Donald Trump’s win and Marco Rubio’s China hawk credentials might make everyone’s Christmas shopping a lot pricier next year.

While everyone’s shopping carts are safe for now, escalating trade tensions could send shipping costs in the South China soaring, according to logistics execs like Mory-Tnte COO Thaswin Nagantra.

Freight costs have increased about 10% to 15% following Trump’s victory and are expected to climb further, Nagantra tells MONIIFY.

Why? Well… nearly a third of global trade flows through the South China Sea — a hotbed of claims, counterclaims, and geopolitical drama.

China’s “nine-dash line” in the South China Sea clashes with the economic rights of Southeast Asian countries.

And while Trump has vowed to stop wars (read Ukraine and Israel), it’s worth noting that the US Navy actually increased patrols in the South China Sea — significantly — during his first term. Rubio, tapped for secretary of state, will likely ratchet up pressure.

The hawk

Rubio, a three-term senator from Florida since 2011, was previously one of Trump’s harshest critics during their 2016 presidential bid. And that’s how his “little Marco” moniker stuck, after trading barbs with Trump over his allegedly small hands.

Both men mended their relationship during Trump’s first term in office, and his time on the Senate Foreign Relations Committee and Intelligence Committee cemented his reputation as a China hawk.

In 2021, Rubio called on the Biden administration to blacklist Honor, which was a spinoff of sanctioned Chinese tech company Huawei. He also made a similar call to tighten the Huawei dragnet this year following its release of a laptop with Intel AI chips.

Rubio’s appointment signals a clear return to Trump’s previous foreign policy playbook, which translates to significant hostility towards China, Dr Chong Chia Siong, a senior fellow at Singapore’s S. Rajaratnam School of International Studies, tells MONIIFY.

A chokepoint

What’s at stake? A lot more than everyone’s bargain haul.

Nearly a third of international shipping goes through this stretch, which connects Europe and Asia. Resources like fish and natural gas and oil reserves under the sea are also cash cows for these claimants.

China has sent fishing fleets — often seen as militias — and coast guard ships to drive off rigs and fishermen or ram other regional coast guards in disputes.

Tensions extend beyond China, with Indonesia, Vietnam, and Malaysia clashing over claims.

The US, which will likely continue supporting other claimants (think Vietnam and the Philippines), and allies like Australia, the UK, and Germany, have increased naval patrols in the region over the past decade.

Escalation risks exist, but neither side would want a full-blown war, say experts like Thomas Daniel from the Institute of Strategic & International Studies Malaysia.

Others like Carmelo Ferlito, an economist and the CEO of Center for Market Education, lay hope in Trump’s rep of being a “practical man.”

If trade tensions emerge, they are unlikely to escalate into broader geopolitical conflicts, Ferlito tells MONIIFY, but will likely trigger a reshaping of the global supply chain.

The plan B(s)

Any escalation could affect shipping routes and trade agreements, says Premkumar Rajagopal, president of the Malaysia University of Science and Technology, potentially disrupting supply chains.

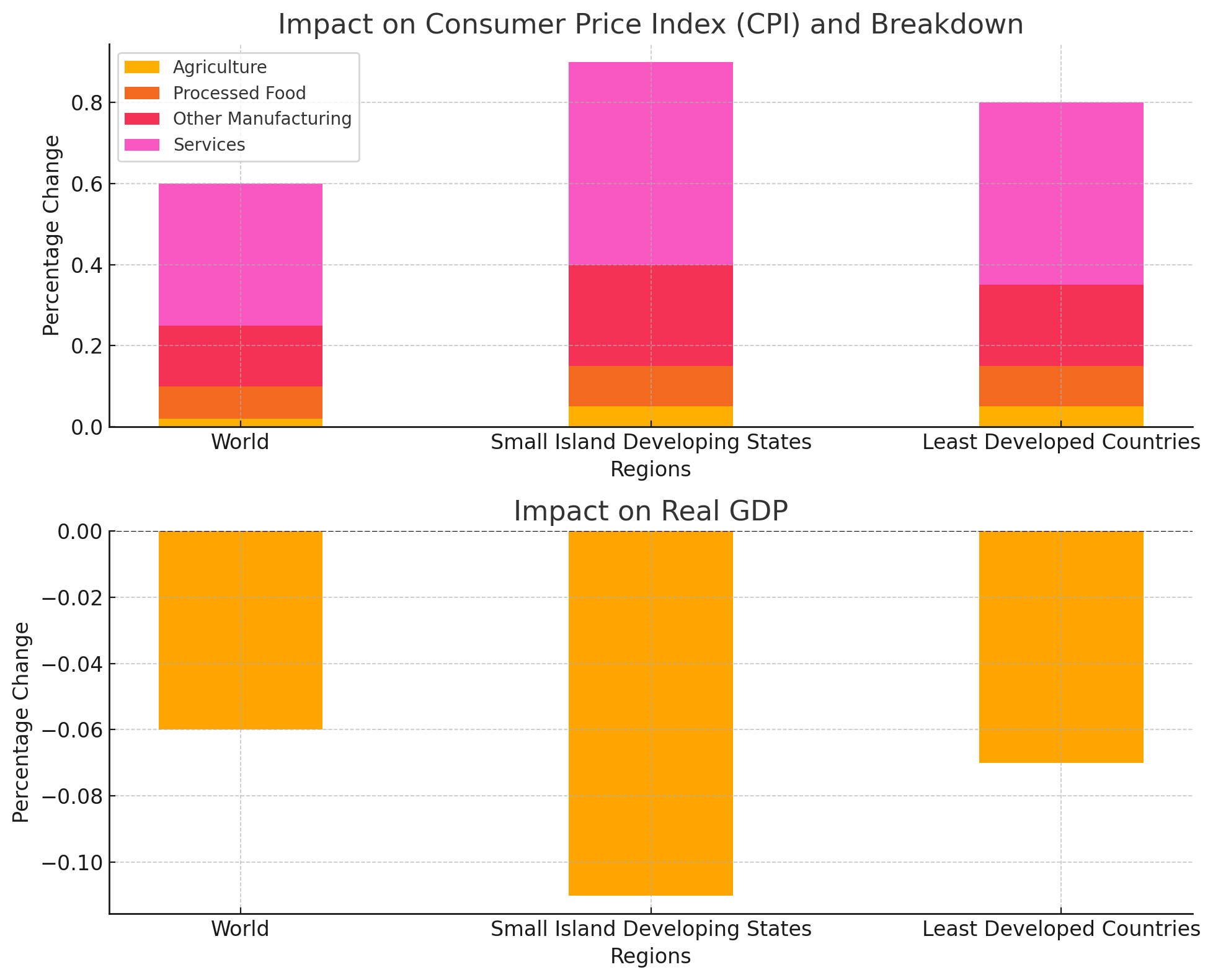

The United Nations Conference on Trade and Development projects that the global economy could see its real GDP dragged down by 0.06% due to disruptions in the Red Sea and the Panama Canal, which Trump threatened to regain control of on Sunday.

But beyond that stat is the reality that this is gonna sting much harder for small and developing island states that are reliant on maritime trade. And when freight costs spike, it is their private sector businesses that are going to be hit the hardest.

On the other hand, as businesses diversify their supply chains away from China, suppliers in other regions such as Southeast Asia could net more business, Rajagopal says.

Or maybe the silver lining is that the tensions lead to better options? That is a solid maybe.

New routes like the India–Middle East–Europe Economic Corridor and Thailand’s land bridge to bypass the Strait of Malacca by connecting the Gulf of Thailand and the Andaman Sea could be explored. But these solutions need serious $$$ and time. All in short supply.

Bottom line: While consumers might notice higher prices, the real hit could be to businesses’ balance sheets across the South China Sea.

They are facing a stark choice: surf the shifting tides of geopolitical tension, rising costs, and disrupted supply chains, or risk being swept aside. Adapt, innovate, or die.

Edited by Ankush Chibber and Victor Loh. If you have any tips, ideas or feedback, please get in touch: talk-to-us@moniify.com