Across the four biggest emerging markets that hit the polls this year, incumbent parties hung onto power like pros. But it wasn’t a smooth ride.

The polls sent EM investors into a nervous frenzy, dishing out chaos by the bucketload.

And then came the big daddy of all elections as Donald Trump won the White House and readied his tariff gun for EMs. The drama never ends.

South Africa: The nail-biter

South Africa’s election season felt like a bingeworthy series with a cliffhanger finale.

Leading up to June, markets were spiraling as fears spread that the African National Congress’s hold on power was on shaky ground for the first time since the end of Apartheid.

Then the big reveal: the ANC lost its majority but clung to power through a coalition. Cyril Ramaphosa, the market’s favorite, stayed on top.

Read more: Asia braces for Trump tariffs: Who wins and who loses?

The results calmed investors. The rand, surprisingly resilient, is down just 3% against the dollar—impressive for a currency known to buckle under pressure.

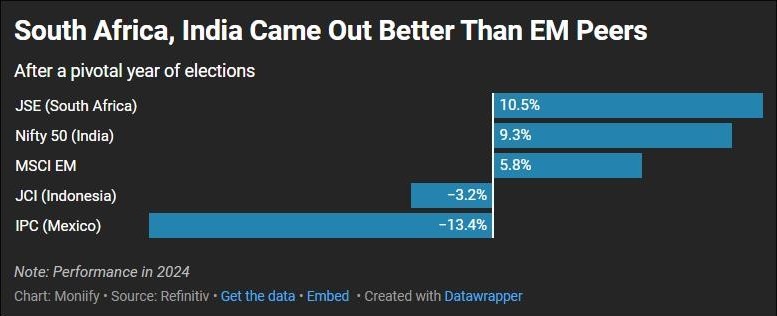

Meanwhile, the FTSE JSE All-Share Index is up nearly 10%, trouncing the MSCI EM index’s 6%. Even S&P joined the party, upgrading South Africa’s outlook to positive.

Not bad for a country that was bracing for disaster.

India: Modi’s coalition curveball

India’s election was a close call, with the BJP needing coalition allies to secure another term for Narendra Modi. Markets panicked initially, with the Nifty 50 dipping 6%. But Modi’s re-election eventually steadied nerves.

Growth is slowing, and Modi’s reformist glow has dimmed, but the Nifty 50 is up 9%, and the rupee’s modest 3% drop against the dollar outperforms most EM currencies.

Modi may not be bulletproof anymore, but when it comes to India’s markets, he’s still the safest pair of hands in the game. Still, Trump’s tariff threats loom large, with India firmly in his crosshairs as a “big abuser” of trade rules.

Read more: Modi’s India needs BFF Trump more than US does

Jakarta: No spark

The island nation’s February election came and went with little drama. Jokowi handed the reins to Prabowo Subianto, whose victory cleared political uncertainty but didn’t ignite investor excitement.

Stocks have been down 3% since the vote, and the rupiah has slid 5% against the dollar. Growth predictions hover at 5%. Decent but hardly thrilling for Southeast Asia’s heavyweight.

Jokowi’s EV-based nickel export push sparked a trade spat with the EU, while Subianto has yet to offer a clear vision to boost investor confidence.

The Asian Development Bank is predicting 5% growth next year. That’s solid, but pretty “meh” for Southeast Asia’s biggest player.

Right now, Indonesia’s a more mid-table player than breakout star.

Read more: Jakarta joins Mumbai in the correction club

Mexico: Cue the change

The US sent Trump back to the White House after a second showdown against a female candidate. Mexico did the opposite, by electing its first female president, Claudia Sheinbaum.

Sheinbaum rode a wave of love for her predecessor, Andres Manuel López Obrador (aka Amlo), who somehow managed to keep both lower-income voters and Wall Street on his side.

But her Morena party’s landslide win comes with baggage. Its push to elect judges has raised alarms about institutional risks. Investors are sweating.

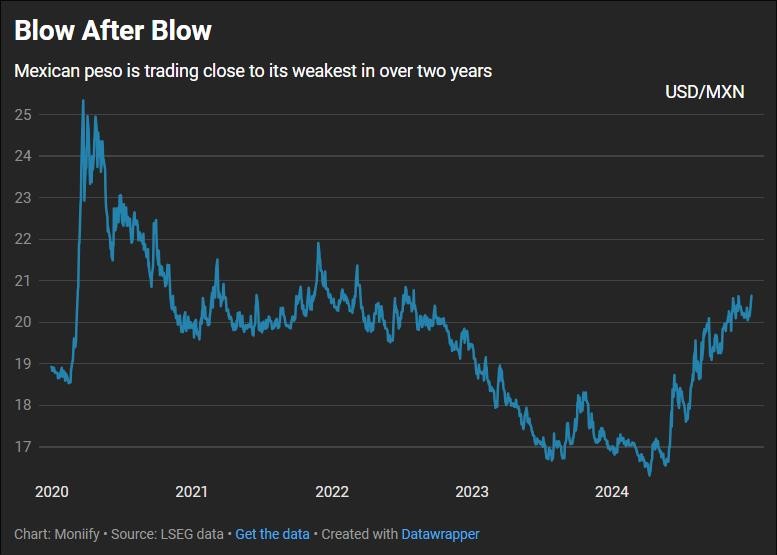

And then there is Trump. His return sent the peso into a brutal 22% freefall, while stocks slumped by about 15%.

For a country riding high on economic optimism, 2024 feels like a plot twist no one asked for.

Edited by Ankush Chibber. If you have any tips, ideas or feedback, please get in touch: talk-to-us@moniify.com