Bitcoin has just podiumed in a survey of global fund managers, picking up the bronze as the third best-performing asset class for 2025, in the latest show of industry confidence that crypto’s time has truly come.

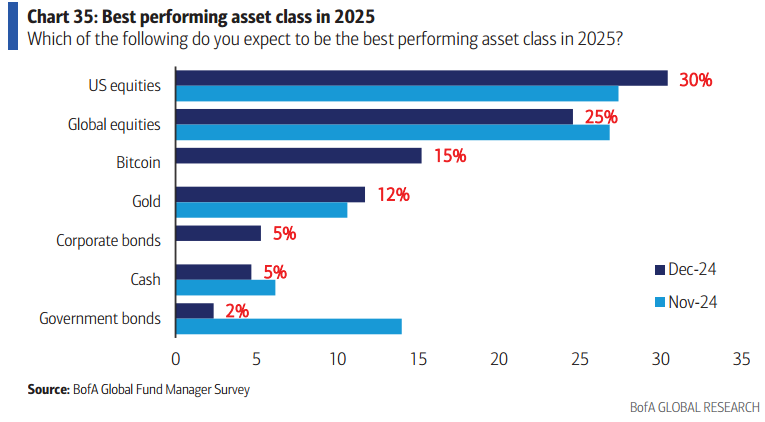

Asked which assets would do the best next year, 15% of the heavyweight fund managers surveyed by the Bank of America picked Bitcoin, which has been on a bull run that’s taken it to over $107k. Yes, folks: the Trump bump is real.

Bitcoin came in behind US equities (30%) and global equities (25%), and ahead of gold, which got 12% of the votes. That makes sense given that Bitcoin’s massive rally of 154% this year has dwarfed gold’s 29% rise, as the US regulators have approved crypto-linked ETFs, and Donald Trump has pledged to make the US the crypto capital of the world when he gets back into office.

From there, it was daylight between gold and the rest of the leaderboard, with corporate bonds and cash each getting 5% of the vote, and government bonds just 2%.

The survey results reflect a string of big moments for crypto amid the ongoing surge. This month, BlackRock, the world’s biggest asset manager, rolled out the red carpet for Bitcoin, saying a 2% allocation in the cryptocurrency was now essential for any balanced portfolio.

The only stocks that matter

But for all the excitement around Bitcoin, it’s still US stocks that come out on top. Allocations to this part of the world keep climbing, hitting a record high in December with a net 36% of money managers overweight on US stocks.

Dollars are practically pouring out of everywhere else — emerging markets, the eurozone and cash — straight into US stocks, according to the survey. In fact, investors aren’t letting a dollar sit idle — cash levels dropped to a three-year low at 3.9% of assets under management, and cash allocations hit their lowest on record.

And it’s not just tech… financials are glowing. Allocations to the sector also jumped to a record high (hello, banks and insurance companies).

But with US stocks tipped to perform best next year, there are a couple of risks to look out for. First, a global trade war that triggers a recession. Secondly, inflation that causes the Federal Reserve to hike rates.

The survey ranked these two outcomes as the top risks that the markets face in 2025. Watch this space.

Read more: Plot twist: What if the Fed raises interest rates in 2025?