But the markets are on a tear as if he has already won. It’s not that straightforward, though, and there are several scenarios that markets are squarely ignoring right now.

Kamala Harris is leading the official pre-election poll predictions, but betting markets see Trump winning hands down. According to Oddschecker, there’s more than a 67% chance of a Trump victory, right now.

The fact is it’s still too early and too close to call, according to VP Bank.

But here are some possibilities for how market action will play out depending on who wins the Harris vs Trump battle:

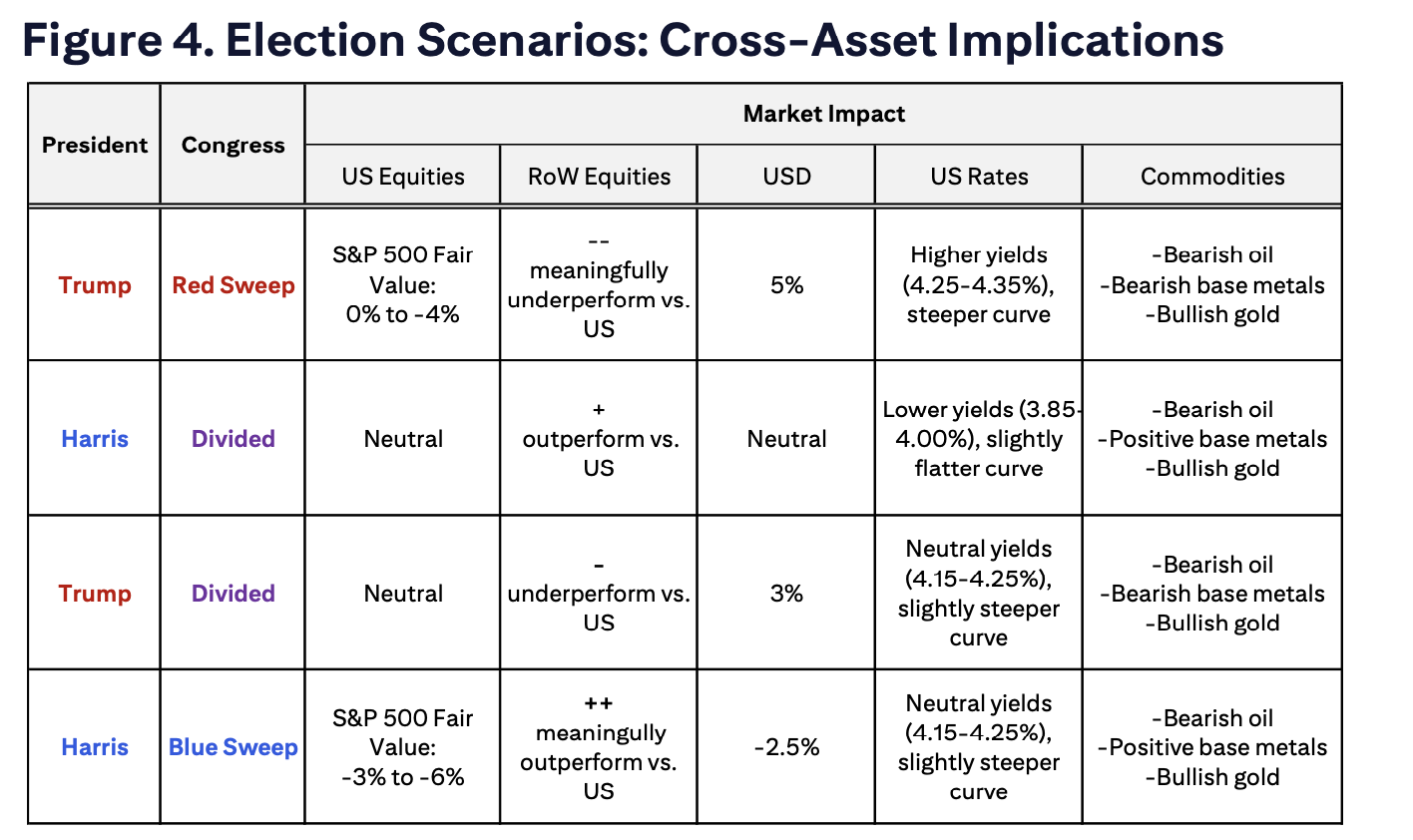

- If Trump wins, analysts expect stocks to keep adding to their gains, buoyed by his pro-business stance – aka lower corporate taxes and less scrutiny on Big Tech.

- A Harris win might initially be more bearish, and her policies pushing for higher corporate and capital gains taxes might spook the market, Yardeni Research says.

- A sweep by either the Democrats or Republicans might raise the chances of major policy changes and unsettle the markets.

- A gridlock, or very narrow victory for either side, would oddly be “the most bullish outcome,” Yardeni Research says. This scenario could make it tough for the next president to push through big changes, meaning more stability and less abrupt policy shifts, no matter who wins.

Here’s a nice table to pin to your desk:

Deutsche Bank expects business as usual whoever comes out on top. The bank notes that a dip heading into the election followed by a rally after has been a consistent pattern in past tight races. If the result seems predictable, stocks often treat it as a non-event and continue their upward trend without much disruption.

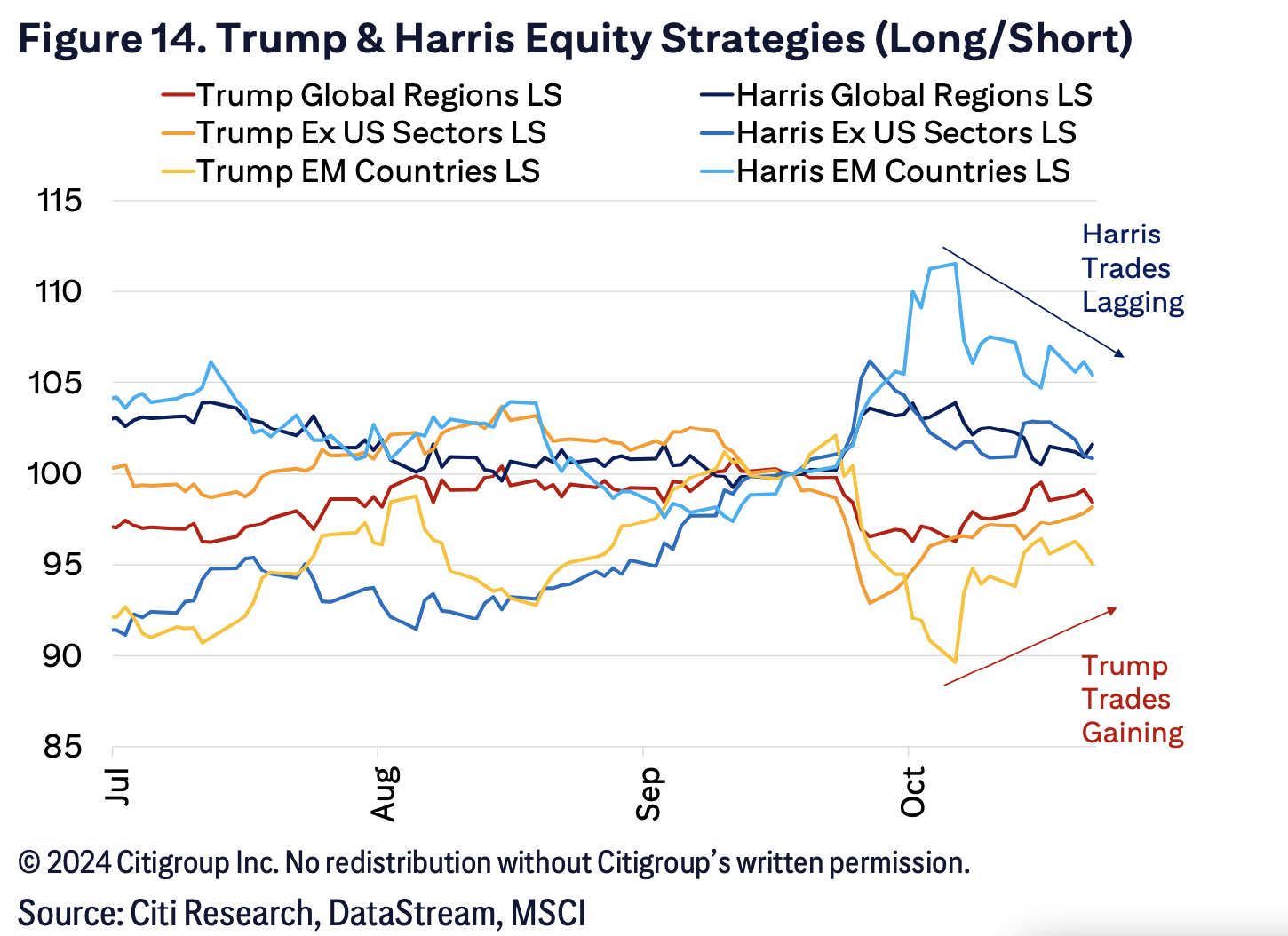

This time around, Trump trades have already taken off. The biggest play, the Trump Media & Technology Group stock, is already up 220% in the last month.

The MONIIFY Trump stock basket continues to outshine the Harris basket, holding its lead and even widening the gap over the last month. Even Bitcoin has surged past $70,000.

Platforms like Robinhood and Interactive Brokers have rolled out new tools this month that let US investors trade on their political predictions. By buying or selling outcome-based contracts, they can bet on election results and other events. These products come with high risk though, as they’re a form of derivatives trading that can lead to significant losses if the outcome doesn’t go as planned.

ChatGPT corner