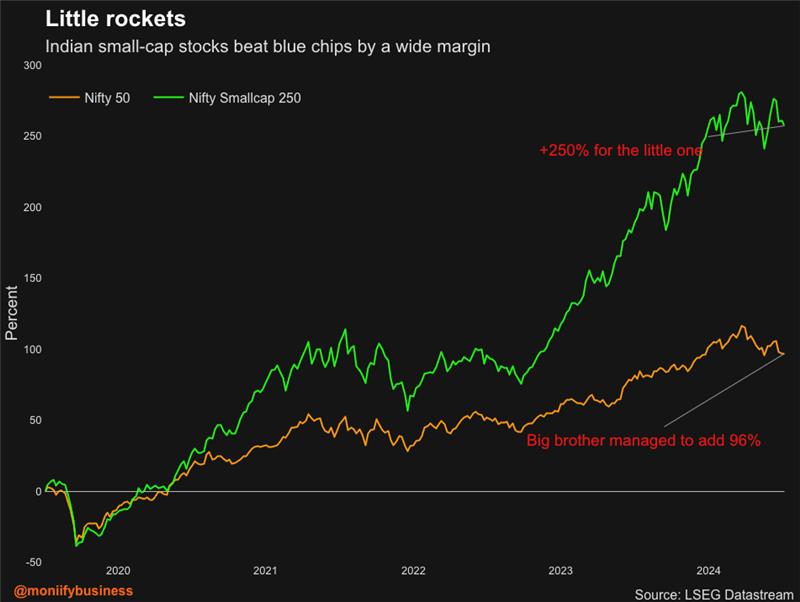

India’s small caps have been on a tear, delivering returns that make large caps look like they forgot their running shoes at home. But like every adrenaline-fueled run, this one might be approaching a hairpin turn.

These pint-sized powerhouses, defined as companies whose market cap falls outside the top 250 most valuable stocks, have been the darlings of 2024. They have clocked gains of 26%, blowing past the Nifty 50’s 9% gain, leaving large-cap investors wondering if they’ve brought a slingshot to a gun fight.

But these small caps aren’t exactly building AI empires or dominating cloud computing. And analysts are now beginning to sound the alarm, pointing to an uncomfortable blend of greed and frothy valuations.

Read more: The ‘Make in India’ champ that beat Nvidia in 2024

Blowing bubbles

The index is now trading at 34 times, pricier than the Nasdaq 100 — home to Apple, Nvidia, and the world’s biggest tech plays.

Societe Generale analysts led by Puneet Singh are not biting their tongue. These stocks are “clearly in bubble territory,” he says in a note.

DSP Mutual Fund strategist Sahil Kapoor tells MONIIFY that current valuations of small-cap stocks leave little “margin of safety”, and it is prudent to avoid them altogether.

He points out that while small caps have delivered annual returns north of 40% since 2020, their profit growth has averaged just 17%. The hype is outpacing the actual results, and that’s a dangerous game to play.

Read more: What does the rupee’s record low mean for your money?

Big risks, big questions

Monday’s 2.9% drop in the Smallcap 250, alongside a 1.6% dip in the Nifty 50, was another reminder that small caps might not be bulletproof. Was it just a wobble, or the start of a broader unraveling?

For large caps, though, the picture is brighter. Ambit Institutional Equities and Morgan Stanley expect the big players to take the lead in 2025. Morgan Stanley forecasts an 18% rise in the BSE Sensex, driven by strong domestic growth, steady oil prices, and no US recession.

Small caps may have been the stars of 2024, but SocGen’s Singh offers a stark warning: when the music stops, you don’t want to be the one holding Asian equities’ “hot potatoes.”

Read more: India’s 2025 stocks outlook is giving déjà vu

Edited by Ankush Chibber. If you have any tips, ideas or feedback, please get in touch: talk-to-us@moniify.com