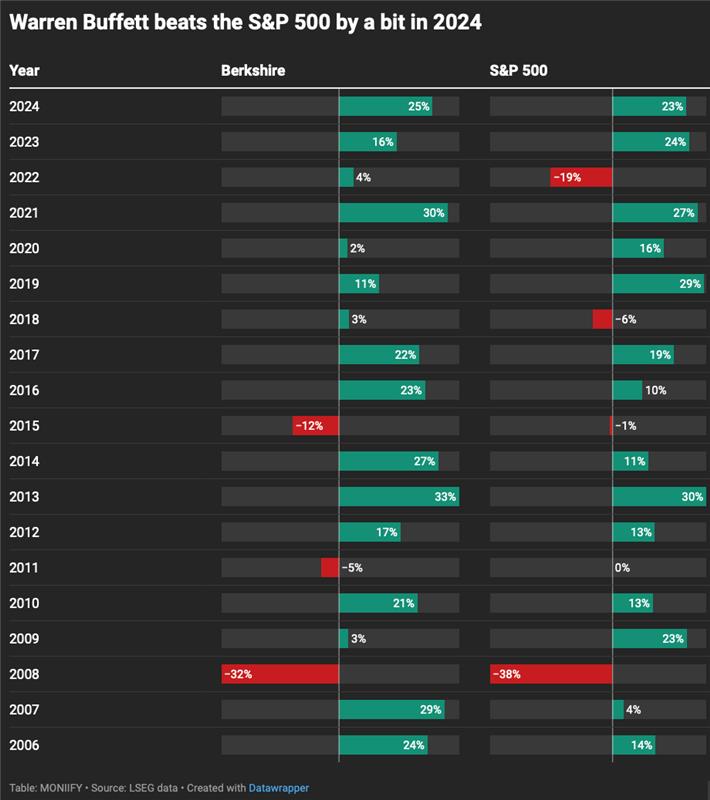

The Oracle of Omaha squeaked past the S&P 500 in 2024, thanks to a last-minute tech pullback. But the Warren Buffett magic isn’t hitting like it did in the 1990s.

The famed Berkshire Hathaway outperformance has faded through the years, with the company lagging the S&P in two of the past five.

Over the last two decades, Buffett’s portfolio has outperformed the index by 215 percentage points. Not bad, but a far cry from the 5,700% lead he held in the previous 20 years.

Why? It’s simple: apart from Apple, Berkshire doesn’t have big exposure to tech themes like AI or crypto yet.

But before you write him off, remember this: when markets tank, Buffett shines. His focus on safety has consistently helped Berkshire weather storms better than the broader market.

In a crisis, boring can be beautiful. Buffett’s bets keep proving it.

Edited by Ankush Chibber. If you have any tips, ideas or feedback, please get in touch: talk-to-us@moniify.com