Let’s start with the obvious one: China.

Chinese stocks are taking a battering. Why? Because Trump’s favorite word is tariffs.

He has said it’s “the most beautiful word in the dictionary.” Hong Kong stocks slipped 2% on Wednesday, when the rest of the world and Bitcoin were on fire. The Mexican peso also sank.

We’ve kinda seen it all before (in 2016). Trump has upped the ante this time though: he’s said he’ll target countries like China with tariffs of anywhere between 60% and 100%, with a 10% across-the-board levy on imports from elsewhere.

Europe? What’s it doing on this list?

The new-new bit is the likelihood of tariffs on the US’s biggest trading partner: the European Union. The euro’s been in a total panic today. It’s down a full 2% today and heading for its biggest one day decline since Brexit. (Ouch.)

Goldman Sachs estimates that the impact of an EU-US trade war would shave 0.9% off GDP in the euro area vs 0.3% in America. That’s really quite a lot for a mature continental economy with plodding growth. Remember, the EU as a bloc is expected to grow just 0.8% this year, so these new taxes could spell r-e-c-e-s-s-i-o-n for America’s biggest ally.

Actually, that’s two black eyes for some

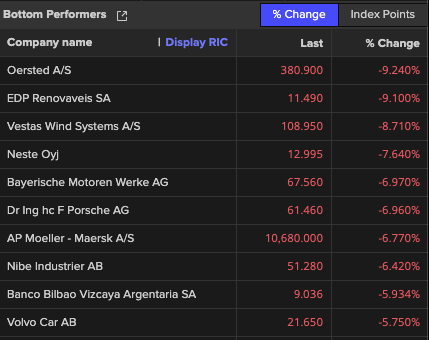

There’s a double blow in store for some European stocks. Basically, any of the fancy carmakers – Volkswagen, Porsche, BMW and Mercedes-Benz – are in trouble.

First blow? The chance of direct levies on European goods. Second? The knock-on impact of a China slowdown after Trump slaps fresh tariffs on the world’s second-largest economy. All these stocks are sinking while the European big board is painted green.

The hangover has also spread to drink makers Diageo, Pernod Ricard and Davide Campari. Expect Guinness, Chivas Regal and Johnnie Walker to become a tad more expensive for Americans. (How about some bourbon tonight?)

In a nutshell, a Trump-led administration will probably mean tariffs galore!

While we don’t know exactly how high or wide-ranging they’ll be, we can expect some serious back-and-forth on global trade. Other countries are likely to clap back with their own tariffs, setting the scene for a lively showdown (read slowdown?) in the world of international trade.

Green turning red

Trumps’ focus on fossil fuels (“drill baby drill!”) is gonna slowdown everything green energy globally. Clean energy might be out, at least for a while, says Dipanjan Ray, senior portfolio manager at Emirates NBD Asset Management. So, if you’re rooting for green energy, prepare for a bit of a rough patch. European wind energy stocks Orsted and Vestas are the worst performers in the EU, alongside the car stocks.

Joker in the pack

The surprise underperformer from a Trump victory is APPLE!

Yes. The iPhone maker. China is one of its biggest markets and any tariffs will lead to retaliation (remember Beijing banning iPhones for state workers?). The losers are piling up even before Trump moves back into the White House in January.