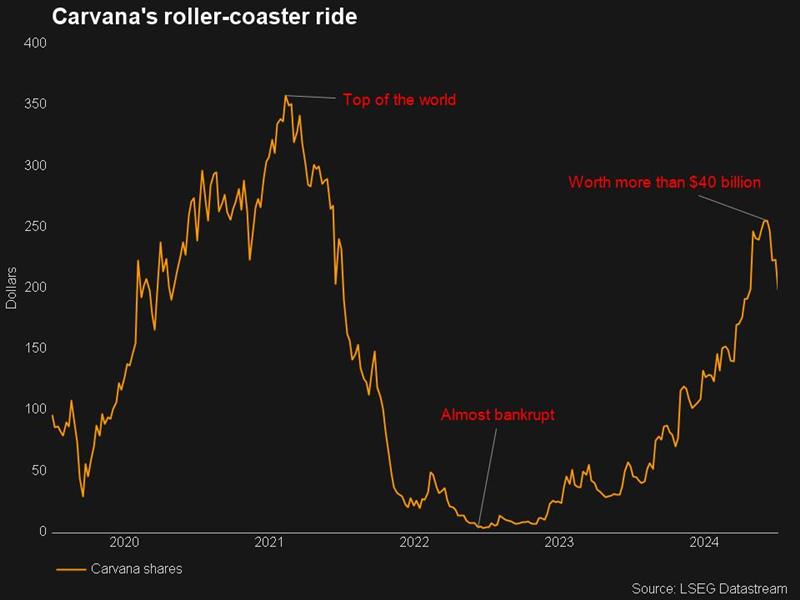

When a stock rockets like Carvana, the crash question is always lurking: is it gravity, or a short-seller, ready to bring it down? For 2024’s used-car comeback kid, it might be both.

Short-seller Hindenburg Research kicked off the New Year targeting Carvana, now flaunting a $40 billion-plus market cap, with accusations of “accounting grift” in a damning new report. The stock dipped 2% on the news.

Carvana rejected Hindenburg’s claims, with a company spokesperson telling MONIIFY that the short-seller’s arguments were “intentionally misleading and inaccurate,” adding that they had “already been made numerous times by other short sellers seeking to benefit from a decline in our stock price.”

But if Hindenburg’s 2024 track record is anything to go by, investors should press pause for a serious rethink.

Super Micro Computer tumbled 45% after similar allegations, and Temenos lost 27%. When Hindenburg shows up, it’s rarely a soft landing.

Red flags everywhere

The warning signs were already there. Revenue growth for Carvana is set to slow from the mid-20s to barely double digits over the next three years.

But its price-to-earnings ratio is an eye-watering 86x. The company remains the priciest among its peers, with Carmax’s valuation of 20.2x and Lithia’s bargain-basement 9.8x.

Ernie Garcia II and Ernie Garcia III, the father-son duo behind Carvana, swerved the firm away from bankruptcy in 2023 by restructuring debt and slashing thousands of jobs while swapping in AI to handle sales.

Read more: Adani’s downward spiral is not your buy-the-dip moment

The move worked, with sales growth speeding past rivals like Carmax and Lithia, but its stock price is stuffed with every ounce of optimism it can handle.

Father Garcia has also been selling the stock all through this multifold rally since hitting bottom two years back. Hindenburg sees that as a red flag.

Analysts aren’t fully sold either. Some 14 analysts say “hold,” with nine leaning towards “buy” and just one waving the “sell” flag. Almost 6% of Carvana’s outstanding shares are shorted, according to LSEG data.

Read more: #HotStox: Super Micro’s not so super S&P 500 party

How do you ride this?

Wall Street’s big banks have been in Carvana’s corner. JPMorgan and Wells Fargo both saw the stock soaring to $300, a potential 50% gain, but before the Hindenburg report.

JPM’s Rajat Gupta backed Carvana as the “top pick in the auto retail ecosystem,” citing strong margins and market share growth.

What should you do? Well… If you’re riding the AI-fueled hype and trust Wall Street’s optimism, this might look like a golden ticket. Maybe.

But if Hindenburg’s allegations — and Carvana’s lofty valuation — keep you awake at night, sitting this one out might not be the worst move.

Read more: Roblox: The unreality of a Nasdaq 100 company

This story was updated to include Carvana’s reponse. Edited by Ankush Chibber. If you have any tips, ideas or feedback, please get in touch: talk-to-us@moniify.com