Hedge funds and big asset managers are cashing out on Big Tech’s best and making a sharp pivot towards the market’s forgotten corners – small caps, industrials and sectors tied to actual economic growth.

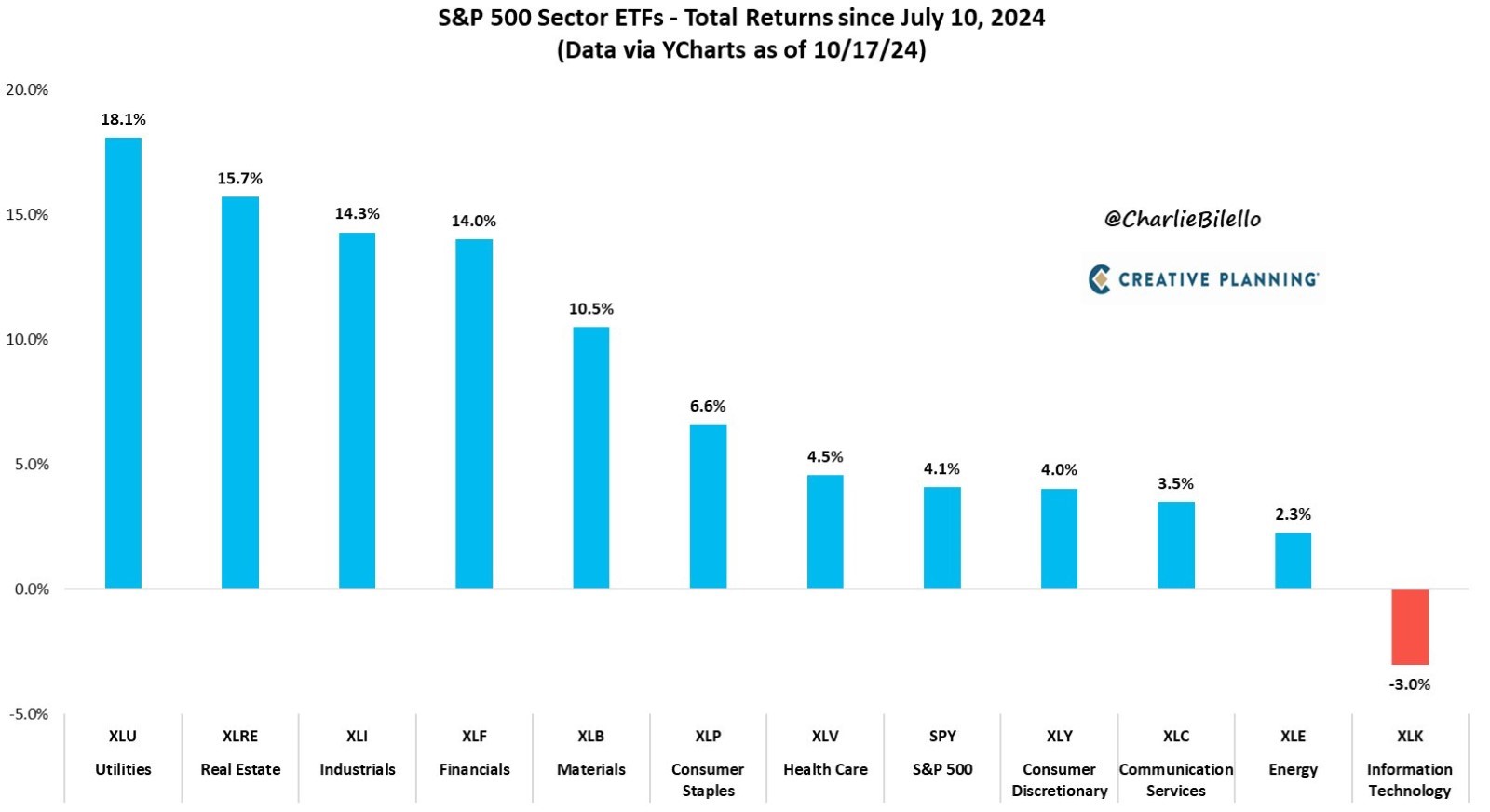

Since July 10, tech stocks have been the only S&P 500 sector stuck in the red, while industrials and utilities (fueled by AI’s insatiable energy demand) have rallied.

- The S&P 500 industrials group is flexing. It is up almost 11% in just three months, easily leaving the broader market’s 5% gain in the dust.

- Small caps might be gearing up to steal the spotlight. The Russell 2000 ETF has a history of pulling off median returns of 10% from October 15 to December 31 during election years, every election since 1979. It is currently trading at an 11% discount to the S&P 500 and is up more than 15% in six months.

- Morgan Stanley is throwing its weight behind cyclicals, or sectors that feast when the economy is booming. Think financials, materials, energy and consumer plays.

Tech stocks might have hit a rough patch for the last three months but let’s not forget that they are still up for the whole year. Wall Street analysts expect these gains to spill over into other sectors of the economy as recession fears fade.

This shift could mean that cyclicals might be some of the first to soak up all that fresh $$$ once the election uncertainty clears.

Even though money’s moving out of tech right now, the AI hype train is showing no signs of slowing down. MONIIFY previously wrote that UBS analysts are recommending using any near-term volatility to buy the dip and stack up long-term positions.

So, if you’re in it for the long haul, this could be your shot to grab a piece of the action before the next big surge.

ChatGPT corner