The Magnificent Seven — your Apples, Microsofts, and Teslas — have hogged the S&P 500 spotlight for long enough. But guess what? The rest of the market just grabbed the mic and declared: “We’ve got next.”

The 493 other companies in the index are finally stepping up, with their glow-up poised to flip the script in 2025.

This year, they accounted for just 29% of the S&P’s earnings growth, while the Mag 7 carried the load. Next year? The underdogs are projected to deliver 73% of earnings growth. Power shift, incoming.

Some trends are already in motion. The Mag 7, coasting on pandemic momentum, are cooling off, while sectors like industrials, energy, financials, and retail are hitting the gas.

Lower interest rates and easier comps (aka starting from rock bottom) are tailwinds for the 493, says Alan Wynne, global investment strategist at JPMorgan Private Bank.

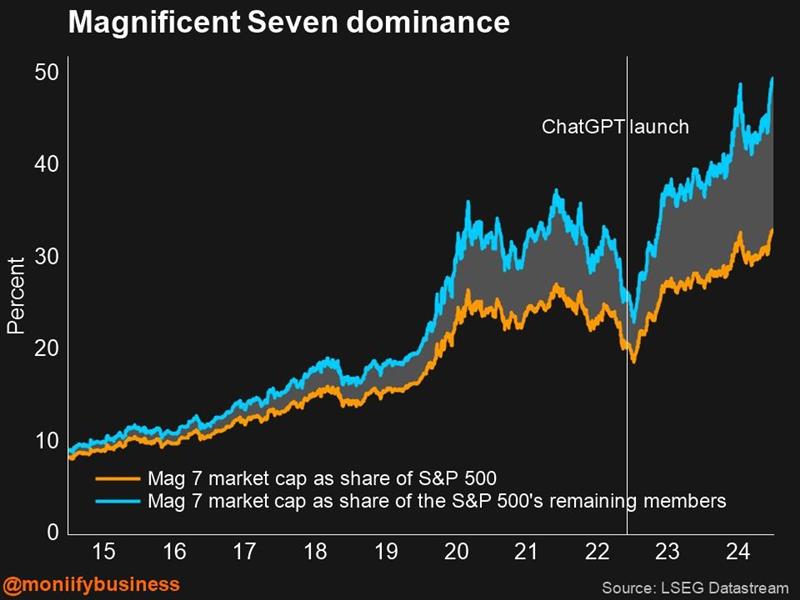

Read more: The Mag 7 are eating global stock markets alive

“We think performance should broaden next year, as the 493 are expected to increase their earnings growth more than 5x (to 13%) in 2025,” he says. For context, this group barely scraped 2% profit growth last year.

Analysts, in fact, expect 96% of S&P 500 companies to grow earnings per share by the fourth quarter of 2025 — a record.

The Mag 7 needs a break

Meanwhile, tech’s once-dominant Mag 7 firms are slowing down, and the data’s already showing a shift. Financials and industrials, the sectors everyone loves to call boring, have dethroned tech in year-to-date inflows.

The Technology Select Sector SPDR Fund saw $1.7 billion in inflows between January and November, according to FactSet. That’s much lower than the $5.8 billion financials ($XLF) got, and weaker than the $2.6 billion pulled in by industrials ($XLI).

If you’re still stacking your portfolio with tech heavyweights, it’s time to rethink the strategy. Diversify. Skip the tech hype for a minute and dig into finance, energy, and industrials.

Read more: S&P 500’s bad breadth problem? It’s a nothing burger

Here comes the buzzkill

It’s not all smooth sailing. Inflation, the market’s least favorite party crasher, could still make a cameo.

The Federal Reserve’s cutting rates to boost growth, but a strong economy and Donald Trump’s return to the White House could throw a wrench in the works.

GDP is set to grow 2.8% this year, climbing to 3.3% in the fourth quarter, according to the Atlanta Fed. Pair that with Trump’s plans to slash corporate taxes and reimpose tariffs, and inflation might rear its ugly head again.

Torsten Slok, chief economist at Apollo Global, warns that fiscal tailwinds could force the Fed to hit the brakes and hike rates in 2025 — just as markets are banking on lower borrowing costs.

If that plays out, we’ve got the hideouts for you here.

Read more: 2025, the S&P 500’s hangover year: MONIIFY poll

Edited by Ankush Chibber. If you have any tips, ideas or feedback, please get in touch: talk-to-us@moniify.com