But pop the hood and you might see things differently.

Valuation? Check. Fundamentals? Check. In fact, all signals are flashing green!🚦

Yes, Indians aren’t buying as many cars these days – there is indeed a slowdown. So, where do you place your bets in times like these? Well, companies that have weathered past slumps, just like Maruti Suzuki, which still boasts a 42% market share, may not be such a bad option.

The odometer

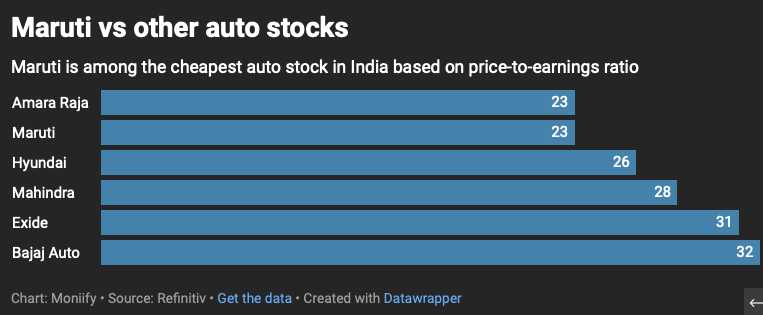

- Maruti’s shares are trading at 23 times forward earnings, which is slightly cheaper than the Nifty 50 index – and A LOT cheaper than its peers.

- It’s growing profits at a very fast pace: +247% in the last two years. The latest quarter missed estimates by a wide margin, though.

- Almost 90% of analysts covering the stock recommend “buying” or “holding” it.

Shifting gears

Despite the overall slowdown, Indian consumers are shifting towards bigger cars. And Maruti, once the go-to carmaker for smaller vehicles, has had to play catch-up. But it sold 61,549 SUVs last quarter, beating even segment leader Mahindra’s numbers (51,062 SUVs sold).

There are speed bumps ahead, though. Maruti’s entry into the EV space has been slow, with its plans still in the works. And though it’s known as the “people’s car” because it’s budget-friendly, its safety ratings lag those of rivals like Tata Motors and Mahindra.

What Maruti and its peers will be waiting for are October sales figures. This is the festive season in India and the time when households make big purchases. And those numbers will help you to assess if this humble maker of affordable small cars is still able to hit top gear.