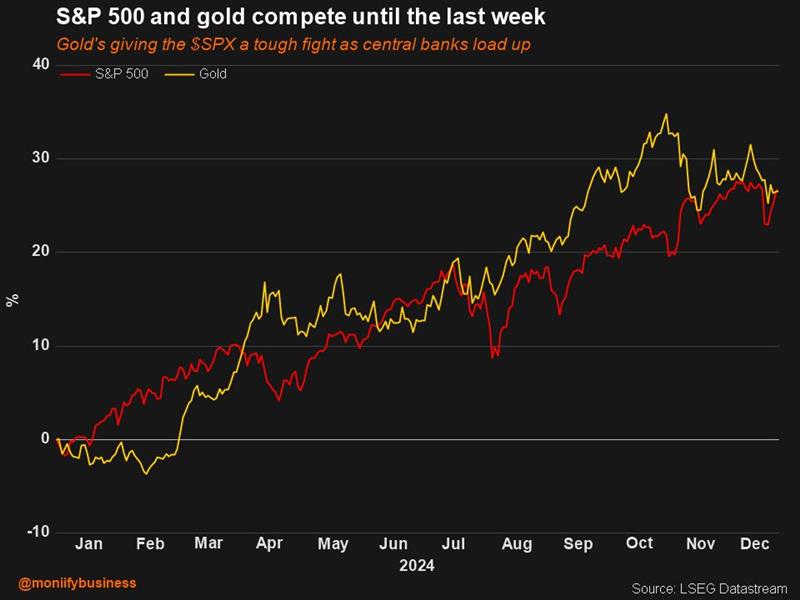

For the first time in at least three decades, gold and the S&P 500 are duking it out for the crown of 2024’s top-performing asset.

Gold’s 28% rally has had it ruling the scoreboard all year, but the S&P 500’s late-game Santa rally (up 27%) has it threatening to steal the show. The last time both came this close was in 2009, and gold edged out stocks. It’s a nail-biter.

The case for gold

UBS expects the yellow metal to keep climbing in 2025, as central banks keep adding to their reserves to diversify holdings.

“De-dollarization efforts” are real as central banks are expected to buy another 900 metric tons of gold or more next year, UBS strategists led by Mark Haefele say in a note.

With policy uncertainty in the US, a war still raging in Europe, and investors craving hedges, gold’s safe-haven appeal isn’t fading anytime soon. UBS expected gold ETFs to keep raking in the cash.

But there is a catch.

A strong dollar, thanks to the Federal Reserve hinting at fewer rate cuts next year, will not bode well for gold. UBS recently lowered its 2025 target from $2,900 per ounce to $2,850 — still a solid 8% gain from current levels. And better than what pros we polled expect for the S&P 500.

Read more: Wall Street’s 2024 faceplant: The year all its predictions got smoked

S&P stands tall

Normally, gold and stocks don’t hang together. It’s either “gold destroys stocks” or “stocks leave gold in the dust” –– no middle ground. Makes sense, right? They are polar opposites. Safe haven vs. risky assets.

But in 2024? Everything is on the menu. Investors are piling into both safe and risky (think gold, US and emerging-market stocks, cash, high-risk debt). Fear meets FOMO.

Gold may have geopolitical chaos and central bank love going for it, but the S&P’s not exactly riding on hot air.

Read more: It’s US stocks, Bitcoin or nothing for 2025

The AI boom, rate cuts, and those untouchable Magnificent Seven mega-stocks have kept US markets buoyant.

And let’s be real. If the Mag 7 i.e. the likes of Apple, Amazon or Microsoft stumble, we’re all in trouble. They are basically too big to fail at this point.

Betting on the S&P isn’t just about gains. It’s about betting on Uncle Sam not letting the economy collapse. As good a bet as any you can put hard cash on.

Edited by Ankush Chibber. If you have any tips, ideas or feedback, please get in touch: talk-to-us@moniify.com