Listing your company isn’t for the faint of heart — endless paperwork, accountant juggling, and regulator schmoozing. But in 2024, India looked that in the face and said, “Game on.”

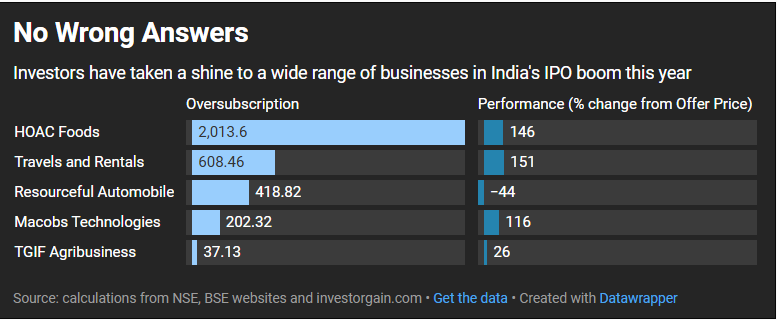

This year, a record 337 IPOs raked in about $20 billion, turning the stock market into a mix of hype, hustle, and head-scratchers. Investors seemed ready to throw cash at anything that moved, leading to some of the wildest market debuts in years.

Some made waves, others raised eyebrows, and a few just made you say, “Wait, what?”

Let’s take a closer look at the choicest five that had investors scratching their heads… and sometimes laughing out loud.

Read more: MobiKwik IPO: The small fintech fish making big waves

HOAC Foods

Delhi’s own flour and spice seller, Hari Om (yep, named after a Hindu mantra), brought its neighborhood grocery vibes to the stock market in May. With just 10 stores and 50 employees, it didn’t scream “Dalal Street darling.”

And yet? The IPO was oversubscribed 2,013 times. Turns out, investors were starving for it. The result: a 146% gain since listing. Spicy returns, indeed.

Resourceful Auto

What’s better than one Yamaha motorcycle dealership, you ask? Two. That’s the pitch.

This Delhi-based company sold dreams of “freedom and exploration on two wheels,” which apparently was poetic enough for 418x oversubscription this August.

Since listing, though, the ride has been less than exhilarating. More pothole, less highway as the stock is now down 44%. 😉

Read more: India’s market gloom deepens as IPO boom cools down

Macobs Technologies

Let’s talk about men’s grooming. No, not haircuts. We’re talking below-the-belt grooming.

Enter Menhood, a Macobs brand that wants men to take self-care seriously.

Investors were… surprisingly into it. Its July IPO was oversubscribed 202 times and shares have risen 116% since listing. Investors clearly saw the upside. 😏

Between hygiene campaigns and razor-sharp returns, here’s proof that self-care sells.

TGIF Agribusiness

It runs pomegranate farms. That’s it.

Talk of direct-to-consumer strategies and advanced farming techniques like “fruit thinning” added some buzz to the May IPO, which was solid but not bananas.

The stock is up a modest 26% since listing though. Sometimes it’s the quiet ones you need to watch.

Read more: S&P who? India’s retail army is supercharging its stock markets

Travels and Rentals

Kolkata’s near 30-year-old travel agency played it safe with its IPO pitch: flights, hotels, tour packages. Nothing groundbreaking, but clearly, it worked.

Its IPO in September was oversubscribed 608 times, and investors are now sitting on a smooth 150% gain. The takeaway? Sometimes plain vanilla wins the day.

The afterparty

For now, 2024’s IPO parade feels like a stock market fever dream: motorcycle dealers, pomegranate farmers, and men’s grooming companies all making bank $$$.

But here is the reality check: IPO adrenaline does not last forever. Some of these companies will crash back down to penny stock earth with low liquidity and a sad price chart. Still, India’s record IPO year proved that in the stock market, anything goes.

Oh, and shout out to Divine Power Energy cause what an awesome name.

Edited by Ankush Chibber. If you have any tips, ideas or feedback, please get in touch: talk-to-us@moniify.com