A big, sellout debut. Sizzling opening-day numbers. Then… nothing. IPOs in the Gulf have a reputation for quickly fizzling into a massive snooze fest.

The $2 billion question is: Will Talabat be any different?

Talabat — one of the region’s best-known food and grocery delivery companies — starts trading in Dubai on Tuesday 10 December.

The IPO was oversubscribed by more than 10x, according to a company statement. At 7.5 billion dirhams ($2 billion), it’s set to be the UAE’s biggest IPO this year, and even the world’s largest tech listing of 2024. 💨

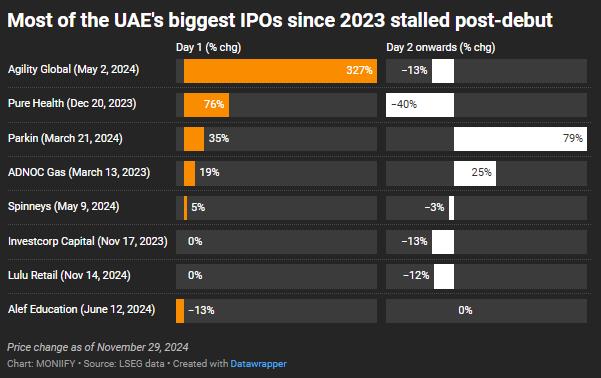

But look what happened to these other promising Gulf IPOs:

- Lulu’s recent big IPO saw a flat debut even after being oversubscribed more than 25 times. It’s down 12% since listing in Abu Dhabi on 14 November.

- Agility Global, a subsidiary of Kuwait’s Agility Public Warehousing Company, rose more than 300% on its first day in Abu Dhabi in May this year, only to drop 13% in the months that followed.

- Healthcare provider Pure Health enjoyed a rally on its debut in December last year, climbing 76% before sliding by 40% since then.

OK, so we made a table for the rest but with some exceptions, you can see where this is going…

So, why the fizzle?

It’s basically buy-first-think-later vibes.

Six of the eight major IPOs since 2023 failed to rise after their first day pop. State-owned ADNOC Gas rose just 25%, underperforming the 42% jump in global stocks. And most of Parkin’s gains were in the last week or so, when Dubai’s Roads and Transport Authority approved a variable parking tariff policy.

Investors chase those sweet Day 1 gains, while questions about growth and fundamentals are left for the future, says Faisal Hasan, chief investment officer and head of asset management at Al Mal Capital.

Read More: Swiggy’s sweet debut could turn sour quickly

This approach to valuation possibly contributed to weak showings by the likes of Alef Education and Spinneys’ over the past year.

The issue isn’t just excitement burnout — it’s also liquidity.

With limited shares floated, especially by state-owned companies, it’s tough for big players to make moves without causing major swings. Fewer shares traded means more volatility. This limits participation by, say, foreign investors and institutional investors, who basically don’t want the volatility a smaller float brings.

The take-up of newly listed shares isn’t as strong as last year or the year before, says Mohammed Ali Yasin, founder and CEO of The Oracle Financial Consultancy and Investments. Going by the trend, it could mean there won’t be a lot of cash chasing future IPOs, he adds.

Will Talabat be any different?

Talabat doesn’t have a liquidity problem, it’s floating about 20% of its shares.

But there’s something else that’s slightly worrying. Talabat’s implied market cap of $10.1 billion is on par with its parent company Delivery Hero, which is listed in Germany.

Its debt burden could be the main reason for Delivery Hero being valued on par with its subsidiary, says Yasin.

Delivery Hero’s debt-to-equity ratio was at a whopping 330% at the end of last year, suggesting it may have a more difficult time covering its liabilities. Almost 10x the average for the food delivery industry, according to data from LSEG.

Talabat “will not have any” debt, adds Yasin.

And, it’s the Middle East. Online delivery is an everyday thing among consumers in the region, especially in the Gulf.

Read more: India’s market gloom deepens as IPO boom cools down

Lower labor costs and taxes than other developed economies like Germany or the UK, means better profits and cash flows, says Clément Genelot, VP equity research for food retail and delivery at Bryan, Garnier & Co. That’s exactly why Delivery Hero and Britain’s Deliveroo have struggled to scale back 2021 highs.

Genelot also noted Talabat’s ability to keep growing double digits.

If Talabat shines, the IPO market could light up again.

Successful IPOs by these companies could lead to increased liquidity in the market, making it more attractive for other firms to list, Al Mal Capital’s Hasan says. And with household names entering the public arena, this could create a “positive-feedback loop.”

So, will Talabat be just another sleepy IPO, or will it rewrite the script? Stay tuned.