The firm, which makes servers that power AI applications and is Nvidia’s third-largest customer, was already having a tough time since joining the exclusive club in March this year.

But after Hindenburg Research, the short seller, called it out in August over alleged accounting shenanigans and hidden transactions, its stock’s been in a nosedive. It’s fallen more than 40%. And just as things were cooling down, its auditor, EY, decided to resign this week.

Its shares tumbled 33% on Wednesday and again on Thursday.

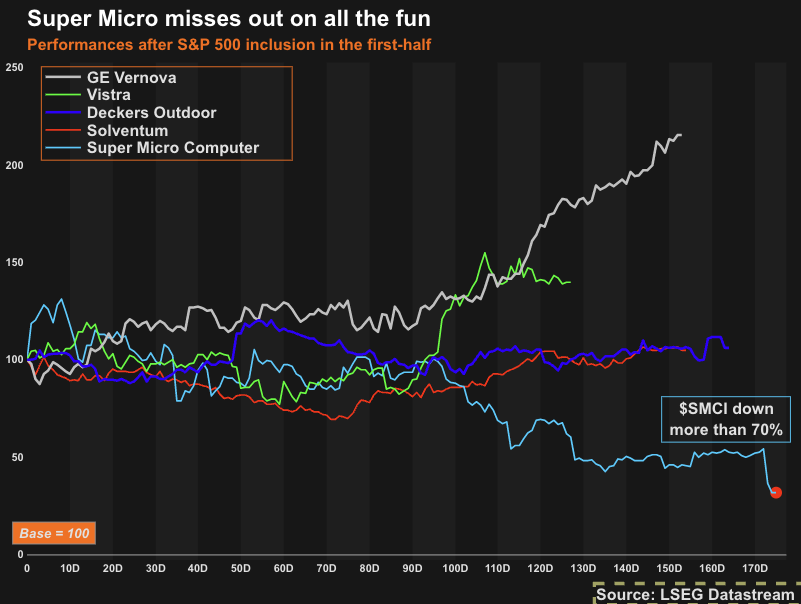

Being part of the S&P 500 club is usually a $$$ booster for stocks (GE Vernova and Vistra are good examples). But instead of a victory lap, $SMCI seems to be stuck in damage control – it’s lost more than 70% since March. Just look at this chart:

What the ex says

- In its resignation letter, EY says it’s lost confidence in representations from Super Micro management and its audit committee.

- EY also says that it’s “unwilling to be associated with the financial statements” prepared by Super Micro. Ouch.

Super Micro has had its fair share of red flags. Already on the Department of Justice’s radar, it took a hit when a former employee filed a whistleblower lawsuit in April, accusing it of improper accounting.

Its track record doesn’t look great either. Back in 2018, it was temporarily delisted from the Nasdaq for failing to file financial statements. And in 2020, the SEC charged it with “widespread accounting violations.” Most recently, Super Micro delayed filing its financials for the financial year ending June 30 – right after Hindenburg dropped its report.

But…

If by some miracle Super Micro manages a comeback, it could be a bargain among AI-related stocks. After all of its losses this year, the stock is trading at a forward price-to-earnings ratio of just eight times and – wait for it – a forward price-to-sales ratio of only 0.6! The lower the ratio, basically, the cheaper the stock.

Nvidia, the only other stock that has somewhat matched Super Micro’s killer rally over five years, sports a forward P/E of 35.4 and a forward P/S of 19.7. Super Micro’s valuation could make it a steal if it can pull off a turnaround.

But there’s a lot to clean up here, no 🧢.