In 2012, Chinese hotpot juggernaut Haidilao opened its first restaurant outside mainland China, choosing Singapore as its launchpad.

Today, following an expansion blitz through Asia, the US, Europe — and most recently the Middle East — the chain boasts more than 1,300 restaurants worldwide.

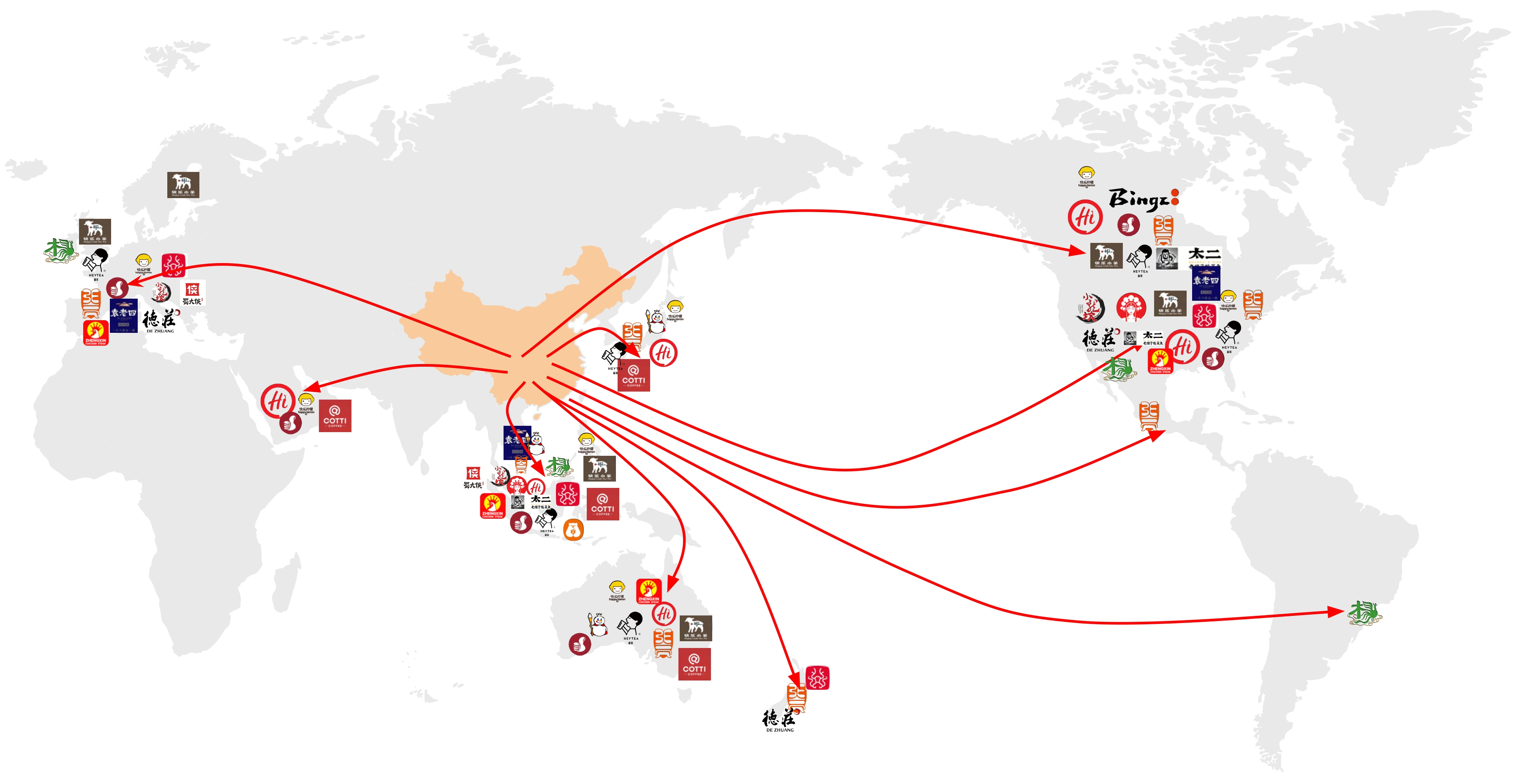

With intense competition and slower consumer demand at home, Chinese food companies are hungry for growth in new markets. Southeast Asia is proving to be a training ground for these brands, which they learn to adapt before expanding further.

“Success in Southeast Asia not only validates their business models, but also equips these brands with the confidence and experience to tackle more complex global markets,” Chen Weihan, insights lead at Singapore-based consultancy Momentum Works, tells MONIIFY.

Across F&B industry conventions in China last year, chuhai – “overseas expansion” in Mandarin – was the leading topic, according to a Momentum Works report. Beyond Southeast Asia, many Chinese F&B brands are considering markets like East Asia, Australia, the US and Europe.

Haidilao’s global expansion

A complex hot pot

Today more than 60 Chinese F&B brands are operating in Southeast Asia, running more than 6,000 outlets, according to Momentum Works.

Singapore and Malaysia have the highest concentration of Chinese brands, because they have large Chinese-speaking populations. But, Indonesia and Vietnam account for about two-thirds of all Chinese F&B outlets in the region.

Perhaps the most famous example is Luckin Coffee, which had a blockbuster IPO on the Nasdaq in 2019, but was delisted in 2020 after fabricating sales figures. Despite this setback, the company bounced back to overtake Starbucks as the largest coffee chain in China in 2023.

In March that year, Luckin Coffee opened its first international outlet in Singapore and now has more than 20,000 outlets. Meanwhile, Cotti Coffee, founded by former Luckin Coffee executives in 2022, now has more than 5,000 outlets globally.

Chinese coffee brand Nowwa, flushed with cash after a fifth funding round last year, has Southeast Asian expansion in its crosshairs and is also looking further.

Read more: China’s ready to play ball in 2025. Or is it?

From farm to table pocket

So, if you’re looking to get in on this action, where should you look?

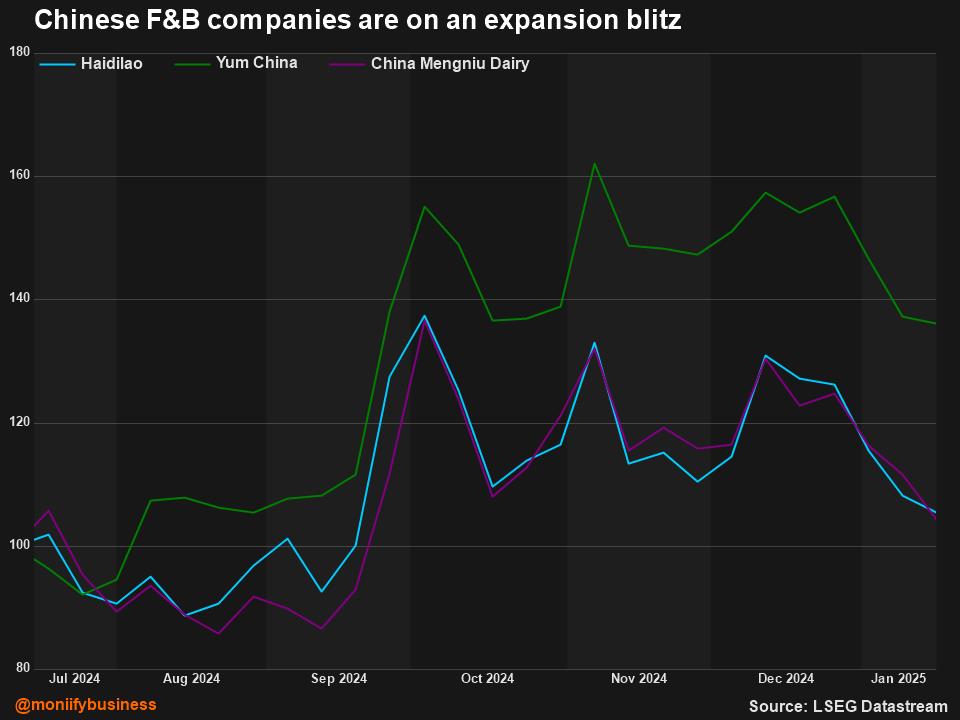

That appetite for expansion has breathed new life into the stocks of big F&B players like Haidilao, Yum China and China Mengniu Dairy.

Citi analysts are positive on China Mengniu Dairy because it sells fresh milk and yogurt, a key growth driver for the dairy industry. The company has a presence in Southeast Asia and has made acquisitions in Australia and Europe.

UBS has a “buy” rating on Haidilao and Yum China, which is listed on the NYSE and manages hotpot chain Little Sheep and Western brands like KFC, Pizza Hut and Taco Bell in China. Nomura also maintains its “buy” rating on Haidilao, saying in a research note on 16 January that the hotpot chain could deliver solid profit growth in the second half.

Read more: Did India just give investors a new reason to bet on China?

Challenges brewing

The expansion of Chinese restaurants comes at a time of sluggish consumer demand and intense competition in China.

China’s economy grew 5.0% in 2024, according to its National Bureau of Statistics, beating analysts’ forecasts of 4.9%. A raft of stimulus measures, including pro-consumption policies, helped the world’s second-largest economy meet Beijing’s growth target of around 5%.

It will take time for China’s pro-consumption policies to boost growth in the staples sector though, according to Citi analysts. More than a million food outlets across China shuttered in the first half of 2024. In an October earnings call, Starbucks CEO and Chairman Brian Niccol described the competitive environment there as “extreme.”

But while Southeast Asian markets may not be as competitive as China, expansion there doesn’t come without its challenges.

Chinese entrants struggle to establish efficient supply chains in markets without the dense logistics networks they’re used to.

“Cultural adaptation, localisation and managing operations would subsequently come into play in determining the success of the brand in the new region,” says Momentum Works’s Chen.

Companies like Haidilao are showing they’ve got what it takes to learn those lessons and adapt. Don’t be surprised to see an outlet popping up near you.

Edited by Victor Loh and Tim Hume. If you have any tips, ideas or feedback, please get in touch: talk-to-us@moniify.com