India, the world’s most exciting growth story, seems to be losing a bit of its mojo.

Official numbers hint at a slowdown, with GDP growth likely to slip to 6.4% this year, a far cry from last year’s blistering 8.2%. Sure, these are just early estimates, but they’re enough to cast a shadow over the markets.

And if Emkay Global Financial Services is right, the reality might be even grimmer. Double yikes.

Blame the slowdown on a cocktail of factors. For starters, elections earlier this year threw a wrench in government spending. Big infrastructure projects were put on hold, leaving a gap that needs filling.

Read more: What does the rupee’s record low mean for your money?

Add to that inflation eating into real wages, and it’s no surprise that private consumption –– a major growth driver –– is looking sluggish.

“Private consumption is likely to remain tepid as real urban wages continue to decline,” says Madhavi Arora, lead economist at Emkay. Basically, people are pinching pennies instead of splurging.

This also means that playing it safe with consumer staples, a go-to strategy in tough times, isn’t such a sure bet anymore. Even giants like Hindustan Unilever and Tata Consumer Products are feeling the pinch, with demand slipping last quarter.

The logic is simple: when people are watching their wallets, even snack time takes a hit. Moreover, the ones with slightly higher incomes are seeking premium products, so that’s a double blow.

Read more: As India’s world-beating growth falters, winners are scarce

So, is there a play?

As government spending ramps up to boost growth, certain sectors could shine.

Defense-related stocks and companies tied to the power sector are worth a look, Kranthi Bathini, equity strategist at WealthMills Securities, tells MONIIFY.

Shridatta Bhandwaldar, head of equities at Canara Robeco Asset Management, also sees promise in the power sector. Long-term demand for electricity is only going up, making companies like Power Grid Corporation, Tata Power, and NTPC potential winners.

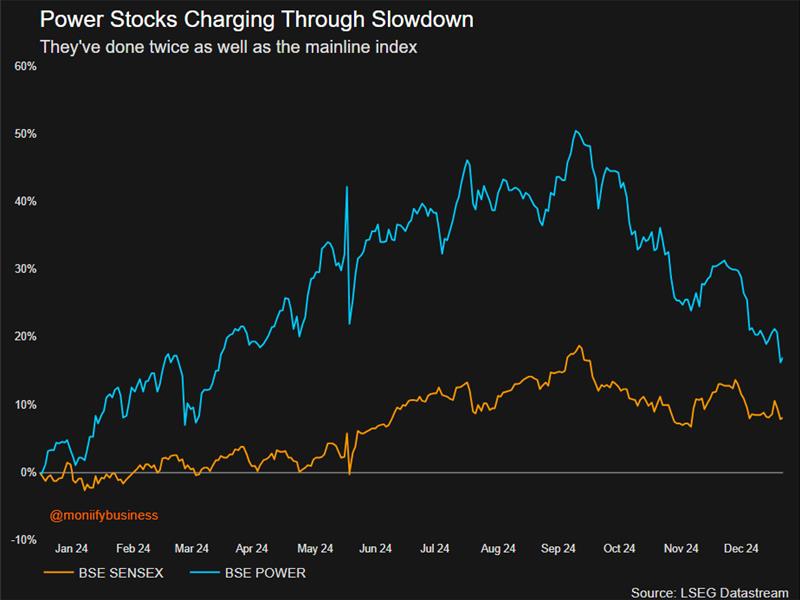

And why not. The group has easily outperformed the BSE Sensex Index in the past year.

The consensus among experts? You’re going to need a sharper strategy in 2025. The days of blindly riding an index or hot theme to glory are over. Picking the right stocks and themes will require more finesse and, let’s face it, a little luck.

Plus, for JPMorgan and Morgan Stanley, India is a runaway emerging markets winner.

Read more: Going public, going wild: India’s 2024 IPO circus went off!

JPMorgan cites a pickup in government spending and the qualities of a relative safe haven amid Trump-led uncertainties as reasons to own India. They both see the rural economy gaining momentum too.

All in all, India’s growth story isn’t over. It’s just hitting a speed bump.

Edited by Thyagu Adinarayan. If you have any tips, ideas or feedback, please get in touch: talk-to-us@moniify.com