US stocks are expected to finish the year up, but disappointing earnings and unemployment data are sending a chill through markets.

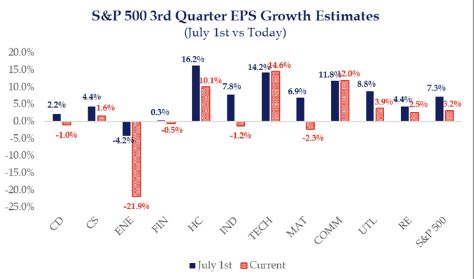

The US earnings season begins with the likes of JP Morgan reporting this Friday, but analysts have slashed estimates for the S&P 500 several times already. We’re now looking at earnings growth of just 3.2% compared to earlier projections of nearly 8%, according to market insights firm FactSet.

Here’s the part that’s a bit scary: these estimates are falling faster than the five-year average, the 10-year average and even the 15-year average, of these cuts, FactSet says.

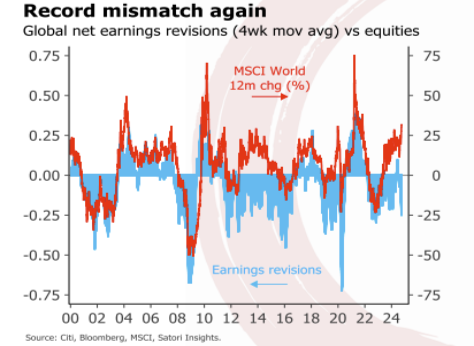

The thing that’s harder to make sense of is how US stock markets keep breaking records even though earnings revisions are tracking south.

The jury’s still out. If S&P 500 companies can’t deliver earnings to match their lofty valuations, it’ll be tough for investors to hang on, especially with geopolitical risks rising every day, and the path of interest rates up in the air after September’s monster jobs report.

Everything but Nvidia fell on Monday, as the AI beast is still expected to grow earnings multifold.

The revised FactSet forecast is well below the second quarter’s 11.3% increase, but it would still indicate a fifth consecutive quarter of growth. Here’s a quick guide for which sectors to keep an eye on:

In a nutshell: the energy, materials, industrials and consumer discretionary sectors are expected to see the biggest declines in profit. The best ones? Tech (obviously), communications, healthcare and utilities.

For financials, JP Morgan has already sounded the alarm on interest income last month. Time to buckle up? ChatGPT thinks so.