Bybit, the world’s second-largest crypto exchange by trading volume, has been ordered to shut down its Malaysia operations for operating without a license, as part of a push by the country’s securities watchdog to regulate the crypto industry.

It’s a major blow for Bybit’s local users, who were locked out of their trading accounts just as prices of cryptocurrencies like Bitcoin, Ether, XRP, Litecoin, and Bitcoin Cash tumbled 10%-16% over the past two weeks, according to CoinGecko. The timing could affect strategies for investors mid-play.

According to Malaysia’s Securities Commission, the exchange was informed of the move on December 11. It said Bybit was given two weeks to disable its platform in the country, cease advertising to Malaysian investors, and terminate its Telegram support group for local customers.

Bybit has complied with these directives so far, the commission said in a statement on its website.

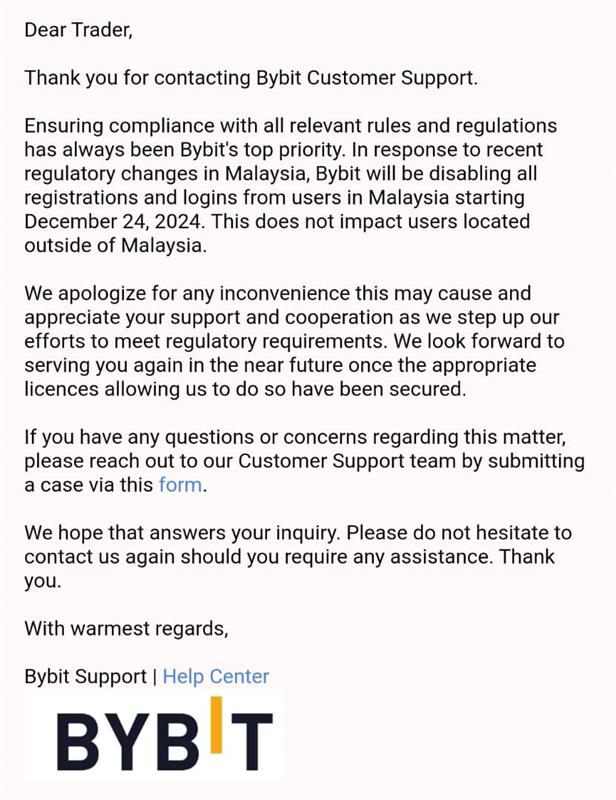

Bybit’s troubles were widely reported only following the commission’s statement on Friday, although Malaysian users had earlier shared on social media an email from Bybit informing them their accounts would be disabled.

Read more: Australia’s crypto cop: Figure it out, mate!

Bybit has yet to reply to MONIIFY’s request for comment, but it posted on Telegram that it was “actively pursuing” the permits required to let it resume its operations in the country.

Bybit claims 50 million users internationally. It’s not known how many of these are in Malaysia, but a Discord channel associated with the exchange has more than 100,000 members.

Warning shots

The action against Bybit is part of a push by the SC to bring exchanges under its supervision, Mohammad Raafi Hossain, CEO of crypto firm Fasset, tells MONIIFY.

The indications are that Bybit will swiftly apply for a license, he says. But it’ll likely have to jump through more hoops or face more scrutiny than if it had applied prior to launching operations in Malaysia.

Fasset is a regulated money broker and credit token business in Malaysia’s Labuan Financial Services Authority. Its operations in the country don’t compete directly with Bybit’s as Fasset is focused on Shariah-compliant tokenized asset services.

The stablecoin curveball

So what’s making licensing tricky? Stablecoins — or rather, the lack of them.

Unlike Dubai’s Virtual Asset Regulatory Authority or Indonesia’s Commodity Futures Trading Regulatory Agency, the SC doesn’t allow Tether’s USDT or Circle’s USDC on regulated exchanges.

Most platforms feature stablecoins for trading pairs and settlements, Hossain says. This means reworking an exchange’s systems to prioritize direct fiat-to-token flows — like Bitcoin, Ether or any other SC-approved tokens — before getting the green light.

Read more: Crypto’s big year: The laws, politics, and tech setting the stage for 2025

A wake-up call

Cryptocurrencies are legal and regulated as securities in Malaysia, but the country’s central bank doesn’t see them as legal tender — official money recognized for payments — and crypto firms are subject to income tax laws.

The enforcement action on Bybit isn’t Malaysia’s first swipe at crypto. Earlier this year, tax authorities cracked down on unreported crypto gains, and just last week, the SC banned Atomic Wallet from operating in the country.

Though Bybit’s future hinges on how fast it can get its paperwork in order, traders can still turn to six fully licensed exchanges.

As the SC warned, investors should stick to “recognized market operators,” reminding Malaysians that unlicensed platforms offer no legal protection.

For both investors and crypto exchanges, play by the rules — or risk getting played.

Edited by Tim Hume and Amitoj Singh. If you have any tips, ideas or feedback, please get in touch: talk-to-us@moniify.com