Bitcoin kicked off the first full business week of 2025 like a rock star, reclaiming the six-figure milestone for the first time since 19 December, and soaring as high as $102K before settling in.

Politics might just be the unlikely fuel for this latest rally.

A stunning exit

Justin Trudeau’s decision to resign as Canada’s prime minister has crypto circles spinning.

The move could potentially make way for Pierre Poilievre, a guy who once bought a chicken shawarma with Bitcoin and pledged to make a plan that would “enable Canada to become the blockchain and crypto capital of the world.”

Whether that pans out or not, the speculation alone seems to have fully fired up traders. Trudeau’s resignation was the top trending discussion in crypto circles.

Read more: Morocco’s U-turn on crypto has a details problem: MONIIFY Scoop

Adding to the momentum is the impending exit on 28 February of Michael Barr, the US Federal Reserve’s anti-crypto vice-chairman.

An ally of anti-crypto US Senator Elizabeth Warren, Barr has been described as the agency’s “debanker-in-chief” over his alleged link to “Operation Chokepoint 2.0,” the reason why banks cannot custody crypto. He remains on the Fed board, though.

And finally, the Kamala Harris-led official certification of Donald Trump’s election victory on 6 January, a symbolic date, marking the end of a volatile political cycle for crypto.

The Trump-Bitcoin connection has already fueled wild market narratives, and the run-up to his 20 January inauguration could bring more.

Read more: Bitcoin’s being boring — and maybe that’s a good thing

A psychological win

Going past $100K is always significant. It’s seen as a resistance level, and once past it, the heebie-jeebies seemingly make way for positive psychological trader behavior.

BTC went as high as $102K on the back of that momentum and is now already up 10% since the start of last week. Some major altcoins are feeling it too. Ether, Solana, XRP, Dogecoin and Cardano are up 10% to 30% in the past seven days.

Bitcoin’s comeback follows a holiday slump, where it dipped near $91K on 30 December — a 15% drop from its 17 December all-time high of $108K — as investors took profits and US spot Bitcoin and Ether ETFs saw outflows.

Traders are anticipating the next Trump-fueled rally could push BTC even higher.

Read more: Crypto’s big year: The laws, politics, and tech setting the stage for 2025

Big boys be buying

Big money is still backing Bitcoin. MicroStrategy, the biggest publicly traded Bitcoin HODLer, snapped up another $101 million in BTC, and new money is also making its way towards the OG crypto.

Energy management firm KULR Technology Group bought BTC for the second time, rather quickly after its first purchase last month, snapping up $21 million’s worth.

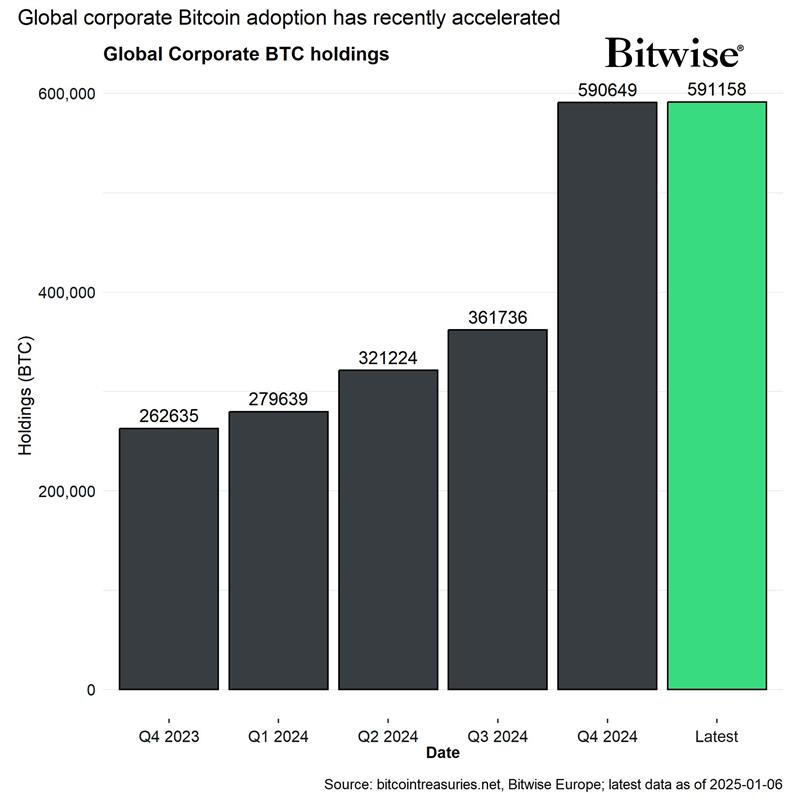

KULR will not be alone in doing so this year. Hunter Horsley, CEO of asset manager Bitwise, says corporations stacking Bitcoin in their reserves will be a major theme this year, with data compiled by the firm showing increasing adoption.

At the same time, money has started to flow back into US spot Bitcoin ETFs, logging two straight days of inflows topping $900 million, according to investment firm Farside. This reverses December’s outflows as investors reset for the new year.

Read more: Trump’s crypto promises have Asia’s Gen Z hooked

Where next?

Not everyone’s so optimistic about where BTC ends up this year.

The party might be reaching its climax — CryptoQuant’s telegraphing analyst Crypto Dan’s views suggest caution. He’s predicting a market peak by mid-2025 and advises gradual selling.

So does Bitcoin advocate Fred Kreuger. “It’s about the level of conviction,” he says, indicating that the casuals will lose.

Now there is talk that the record devaluation of India’s currency and the poor performance of China’s markets could make Bitcoin attractive for traders in these countries. A potential catalyst that must be watched.

Bitcoin is back with momentum. But the real story is what’s next.

Will Trump’s return, corporate buying, and ETF momentum fuel another leg up? Or will cautious selling and market fatigue bring BTC back down to earth?

Edited by Amitoj Singh and Ankush Chibber. If you have any tips, ideas or feedback, please get in touch: talk-to-us@moniify.com