Forget all the hype around AI and Nvidia, the smart money is piling into Alibaba. The Chinese e-commerce giant is one of the cheapest tech stocks out there and it’s forecast to rise 20% in 12 months.

Even Michael Burry (yep, The Big Short guy who called the 2008 crash) just made it his top pick.

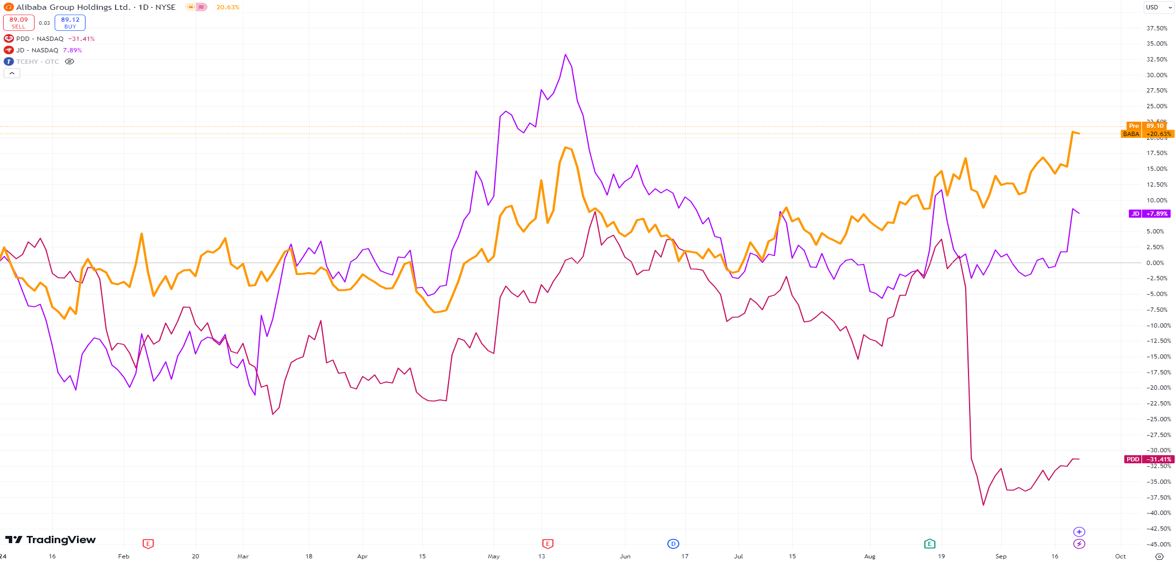

The stock’s already heating up. Alibaba’s US shares, or ADRs, have jumped 20.6% since January, beating out Chinese rivals like PDD Holdings and JD.com.

Discount pick #1

- Alibaba is a total steal compared to its peers. Its forward price-to-earnings ratio is just 9.1, way lower than the industry’s 20.5 average, and it trades at a 58% discount to the S&P 500.

- Analysts are calling a 12-month target of $105, which would be an 18% jump from where it’s sitting right now, according to Refinitiv data.

Investors from Mainland China are going big on Alibaba’s stock in Hong Kong, and that’s driving its ADRs up. Since Alibaba opened up its Hong Kong stocks to mainland buyers on September 10, they’ve gained another 5.4%.

So what’s going on?

Alibaba’s stock has taken some big hits in recent years. The company was in trouble with regulators, a slowing Chinese economy took its toll on sales, and China’s long-running trade row with the US has made it more complicated to do business.

Even with these setbacks, Alibaba is on a roll. It has crushed expectations for two years straight, with gross profits rising 14% to $14.4 billion in the financial year ending March.

Alibaba also scored a major win in August when China’s antitrust watchdog ruled that it had ended the monopolistic practices that had sparked a years-long investigation in 2020.