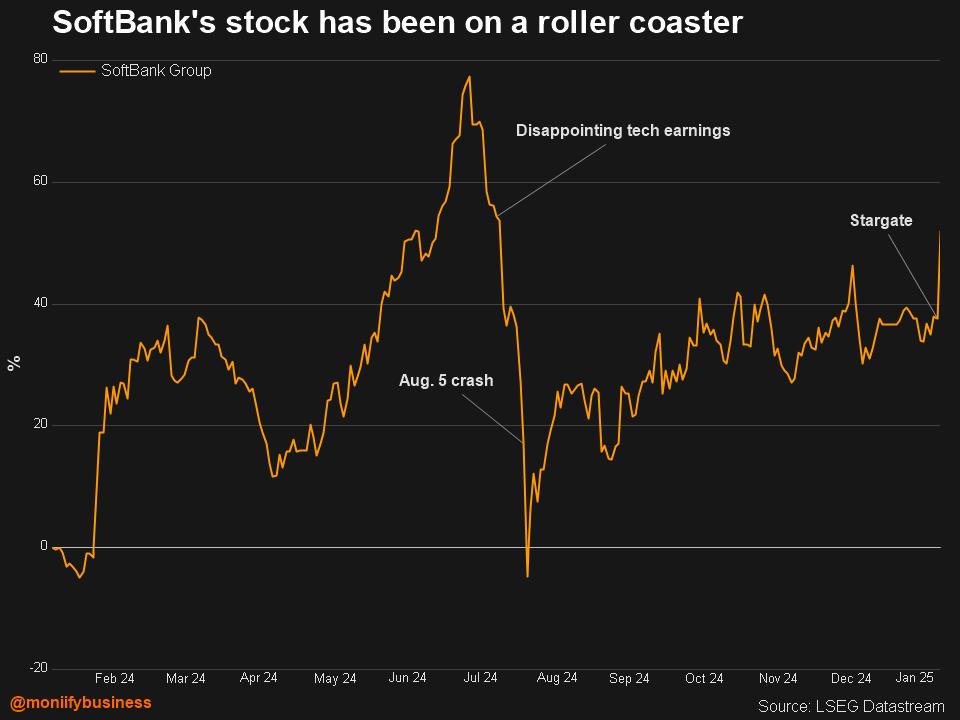

Trump’s unveiling of the major AI joint venture on Tuesday sparked massive excitement in the markets with its big names and headline-grabbing promises. There’d be $500 billion spent over the next four years building new AI infrastructure, with $100 billion to be deployed “immediately,” according to SoftBank founder Masayoshi Son, whose company is funding the project along with OpenAI, Oracle, and MGX.

But even as hundreds of billions in investment flooded into the companies associated with Stargate on the stock markets, Elon Musk – who is not part of the project – cast doubt on whether the funding claims stacked up.

“They don’t actually have the money,” he posted on X, adding the claim that “SoftBank has well under $10bn secured.” That drew a direct rebuttal from OpenAI CEO Sam Altman, who said Musk’s funding claim was “wrong, as you surely know.”

But is the world’s richest man on to something? Going by our analysis of SoftBank, OpenAI and Oracle’s spending habits in the past few years, it might be a stretch to bankroll $100 billion “immediately.”

Read more: Why Sam Altman’s AGI reflections could lead to peril or progress: Opinion

Market frenzy

The excitement around the megaproject has seen a torrent of investment flow into stocks linked to Stargate, with the project’s equity funders and technology partners like Oracle, SoftBank, Nvidia, Microsoft and ARM collectively adding an estimated $460 billion in market cap since the announcement. (MGX, the other equity funder, isn’t listed – hence the confusion for many careless investors.)

But market cap ≠ cash, so this doesn’t mean the money they want to invest is ready.

SoftBank, the leader of the pack, had less than $40 billion in cash and cash equivalents in 2023, according to their annual report. OpenAI is already burning cash. And as for Oracle? It usually doesn’t spend more than $10 billion in capex.

Read more: Trump’s oil obsession is back. But will it pay off this time?

Show us the money

Going by how much cash SoftBank has, it’s unclear where the funds would come from –– stake sales in Arm Holdings or Alibaba, raising debt or selling its shares. All of those aren’t really something a stock investor would rate as good news.

Mark Taylor, a director at investment bank Panmure Liberum, shares Musk’s scepticism, saying the funding numbers being circulated around the project “seem fairly fanciful, but serve their purpose in grabbing headlines.”

“No doubt the US wants to assert itself as an AI-dominant force, and this is good messaging,” he tells MONIIFY.

“But SoftBank would have to sell Arm or Alibaba stakes to fund such a high spending bill. OpenAI certainly doesn’t have $19bn knocking around, and the Microsoft tones, and lack of direct participation, suggest Sam Altman will need to find the money elsewhere.”

“If $100bn is a high hurdle, $500bn is dreaming?” he adds.

Read more: The DOGE man is the wild card in Trump 2.0

That scepticism highlights a broader question: is Stargate more of a financial engineering exercise than a groundbreaking AI initiative? The speed at which investors rallied behind the announcement suggests a willingness to buy into hype over hard details.

MONIIIFY hasn’t heard back from the equity funders in the Stargate JV with requests for comment on the funding, with OpenAI just referring us back to their blog on the announcement. Nvidia’s spokesperson said the company was “delighted to push the limits of computing as OpenAI discovers the next frontier of AI.”

Read more: Looking to Trump-proof your portfolio? Here’s the cheat sheet

Wanna MONIIFY this?

But if you’re looking at getting in on the action around #TeamStargate stocks, here’s what you should know.

SoftBank trades at 36 times forward earnings, a tad pricier than Nvidia –– the AI posterchild.

Nvidia is in the Stargate mix for its world-famous chips. Picking Nvidia over SoftBank seems wise going by the price-to-earnings ratio.

If you’ve got Nvidia fatigue, Oracle could be a decent bet: cheaper and growing faster than SoftBank. The stock trades at 27x earnings, a little higher than Nasdaq 100. Stargate is just noise, Oracle’s anyway seen ramping up sales growth over the next two years.

Read more: Nvidia is giving buy-the-dip vibes

As for those of you who poured money into $MGX? We’re trying to bite our tongues. But the least you should do when you buy a stock is to get the ticker right.

Edited by Tim Hume. If you have any tips, ideas or feedback, please get in touch: talk-to-us@moniify.com