Taj, Oberoi and the rest of India’s luxury hospitality chains are basking in a golden era, riding a surge in travel and the country’s ever-expanding wedding market.

And it’s just the beginning, say analysts.

India’s growing affluent class is splurging on personalized travel experiences. And it’s luxury hotels that are reaping the benefits, with the segment showing the highest growth in bookings.

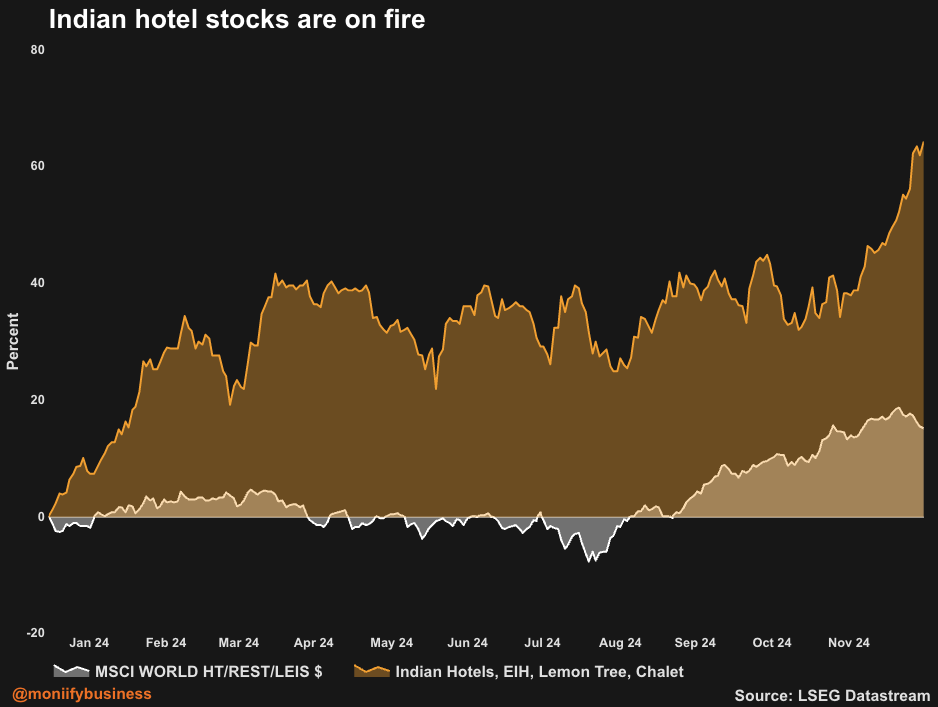

Tata-owned Indian Hotels’ shares have doubled in value this year, while Oberoi-owned EIH jumped 70% in the same period, as demand for rooms outpaces capacity. That means prices are going to stay higher, if not rise even more. By contrast, the MSCI World’s index for hotels and resorts rose just 17% this year.

What’s more, better connectivity and infrastructure are unlocking new destinations, including religious hubs like Ayodhya and Varanasi, which are experiencing a tourism boom, says Deven R Choksey, founder of DRChoksey FinServ, a boutique fund and wealth management company.

As for weddings? Indian families are known for going large on the big day, and there’s been no shortage of those occasions of late. One well-known Indian trade union projected there were five million marriages between October and December, 37% up on the same period last year.

Mid-tier operators such as Lemon Tree and Chalet Hotels have also surged 15-45%, handily outperforming benchmark indices.

All of which has translated to more companies wanting to list. Samhi Hotels, Juniper Hotels and Park Hotels have collectively raised $500 million through IPOs this year.

And there are more on the way. Schloss Bangalore, Ventive Hospitality, and Brigade Hotels aim to raise another $950 million.

Will the good times last?

Analysts are bullish about the sector’s future. Axis Capital recently highlighted that projected demand growth of 12% between 2024-27 could outpace the 9% increase in hotel capacity, keeping prices firm. Motilal Oswal foresees a continued upward trend in room tariffs and occupancy rates.

Indian Hotels plans to open 120 new properties in the coming years, while ITC is preparing to spin off its hotels business.

“We believe the current up cycle in the Indian hotel industry can last longer,” say Axis Capital analysts, who recently started covering the sector.

The catch? The rally is flirting with the ‘peak’.

Together, the top three hotel stocks have rallied more than 900% from their pandemic-era lows. Indian Hotels now trades at 64 times forward earnings, and that’s quite expensive compared to Nifty 50’s low-20s valuation.

While domestic tourism is booming, Indian travelers are also venturing beyond borders more than ever, driven by the increasing accessibility of international travel. It’s an emerging trend that concerns the domestic hotel industry.

Choksey says most of the growth upside is priced in, but a potential dip would be a buying opportunity. “If there’s a correction, I can assume a 25% upside is possible over 2025.”

With robust demand drivers and expansion plans in motion, the industry seems poised for a prolonged bull run. So, are hotels the missing ingredient your portfolio needs? For now, the stars seem aligned for this booming sector.