Forget Bitcoin, Tesla and Trump’s $DJT – those bets have been on for a while and a Donald Trump win is likely already baked in.

Instead, keep an eye on corners that could see a fresh boost once the election dust settles and things return to normal. 👀

Private prisons, anyone?

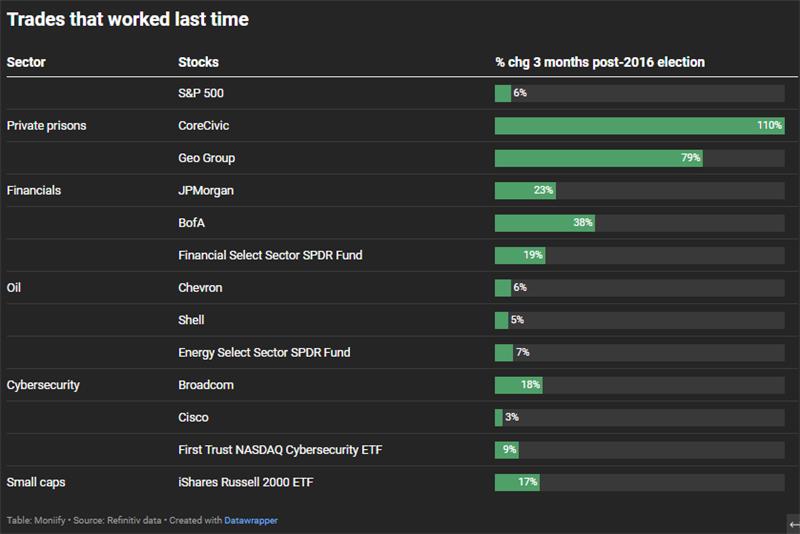

Trump’s no-holds-barred stance on immigration during his last term packed detention centers, and private prison stocks soared. With him back in the driver’s seat, we could see a repeat – and that means more $$$ for stocks like CoreCivic and Geo Group. Back in 2016, CoreCivic shot up 110% and Geo Group followed with 79% gains in just three months. This month alone, they’re already up 10% and 14% (some investors are already onto them!).

Financials might be way less boring than they look

Think JP Morgan and Bank of America. These banking giants could see a boost with Trump back, thanks to his love for deregulation and low corporate taxes. In 2016, financials were one of the big winners after his election, with sector ETFs jumping 19% in three months. If history’s about to repeat itself, these stocks could be primed for another rally.

‘Drill, baby, drill’

It has been Trump’s mantra for years, and that’s not changing. He’s no fan of climate initiatives and is all-in on ramping up drilling. “We have more liquid gold, oil and gas, more liquid gold than any country in the world, more than Saudi Arabia,” he said in his victory speech on Wednesday.

Back in 2016, oil sector ETFs rose 7% in the three months after his election, though gains were modest compared to other sectors. With ample supply keeping prices flat this year, and OPEC+ delaying production increases, oil stocks may offer some stability. Gavekal Research even called them a safe spot amid election jitters earlier this week.

Trump’s ‘America First’ agenda…

… likely means more moves to “protect” the country on all fronts, and that includes ramping up cybersecurity. With a focus on defending critical infrastructure and government networks, cybersecurity stocks like Broadcom, CrowdStrike, Palo Alto and Fortinet could be worth watching. In 2016, similar policies saw sector ETFs rise 9% over three months.

Don’t sleep on small caps

Higher tariffs, especially on China, could help these companies by cutting down on international competition and upping their market share, according to Ibrahim Masood, senior portfolio manager at Mashreq Capital. Masood says that small caps tend to shine when interest rates drop – a shift likely to come early in Trump’s second term, thanks to his inflation-boosting policies. MONIIFY touched on this earlier, and $IWM is already trading upwards with gains of over 5% in pre-market trading on Wednesday.

There’s always $SPX

If stock picking isn’t your thing and you’re looking for a safer play than single names or ETFs, the S&P 500 might be your best bet. Markets tend to settle back after elections, and the fourth quarter is actually the strongest for stock returns in election years, according to JP Morgan.