The holiday cheer on Wall Street just got sucker punched.

Fed Chair Jerome Powell took a more hawkish tone on rates as inflation came back into the group chat and the markets bled out.

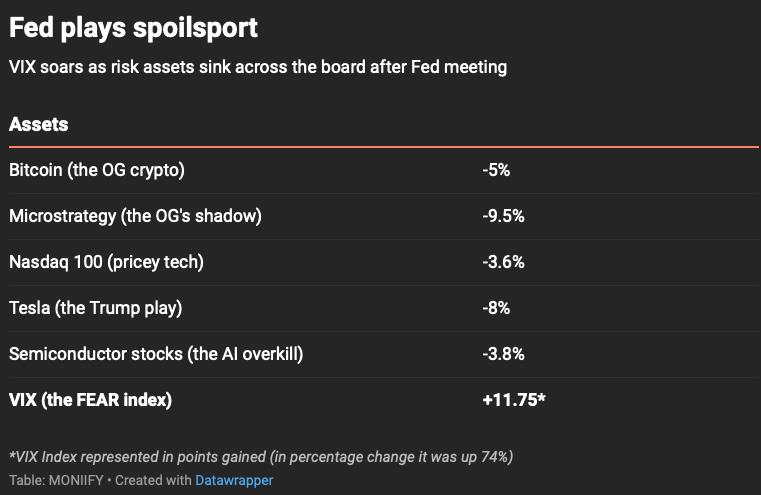

Tesla? Tanked. Bitcoin? Battered. The S&P 500 dropped 3% — its worst day since August’s Nikkei Black Monday crash.

And the Dow logged a depressing losing streak of 10 straight days, something we haven’t seen in 50 years. Merry crisis?

Told ya!

This isn’t a total shocker. Economists and analysts have been warning about the risk of fewer Fed cuts since Donald Trump’s election win last month.

MONIIFY even warned you about this. The Fed now expects just two rate cuts next year, against the market’s expectations of at least three.

Big money is gearing up to tackle it. So should you.

Hedge funds are selling the lowest-quality pockets of the market, aka companies big and small with weak profits and cash flows. Instead, they are hedging their bets on companies with stronger fundamentals, Goldman Sachs traders say.

“We have now entered what we refer to as the ‘danger zone’,” HSBC strategists led by Ryan Wang say in a note. Think 2022 — where higher rate expectations prompted a sharp fall in almost all asset classes.

Read more: S&P who? India’s retail army is supercharging its stock markets

Buy the dip?

But let’s not lose it just yet. Year-end jitters are partly to blame.

A big driver of the current market moves is also investors clearing out the decks as they prepare to close their books for the year, according to traders.

The stock market might stay messy throughout January, with some investors holding off on cashing in profits until early 2025 to defer capital gains taxes, according to Yardeni Research President Ed Yardeni and Chief Markets Strategist Eric Wallerstein.

Their advice? Hold tight, and if stocks tank another 10%, view it as a buying window, not a reason to hit eject. A smart time to be strategic as there is no hint of a bear on the horizon.

HSBC’s strategists agree. Markets are still on a strong foundation, they say, pointing to economic and profit growth. In other words, no bubble here.

The market mess isn’t likely to clear up soon, but that doesn’t mean it’s all doom and gloom. Consider FARTCOIN, which has gone up 5% in the past 24 hours, even as the S&P 500 is trading in the red.

Please don’t take us seriously on this one ^^.

Read more: It’s US stocks, Bitcoin or nothing for 2025