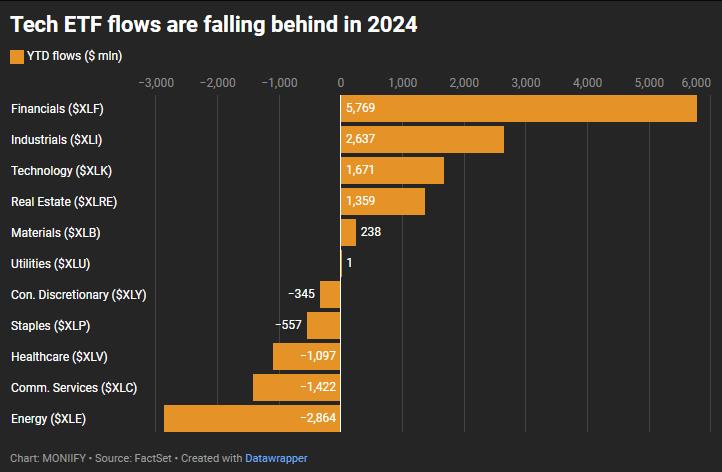

Tech stocks are losing their sparkle, and in ETF land, they’ve been bumped to third in year-to-date inflows. Guess who’s winning? Financials and industrials — the two sectors everyone loves to call boring.

The Technology Select Sector SPDR Fund saw $1.7 billion in inflows between January and November, according to FactSet data. That’s much lower than the $5.8 billion financials ($XLF) got, and weaker than the $2.6 billion pulled in by industrials ($XLI).

Read more: S&P 500’s bad breadth problem? It’s a nothing burger

It gets worse. In November alone, tech slid to seventh place, bleeding $91 million in outflows, while financials and industrials kept stacking cash at the top.

Meanwhile, US-listed ETFs are having a monster year, reaching $10.2 trillion in assets under management and flows are on track to smash records at $1 trillion in 2024.

November was a beast, pulling in $158 billion — a 35% jump from October — with stock ETFs leading the charge.

In the “other” corner, alternatives ETFs shined with $180 million in inflows, but commodities weren’t so lucky. Gold and energy ETFs bled $826 million in outflows.

Turns out, it’s a great time to be steady, not flashy.

Read more: The big shake up: Nvidia 🚀️, Saudi Aramco ⬇️