Traders hoping to strike gold might be feeling a bit scorched lately.

After a stellar run this year, the metal fell 3% in November. Zoom out though, and you’ll see it’s still shining bright. ✨

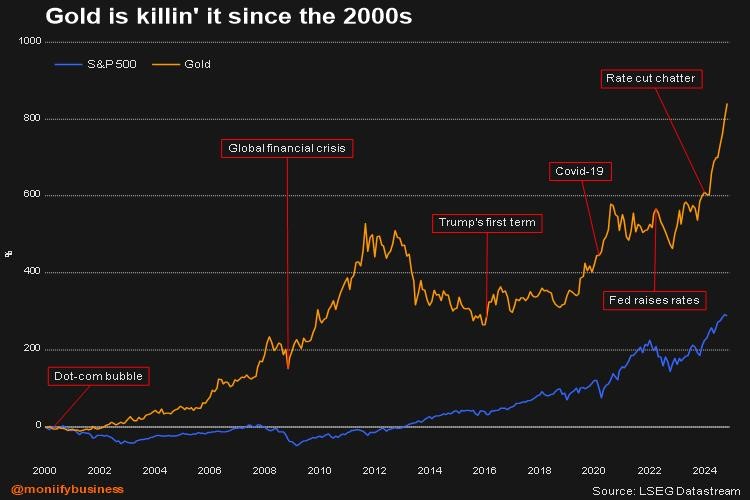

Look, gold isn’t a day-trading instrument anyway. There’s no get-rich-quick shortcut to it. It’s a long-term safety bet that holds its glow even when all else is doom and gloom. While you’re zoomed out, consider this: gold has consistently outpaced the S&P 500 since the noughties, and has attracted investors in times of crisis for even longer.

It slipped after the US election because some traders had built big positions in gold, expecting a close outcome and lots of fighting over the result. In the end, Donald Trump’s win was clearcut, so they pulled out to bet on stocks instead.

But Trump’s also planning to slap super high tariffs on imports from all over the place when he gets into office in January. And he’s promised to cut taxes in the US… That’s more than likely to push inflation up a notch or two, keeping alive gold’s age-old allure as the ultimate hedge against rising prices.

Buy the dip?

- UBS has called the post-election sell-off “excessive”, and says the fundamentals still favor gold, which suggests the metal could rise to new highs in 2025. The bank’s target for the end of next year is $2,900 per ounce.

- Goldman Sachs is even more bullish. It says go for gold as the recent pullback gives you an attractive entry point. Its price forecast for the end of 2025? A cool $3,000 per ounce.

(Source: LSEG Datastream.)

BRICs and beyond

It’s not all Trump though. Central banks in the BRICs and other emerging economies are increasingly shifting away from the dollar, a trend that could gather pace under a combative Trump administration. They’re buying gold instead.

So here’s the thing about gold: it’s the tortoise in a race of hares. It won’t churn out yields, but hold on to it long enough, and it’ll grow your wealth even in times of crisis.

Wall Street asset managers are nodding in agreement, ranking gold third on a list of asset classes they expect to shine in 2025, according to a fund manager’s survey by Bank of America.

A vault of gold in the Bank of England. (Photo source: Bank of England.)

Did you know?

New York and London store most of world’s mined gold. These are stored on behalf of other central banks and governments.

The New York Fed’s gold vault is in the basement of its main office building in Manhattan. It stores 507k gold bars, with a combined weight of 6,331 metric tons.

That’s like 422 trucks of gold!

ChatGPT corner