Now it’s all eyes on the year-end rally, and investors are ready to stop playing defense.

Wall Street’s big shots, glued to screens flashing tickers, are done with the fear of losing. It’s all about that FOMO on massive gains.

Or should we say FOMU, the fear of materially underperforming! It’s panic mode and everyone’s scrambling to not be THAT guy dragging down returns.

The market vibe just went from “meh” to “let’s go!”

Retail investors have been on a buying spree, and now hedge funds and asset managers are scrambling back into the market to avoid missing out on the rally. Picture this: bankers making millions of dollars sweating bullets as they get outpaced by someone chilling on their couch, investing in an S&P 500 ETF from their phone, racking up a slick 25% gain. It’s pros getting schooled by the rookies, and it’s glorious.

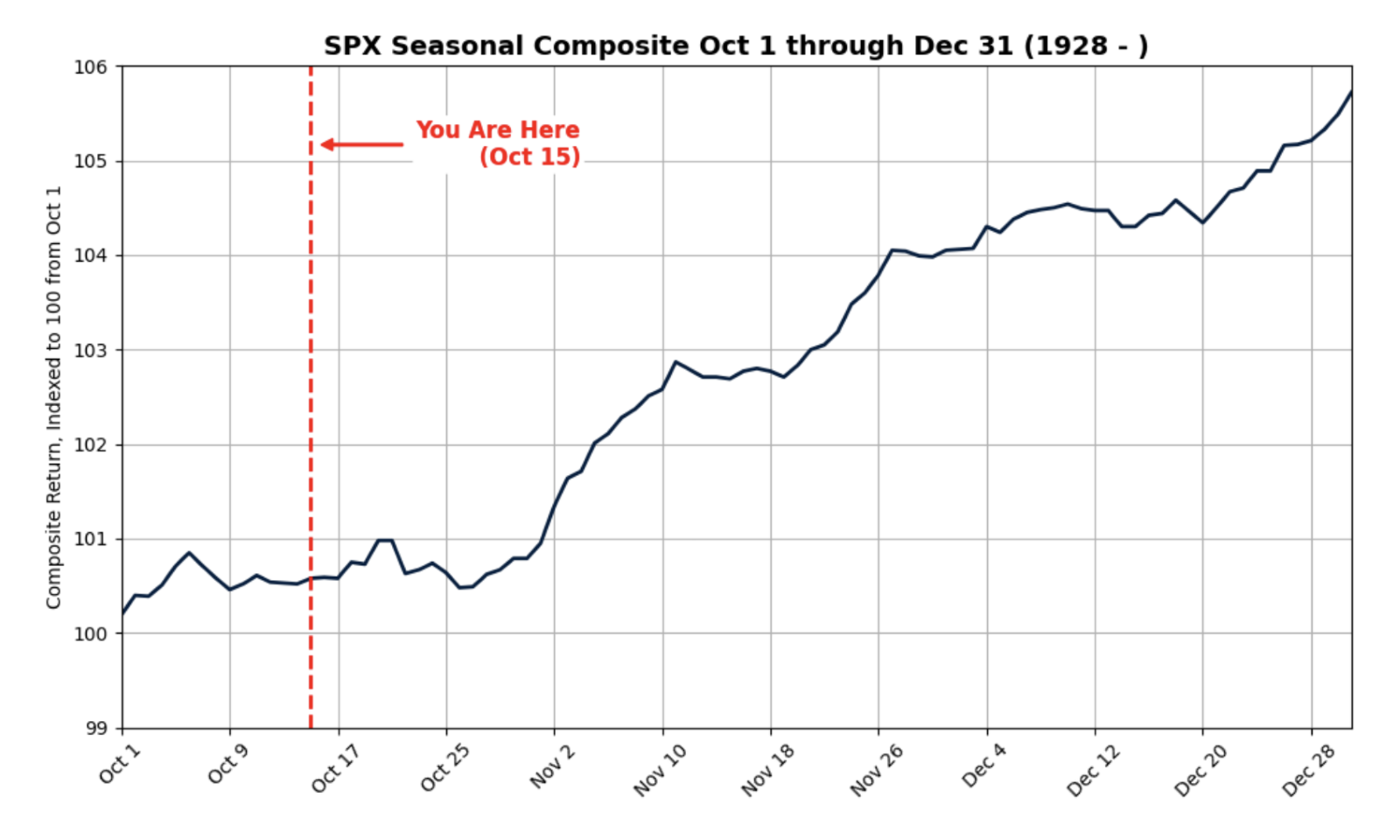

Goldman Sachs traders say they didn’t have the “spooky 6k” for S&P 500 by Halloween on their bingo cards. As it turns out, the only thing scarier than a market slump was underestimating this rally. There is still some near-term fear in the market as on Wall Street thanks to VIX staying elevated. But once that cools after the US elections? It’s game on.

The floodgates are going to open, and it will be raining $$$ in the stock markets. This is what happened in 2020. This is what happened in 2016.

Source: Goldman

The play?

- The economy is in decent shape (recent retail sales data backed that up) and so it is time to look into sectors that thrive when things are booming. Think retail, travel or construction.

- Forget the large caps for a sec. Goldman Sachs is saying that clients are shifting gears and asking for underperformers and mid caps.

- Maybe take a breather on tech and start sizing up small caps? The Russell 2000 ETF has a history of pulling off median returns of 10% from October 15 to December 31 during election years, every election since 1979. Once the last ballot is counted, it could be your best bet for a year-end win.

If you caught our Friday hot take, the Trump trade is already in full swing. And if those predictions hold, this trade could blow up even more after the election results are out.

Peak szn

After 47 record highs this year, the S&P 500 is not hitting the brakes anytime soon. An earnings bonanza is coming this week: 37% of all companies on the index are set to report. If this goes by without any storm, it might be time to put the pedal to the metal.

But let’s not get all rosy without addressing the elephant in the room: THAT DEBT PILE.

MONIIFY will not ignore it. The US national debt has smashed through to a record high of $35.4 trillion, and both Donald Trump and Kamala Harris seem not too eager to tackle it. But the real nightmare? The interest on this debt is a massive $892 billion in 2024 alone, and is expected to nearly double in the next decade, reaching a staggering $1.7 trillion by 2034.

This is not just a “problem” for tomorrow. It’s essentially a ticking time bomb nobody’s interested in defusing anytime soon.

ChatGPT corner