Cryptopreneurs could be rolling in more money soon, with massive cash injections expected for the industry this year.

Venture funding to crypto boomed in 2021-2022, but was gut punched by market crashes, regulatory crackdowns and the ChatGPT-powered AI craze stealing the thunder.

Let’s be clear. AI is still the darling of VCs, pulling in $131.5 billion in 2024 alone, according to PitchBook. That’s one out of every three VC dollars that was invested globally in 2024 going to an AI startup.

And that trend’s unlikely to slow down, especially from VCs chasing quick returns, Ben Kurland, CEO of blockchain research DYOR Labs, tells MONIIFY.

Even so, insiders tell MONIIFY that over $50 billion could flow to crypto-related projects this year, fueled by the Trump effect, fresh investor confidence, clearer global crypto rules, and opportunities in high-growth markets hungry for blockchain innovation.

Read more: Crypto’s big year: The laws, politics, and tech setting the stage for 2025

Taps back on

Which would be a massive uptick from the lean pickings of the past couple of years.

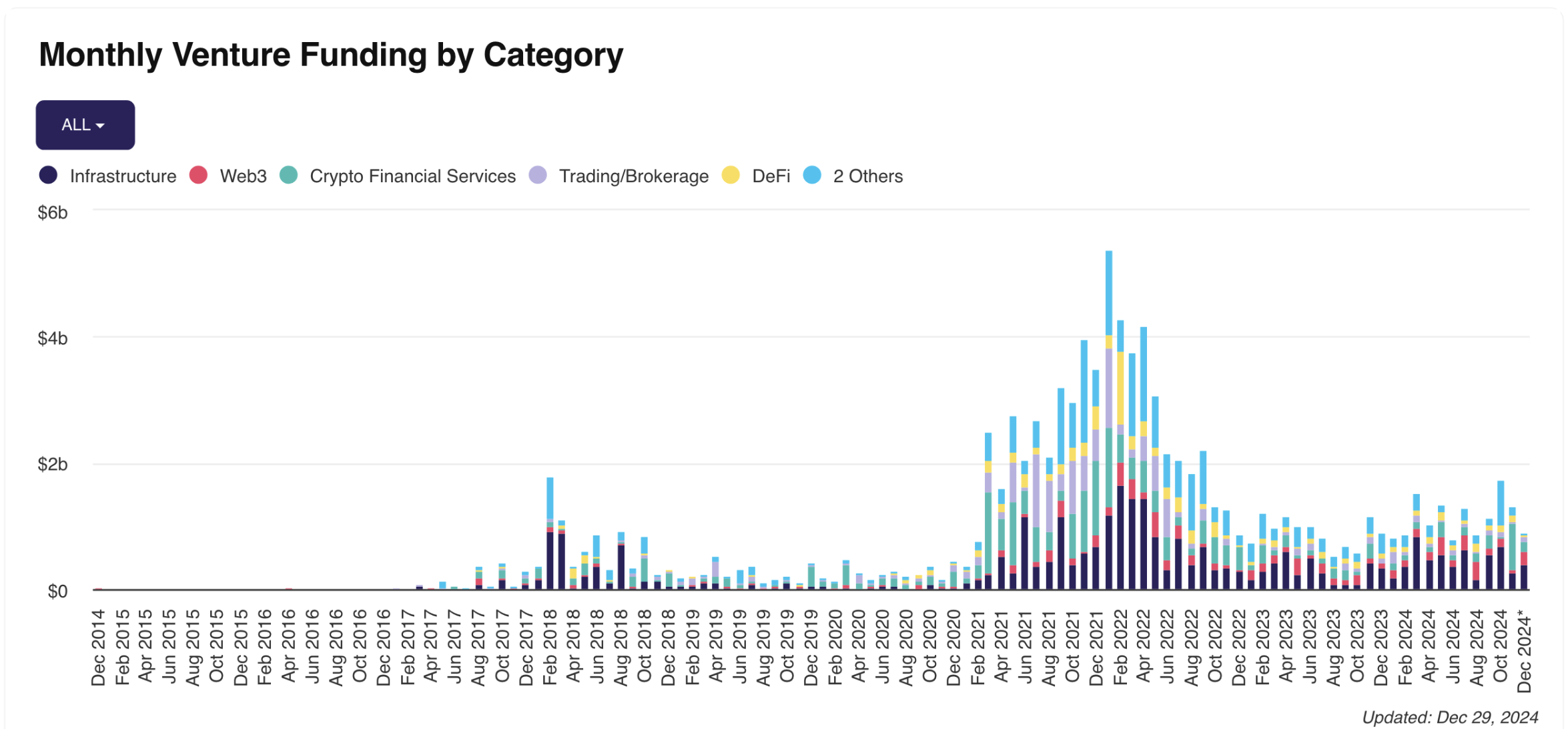

VCs pumped $13.7 billion into crypto and blockchain startups in 2024, according to The Block. That was up 28% from the previous year’s $10.7 billion — but still a steep drop from the peak of $33.3 billion seen in 2022, and $29 billion in 2021.

While the last bull cycle saw six quarters with funding above $5 billion — including one peaking at $10 billion — the bearish past couple of years saw an average of just $2.5 billion a quarter.

But things are looking very different now. VC funding in crypto could “easily” be back in multiples of tens of billions, Animoca Brands chairman Yat Siu tells MONIIFY.

Crypto’s currently a $3 trillion market, and hitting $5 trillion this year isn’t out of the question. Getting there, though, will need $50 billion to $100 billion in funding, says Siu.

Ambitious? PitchBook analyst Robert Le tells MONIIFY that a $5 billion per quarter will be the benchmark for telling if funding’s really back.

$$$ for emerging markets

And it’s emerging markets, especially those with lighter regulations and no legacy tech hurdles, that are poised to benefit the most, Jasper De Maere, research lead at Web3 accelerator Outlier Ventures, tells MONIIFY.

Southeast Asia and Latin America are primed for growth due to their lower funding base, says PitchBook’s Le.

And countries like India, Thailand and Argentina — with high crypto adoption, educated tech workforces and good internet accessibility — could benefit most if they focus on global-scale projects, especially if supported by favorable regulatory environments, Jesus Perez, CEO of crypto co-working hub Crypto Plaza, tells MONIIFY.

Silver lining

But crypto’s recent funding slump could also have an upside for the sector — in that the reduced amount of hype has made the job a little easier for VCs in picking the best projects.

That’s a problem that AI, surrounded by a fog of hype, is contending with right now. Industry figures are concerned the buzz is leading to inefficient spending in AI, and is making finding the winners harder, according to Playbook.

Sectors to watch?

So, amidst the predicted correction around the AI hype, which branch of crypto will bear the fruit?

Experts are looking at stablecoins, AI-crypto hybrids, and decentralized physical infrastructure networks as this year’s top VC picks.

Stablecoins, a $200 billion market, are driving innovation in cross-border payments, real-world asset integration and DeFi, Sagar Barvaliya, general partner at Blockchain Founders Capital, tells MONIIFY.

AI agents are getting some love, too, with their potential to automate social and economic online activity with user-focused or autonomous systems, says Outlier Ventures’ De Maere.

As for DePIN? The hype may have subsided a little around what was one of last year’s hottest VC trends, but it’s still looking hot. It uses blockchain to run physical infrastructure like wireless networks, rewarding users with tokens. The market, already attracting over $1 billion in funding, could hit almost $4 trillion by 2028, according to crypto research firm Messari.

What’s clear is that the VC funding taps are going to be running again in 2025. As for which bets turn out to be the winners? Watch this space.

Edited by Amitoj Singh and Tim Hume. If you have any tips, ideas or feedback, please get in touch: talk-to-us@moniify.com