Are US authorities investigating Tether, the issuer of USDT, the world’s largest stablecoin? That’s the question everyone’s asking but does it even matter?

Crypto says: no.

Sure, the market shuddered a bit immediately after the Wall Street Journal reported last week that the US Department of Justice was conducting a criminal investigation against Tether for potential sanctions and anti-money-laundering breaches.

It should be a big deal because USDT has a market cap of more than $120 billion. It’s a major source of liquidity in trading venues and is increasingly used as a method of payment and transfers in emerging markets.

But once Tether slammed the reporting as “wildly irresponsible” (the WSJ didn’t have any authorities on the record) the market rebounded. It hasn’t looked back since.

By Wednesday, Bitcoin – the largest cryptocurrency – had climbed back up from Friday’s 3% dip to surpass $73,000 a token, inching ever closer to its all-time high.

Resilience

Tether CEO, Paolo Ardoino, dismissed the report as the regurgitation of “old noise.” That’s because Tether has been dogged by reports that it’s under US investigation for years now.

Earlier this year, Ripple CEO Brad Garlinghouse said: “The US government is going after Tether. That is clear to me.” Garlinghouse didn’t say what information, if any, that view was based on, but he did say that crypto markets had proven themselves to be extremely resilient to these kinds of shocks in the past.

Just look at the collapse of FTX and the subsequent sentencing of its founder, Sam Bankman-Fried. Or the jail term handed to Changpeng “CZ” Zhou, the founder of Binance, the world’s largest cryptocurrency exchange. They haven’t stopped crypto from inching its way into the mainstream or held back Bitcoin’s rise.

Tether is still in damage control mode. Ardoino said in a reply on X that the firm holds $100 billion in US Treasury bonds, 82,000 Bitcoins and 48 tons of gold to back USDT.

But with the US days away from a charged presidential election, things could swing Tether’s way.

Most of Tether’s reserve assets, including more than $80 billion in Treasurys, are managed by the US-headquartered brokerage Cantor Fitzgerald, whose chairman and CEO Howard Lutnick is an ally of Donald Trump and a member of his transition team, according to the WSJ report.

The DOJ, the Trump campaign and Cantor Fitzgerald did not immediately respond to requests for comment.

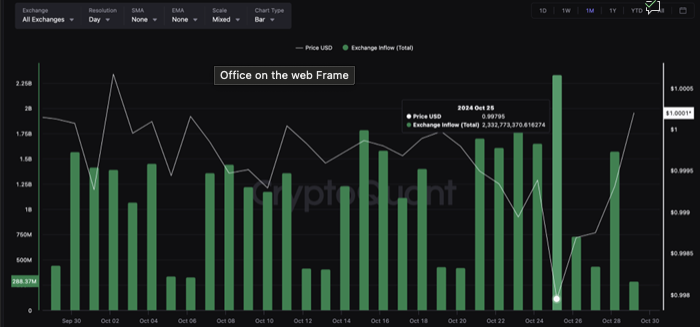

USDT inflows

(Source: CryptoQuant)

Stablecoins shake-up or steady she goes?

Bitcoin’s surge since the news suggests investors aren’t exactly rushing for the exits amid the FUD. (That’s crypto-speak for fear, uncertainty and doubt.) In fact, investors are moving USDT into crypto exchanges at the typical rate, suggesting no major changes, data from blockchain intelligence firm CryptoQuant shows.

If charges are framed against Tether, it could “shake market sentiment,” some market observers have said but if you’re thinking about whether to get in or out of crypto, the Tether investigation is probably not going to be your main consideration at this point.

On Monday, Ardoino told CoinDesk that Tether will not “fight the US,” suggesting it was open to cooperating with the authorities.

“If the US wanted to kill us, they can press a button and kill us anywhere.”