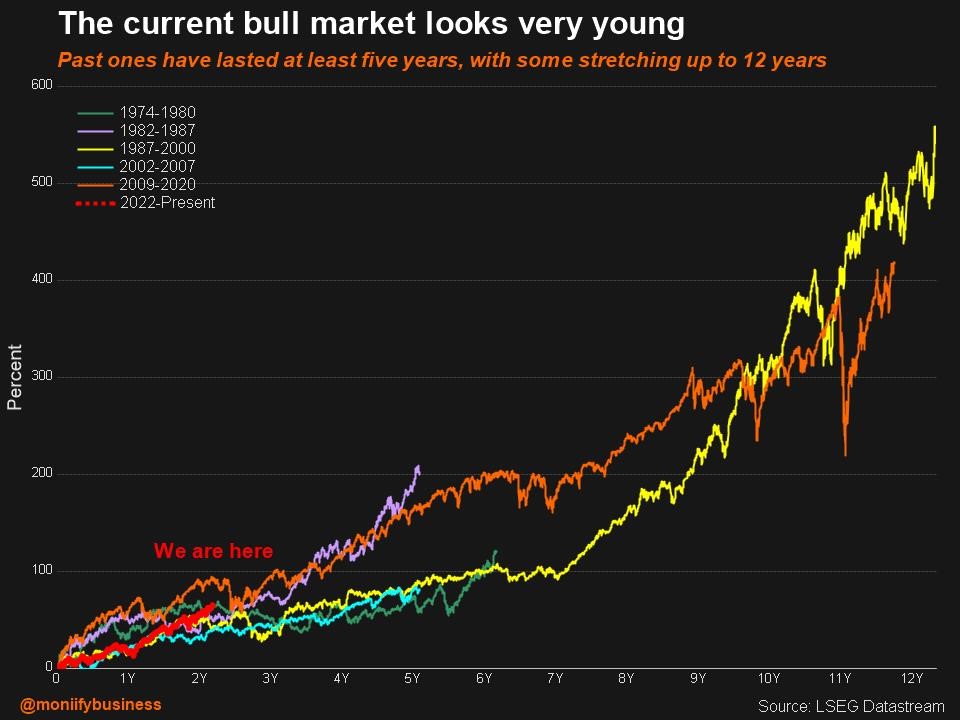

If you think this bull run’s getting old, think again. This market’s just hitting its stride.

Sure, it turned two in October, but compared to the marathon bulls of the past, it’s just a baby. 👶🏻

History’s got receipts too. Since 1974, bull markets have run at least five years before fizzling out. Some, like the 1987 run, stretched for 12 years! And let’s not forget the last big one, from 2009 to just before Covid-19 flipped the world upside down in 2020.

Plus: Wall Street’s still optimistic, and bears are STILL hiding. Bank of America’s 2025 S&P 500 target sits at 6,666 points, while Morgan Stanley and Goldman Sachs are eyeing 6,500.

MONIIFY’s recent poll with market strategists and fund managers strikes the same tone: 53% see the S&P 500 tapping out at 6,500 points by next December. Even if the party slows down, that’s still more than a 7% gain from current levels.