Yup. 😭📱

While the rest of the Magnificent Seven stocks are living the dream, Apple’s out here looking like the weakest link.

Why? Because the markets are starting to price in China’s reply to Trump’s 60% to 100% tariff plans bigly.

JP Morgan traders say the risk of a clap back will hurt Apple. Why? Almost 16% of Apple’s $94 billion revenue in the last quarter came from China. China has several potential retaliatory moves up its sleeve: it’s the world’s largest exporter of EV batteries, a major customer of Boeing planes and an important playground for Tesla.

But why go through all that hassle when you can just ban the iPhone?

Okay, maybe not a full ban, considering Foxconn’s massive workforce in China. But it’s not unprecedented. Last year, government entities and state-backed companies reportedly told staff not to bring iPhones or other foreign devices to work, expanding a 2020 ban on officials using Apple smartphones.

Trum(p)ets

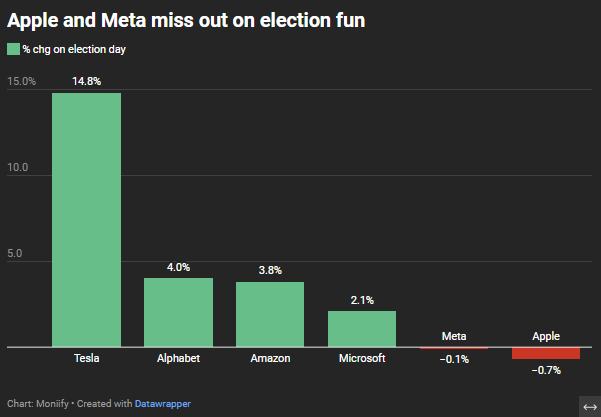

Barring Meta and Apple, most other big tech stocks are cruising on Trump’s well-known leniency when it comes to corporate taxes and antitrust issues. That’s why the Mag 7 lineup looked like this when results dropped on Wednesday. (And yeah, Meta’s Mark Zuckerberg isn’t exactly Trump’s favorite guy either).

Not just a Trump thang

Apple stock hasn’t had the best run since the iPhone 16 dropped in early September. Demand’s looking soft, with Morgan Stanley noting shorter lead times – the time from pre-order to delivery – across the lineup, typically a red flag in the smartphone world. Even Warren Buffett has been selling his shares, slashing his Apple stake by more than 60% in the past year (though he hinted that the selling was for tax reasons).

Here’s the twist: bulls are betting on a major upgrade cycle with the iPhone 17. Morgan Stanley analysts say markets are yet to shift attention to 2026, but they would rather be “early than late to the party.” They see the stock rising 22% over the next 12 months.

Some of their peers on Wall Street are also onboard: 36 of the 49 analysts covering Apple give it a “buy” rating, with a consensus 8% upside over the next year.