’Tis the season retailers live for. 🛍️ 💸

The last three months of the year, or the “golden quarter,” is when many rake in more than 30% of annual sales and up to half of yearly profits, S&P Global says. For stores selling electronics, clothes, jewelry, toys and other “discretionary” stuff, Black Friday (today) onward isn’t just sales season — it’s survival season.

S&P Global expects US holiday sales growth to slow to 3% this year, down from 2023’s 4.7% and below the 10-year average of 5.3%. Europe and China aren’t faring much better, with slowing economies and high prices making shoppers more cautious this holiday season.

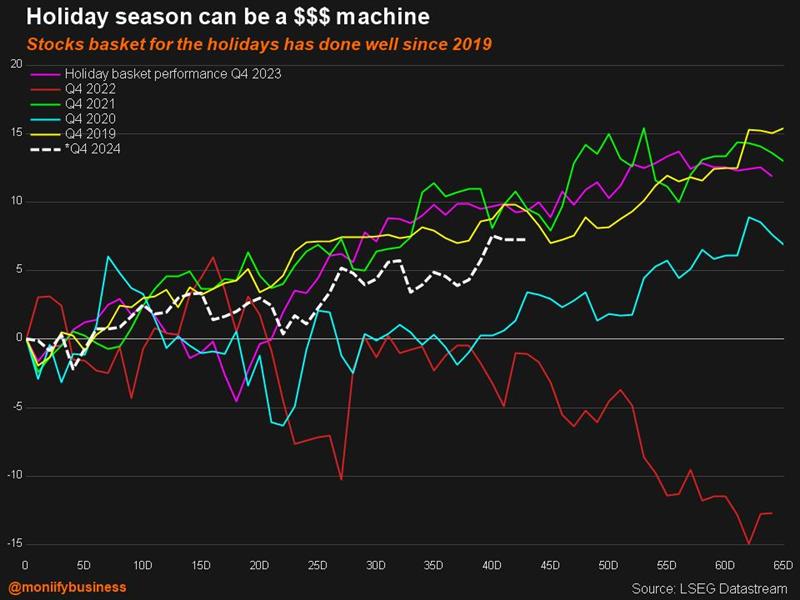

Still, the spending isn’t stopping entirely — and where there’s spending, there’s $$$ to be made. Look at the holiday basket below, it’s got a solid record. (Except for 2022 when the whole market was crashing.)

So, you want to invest in the winners? Think US retailers. Some of the best plays in that basket: Apple ($AAPL), Chewy ($CHEWY), Amazon ($AMZN), Walmart ( $WMT), Etsy ($ETSY) and Delta Airlines ($DAL).

They are all on Morgan Stanley’s list to watch and are ranked overweight by the Wall Street banking giant. Other holiday stocks on the list include United Airlines and brands like Gap and Warby Parker.

So, what’s topping the real shopping lists?

- Toys, apparel and footwear, says a Morgan Stanley Research AlphaWise survey, largely because consumers are expecting higher prices due to inflation.

- Consumer electronics and home appliances, on the other hand, are taking a backseat. Among those planning to spend less overall, 39% point to shrinking incomes as the reason.

- And the HOT products in 2024’s holiday season? Bluey toys, smartphones, Bluetooth headphones, MGA’s Miniverse and Call of Duty: Black Ops 6, according to Adobe’s 2024 Holiday Shopping Trends report.

There’s more

It’s not just individual stocks that are worth keeping an eye on tho.

The week after the Thanksgiving holiday tends to see the S&P 500 index drop – it happens 67% of the time. But through year-end, it tends to flip the script, climbing 75% of the time with an average return of 1.38%, Bank of America says. This suggests “a buy the post-Thanksgiving-dip ahead of a year-end rip pattern,” Stephen Suttmeier, the bank’s technical research strategist, says in a note.

Out of gift ideas? ChatGPT has some for you…