Money doesn’t stay still.

Despite analysts saying not so long ago that China is a risky bet, the bargain hunters are piling in – and piling in hard – on Chinese stocks.

And India and Japan, this year’s favorites, are feeling the squeeze. A record $9 billion was pulled from Japanese stocks last week, fund trackers say, while India is experiencing its first outflows since 2022.

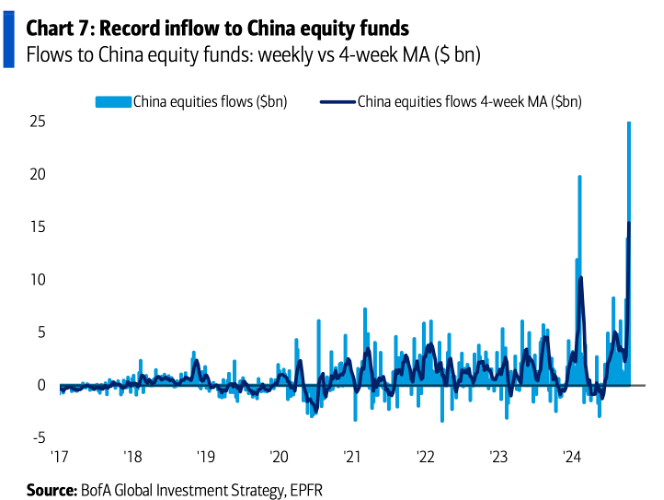

Chinese stocks have raked in a jaw-dropping $39 billion in fresh inflows, meanwhile, as investors switch lanes.

Risk? That sounds like a tomorrow problem. 🚀

Can’t stop, won’t stop

- China’s tech sector attracted $7.4 billion last week, driven almost entirely by big names like Alibaba and Tencent.

- Its GDP growth is expected to be 4.8% this year and 4.5% next year, but Bank of America says these numbers are likely to be upgraded soon.

- HSBC analysts say they still see an 18% to 21% upside in Chinese stocks but warn that they could lose momentum (we’ve seen that happen so many times now!).

The biggest risk for the Chinese comeback now comes not from China itself but from the US election, BoFa’s chief investment strategist, Michael Hartnett, says in a note. A Trump victory could derail China’s rebound, as the former president has threatened tariffs.

For now, though, the chances of China’s economic outlook improving are higher. This week’s GDP data will offer a clearer picture of whether the recovery is gaining traction.

China’s finance minister on Saturday vowed to borrow more to bolster the economy, relieve local government debt, improve bank capital and stabilize the housing market. But markets are waiting for information about the size of the increased stimulus.

If you’re looking for long-term benefits, many Chinese stocks are trading at 50% discounts; a dream deal. But if you can’t stomach 10% swings in a single day, though, try India and Japan.

So, will you jump on board or hold off a little longer?

ChatGPT corner