The markets kicked off the year with all the finesse of a rollercoaster in a thunderstorm –– jumping US stocks, a wild ride in the dollar, and big swings in copper. Thank you, Donald Trump!

One moment, Trump’s tariffs are supposedly softer. Next minute, everything’s changed.

The Washington Post dropped a juicy headline on Monday suggesting tariff plans would only cover critical imports, only for Trump to come in hot with his textbook “Fake news!” denial. There are gonna be tariffs, no doubt –– but the scale, the targets and the timeline remain anyone’s guess.

What it all boils down to is a serious lack of clarity around what’s happening with the incoming Trump administration’s plans. Traders are clinging to any scrap of news like it’s a limited-edition drop, hoping for some kind of direction in the never-ending tariff saga.

Read more: Trump tariffs reloaded. America scores, the world stumbles

And then there’s a bond problem.

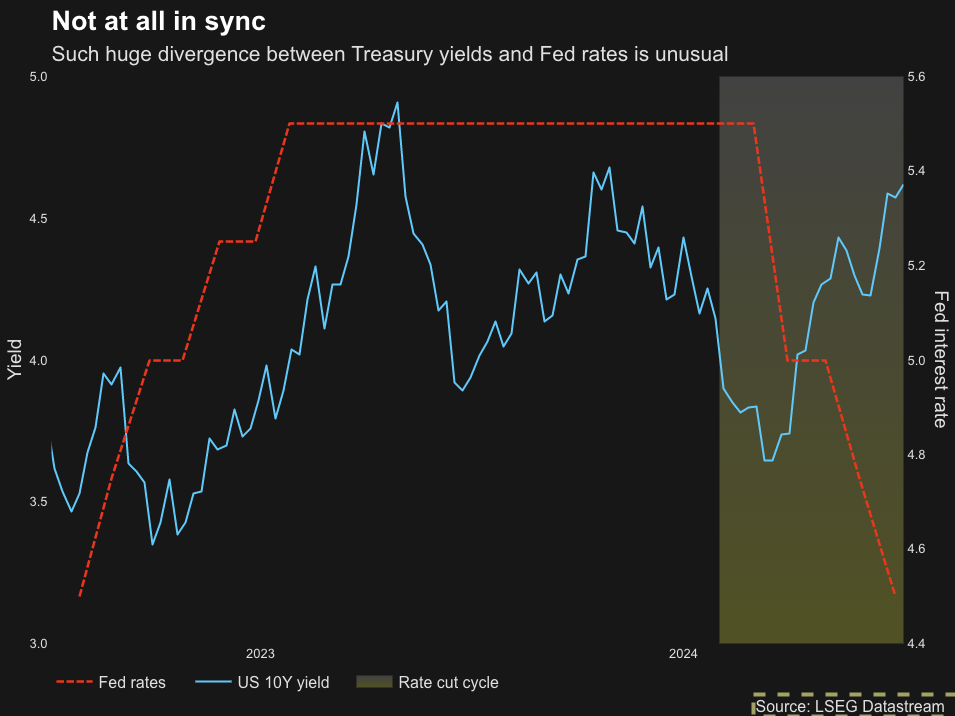

The yields on US Treasuries are rising like a meme stock. The Fed has cut interest rates by a full 100 basis points in the second half of last year, and in the same period, yields on the 10-year notes have gone by the same level. (It’s not supposed to head that way, it should’ve fallen).

“This is highly unusual,” Apollo’s chief economist Torsten Slok writes in a note.

Is it fiscal worries? Is it less demand from abroad? Or maybe Fed cuts were not justified? It’s anybody’s guess and that’s also showing up in bond volatility, and the VIX (Wall Street’s fear gauge) is about to have its own little explosion.

“The market is telling us something, and it is very important for investors to have a view on why long rates are going up when the Fed is cutting,” Slok adds.

Basically, the main worry has been a comeback of inflation, followed by the Fed’s potential pause of rate cuts. Trump’s tax cut plans and tariffs are the reasons behind the change in course.

Read more: What tariffs? Indonesia business is taking a chill pill over Trump 2.0

To make things worse, US stocks are also turning sharply lower now as data showed that US services index –– the measure of prices paid for materials and services –– rose to the highest since early 2023, adding yet another reason for the Fed to sit on its hands.

When the economy is sound and inflation is showing signs of comeback, the Fed wouldn’t want to cut interest rates as this could risk prices to go up further. (More cheap cash in hand = more spending).

Oh, and let’s not forget the VIX. Yep, our old friend the “fear gauge” is back and thriving. 📈 Early-year volatility is always a thing, but this time it’s extra spicy. The market is basically walking a tightrope, hoping for clarity, while dodging the risk of a faceplant.

Read more: The ‘fear gauge’ just blew up. Thanks, Jay!

So here we are, kicking off 2025 with a market that’s part thriller, part comedy, and fully unpredictable.

Trump’s inauguration is less than two weeks away, and the vibes aren’t bullish at the mo. Is that gonna change? Right now, it’s anyone’s guess.

Edited by Tim Hume. If you have any tips, ideas or feedback, please get in touch: talk-to-us@moniify.com