Morocco’s big “plan” to embrace crypto, a U-turn from its ineffective ban, doesn’t have a timeline or specifics on what it would look like yet, persons familiar with the matter tell MONIIFY.

Hope flamed eternal once again last month when Abdellatif Jouahri, the governor of Bank Al-Maghrib, claimed that draft law regulating crypto was undergoing the process of adoption.

Heard that before? Yup, right here. In 2022. From the same man.

Jouahri, who was speaking at a conference in Rabat, also said that the central bank is even exploring a central bank digital currency.

According to the sources, while discussions for the CBDC are underway, the draft law will leave out CBDC and DeFi for now.

Read more: Bitcoin’s being boring — and maybe that’s a good thing

Beyond the ban

Despite Morocco’s 2017 ban on crypto, the underground scene is thriving.

As of end-2023, more than 5% of Moroccans were reportedly dabbling in digital assets. That’s close to two million Moroccans just not taking no for an answer.

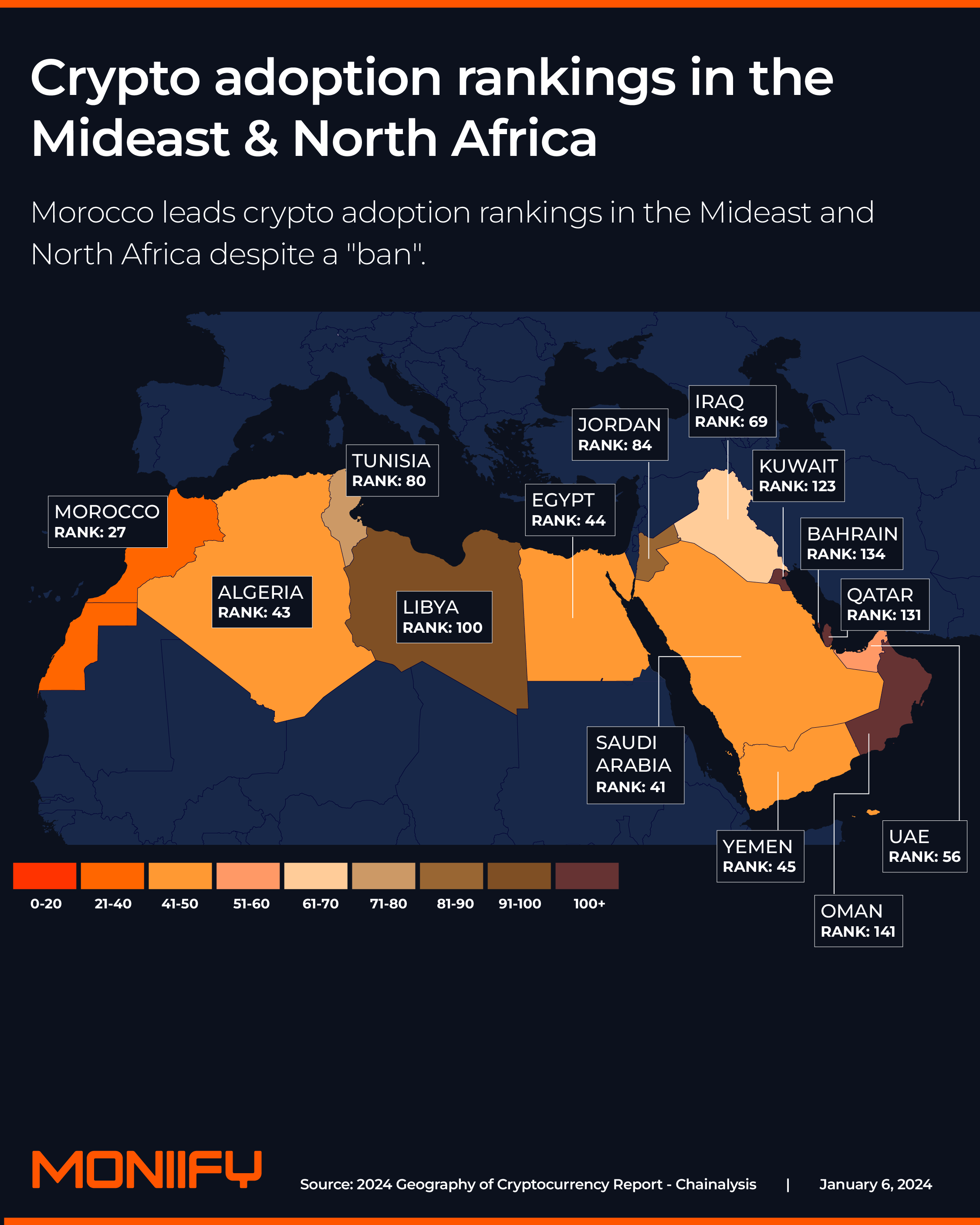

By 2024, the country’s crypto market was worth about $12 billion and has ranked consistently in the top 30 economies adopting crypto, according to Chainalysis.

So why the shift? Bitcoin’s record highs and Morocco’s refusal to be left behind in fintech and innovation are likely factors.

Morocco’s ban was aimed at getting rid of illegal activities associated with unregulated crypto, but the about-face is aimed at imposing anti-money-laundering laws while still encouraging digital innovation, the sources say.

The roadmap

This kind of regulatory procrastination isn’t unique to Morocco. India, Australia, and other countries have also dragged their feet on crypto legislation.

Michael Novogratz, founder and CEO of blockchain company Galaxy Digital, weighed in, saying any regulation needs to be progressive, not reactive, to shield investors from fraud while encouraging growth.

Neighboring countries like Egypt and Algeria — where crypto policies are a murky mess — will be watching Morocco closely.

Read more: AI tokens are coming for memecoins’ throne in 2025

A well-crafted law could turn the country into a blockchain hub for North Africa, attracting investment, startups, and tech talent. Beyond that, it could open doors for financial inclusion, faster remittances, and even tourism.

But let’s be real –– crafting rules for a global, borderless technology is always going to be a slog.

And whether Morocco finds a way or drags its feet, the stakes couldn’t be higher in a global financial future that will have the most pro-crypto US leadership ever.

Maybe that’s why the central bank is keeping its cards close to its chest.

Graphics by Alia Chughtai. Edited by Amitoj Singh and Ankush Chibber. If you have any tips, ideas or feedback, please get in touch: talk-to-us@moniify.com