A soda from a machine? Yawn. But a car? Now, that’s the Carvana magic.

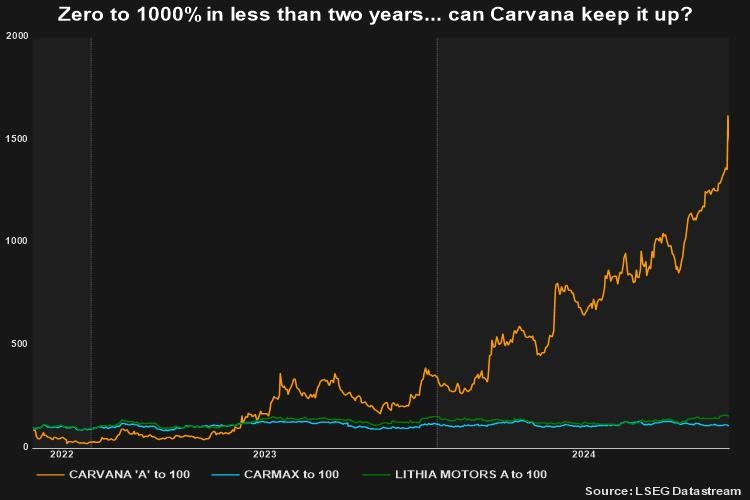

The used-car dealer just came back from bankruptcy-watch to a jaw-dropping $48 billion valuation, with its stock rocketing 100x since 2022 lows.

But the road ahead? Think slow and scenic.

Ernie Garcia II and Ernie Garcia III, the father-son duo behind Carvana, slashed thousands of jobs and swapped them with AI systems to handle car sales end-to-end. That audacious move put the company back on track, with sales growth easily speeding past rivals like Carmax and Lithia Motors.

The numbers

- Carvana’s market cap stands at more than four times Carmax’s and over five times Lithia’s despite trailing them in total revenues.

- Carvana generated $10.8 billion in revenue, while Carmax raked in $26.5 billion, and Lithia Motors pulled in $31 billion.

- The company remains the priciest among its peers, with a forward price-to-earnings ratio of 102.7, significantly higher than Carmax’s 20.2 and Lithia’s bargain-basement 9.8.

So yeah, Carvana may have sidestepped bankruptcy by restructuring its debt in 2023, but its stock price is stuffed with every last ounce of optimism it can handle.

Pick or Pass?

Most analysts say “hold,” with eight leaning towards “buy” and a couple waving the “sell” flag. And after Thursday’s 20% post-earnings pop, the consensus does not expect much action for the next 12 months.

Two major US banks still see a lot more gas in the tank. Wells Fargo sees a 31% lift and is setting a $300 target, while JP Morgan is even more bullish with a nearly 40% upside. Not bad for a stock that was scraping $4 just two years ago.