ETF investing has become Wall Street’s golden child. But what if this ETF explosion might be doing more harm than good?

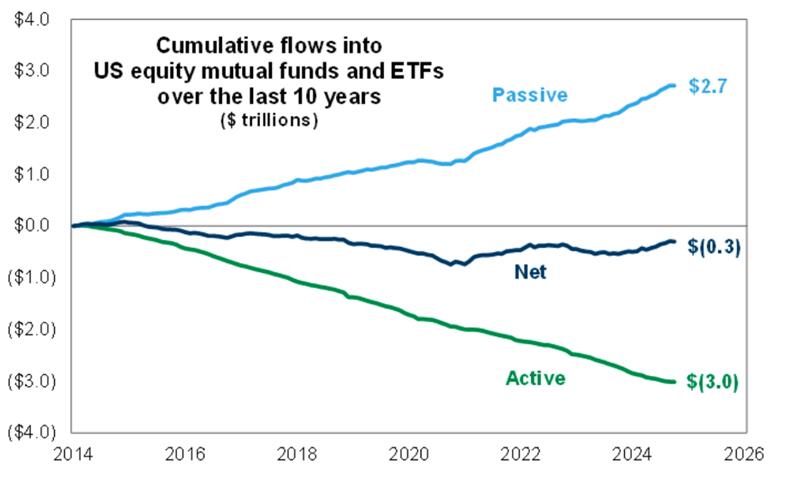

A report from Apollo Global suggests exactly that. The rise of ETFs and passive investing might just be the financial equivalent of shooting yourself in the foot.

It warns that ETFs are hoarding capital and shrinking market liquidity, making it tougher for buyers and sellers to find balance.

When the market stumbles? ETFs don’t play favorites. They don’t ask: “Should this stock survive?” They dump the whole basket, dragging even healthy companies with solid fundamentals down with them.

Read more: Mastering the Trump trades: MONIIFY’s ETF playbook for 2025

ETFs are all about mirroring the market. They scoop up everything in an index — no picking, no choosing.

But there is a catch. Over time, this buy-it-all approach feeds a vicious cycle: big names get bigger, scrappy underdogs get squeezed.

Enter the Magnificent Seven (Apple, Amazon, Microsoft, Nvidia, Tesla, Meta, and Alphabet). These tech titans already dominate indexes, and every ETF dollar acts like steroids, pumping them up further.

About 30 cents for every $ invested in the S&P 500 ETF ($SPY) goes into these big stocks, resulting in a dangerously lopsided market where a handful of players call the shots.

Read more: Gold vs S&P 500: 2024’s heavyweight fight is going down to the wire

We don’t need to be coy about loving ETFs. It’s the low fees. Expense ratios are much smaller than traditional mutual funds, making ETFs the go-to for easy money. Passive investing remains the most cost-effective way for the average investor to build wealth.

Active ETFs like Cathie Wood’s ARK Innovation — where managers with finance degrees actually pick stocks — charge more and have fallen out of favor as investors pile into passive funds. There is easy money to be made from a simple $SPY ETF.

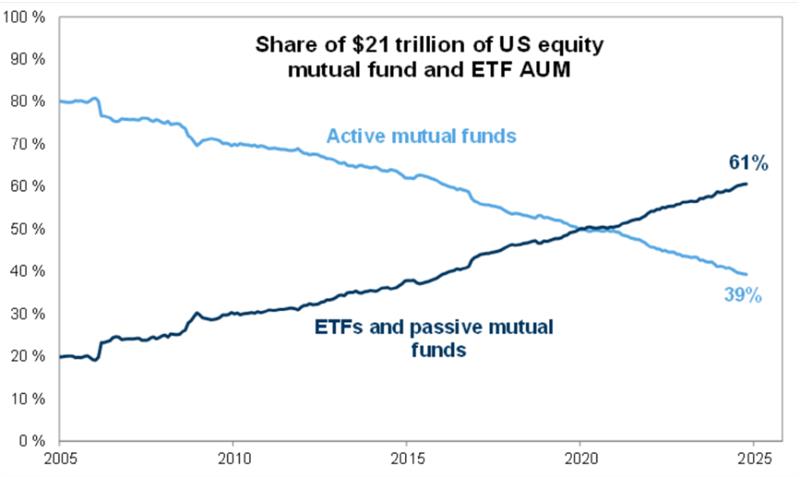

Here’s how dominant ETFs have become: they and passive mutual funds now represent 55% of global assets under management. In the mid-2000s, active mutual funds ruled with 85%. That dominance is done.

Look, ETFs might feel like the ultimate cheat code for investing, but their rising dominance is reshaping markets — and not necessarily for the better.

Critics argue that this change in investing has created market inefficiencies, even if the invisible hand of the market seems to keep things balanced.

The next market downturn will be the litmus test. Will it be a minor correction or a full-blown reckoning for the $21 trillion passive revolution?

Edited by Ankush Chibber. If you have any tips, ideas or feedback, please get in touch: talk-to-us@moniify.com