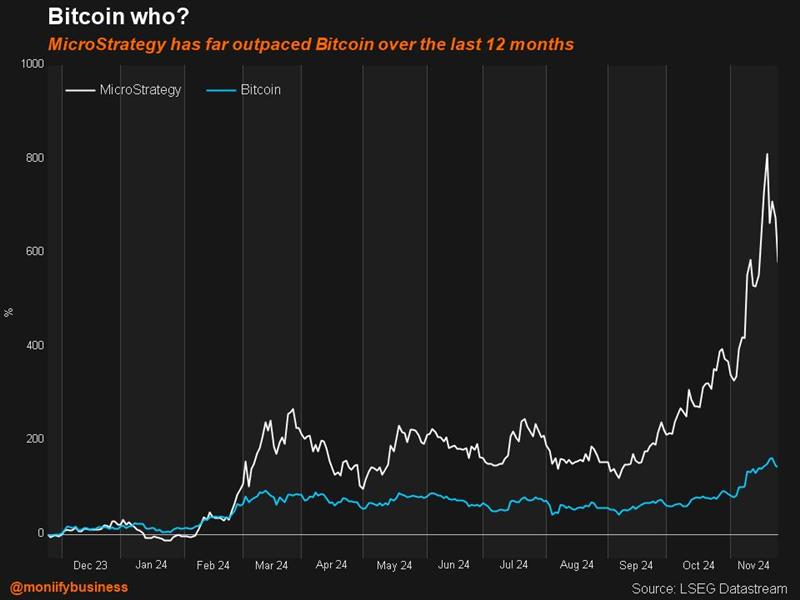

This US software company’s stock has shot up 416% this year — more than four times the jump in the OG crypto. 🤑🚀

Even crazier? It’s left meme king Dogecoin eating dust.

Why the comparison? Because MicroStrategy is not just a “software company” like its homepage suggests. All it’s really doing is borrowing and raising cash to load up on Bitcoin.

MicroStrategy holds so much Bitcoin that individual investors treat it LIKE Bitcoin.

Just last week, it bought 55,500 Bitcoins for $5.4 billion in cash, bringing its holdings up to 386,700 tokens. And it doesn’t end there. MicroStrategy has a goal of raising $42 billion over the next three years to buy more BTC.

And here’s the funny bit: while its software business pulls in around $500 million a year, MicroStrategy’s market value is pushing $72 billion. That’s a wild, wild gap, which…

Doesn’t add up

- MicroStrategy currently holds $36.2 billion worth of Bitcoin – or near 2% of the world’s supply! (That explains its hefty valuation).

- Take Bitcoin out of the equation, and what’s left of MicroStrategy’s market value? About $36 billion for a tiny software business. WHAT? 🤯

- Digital assets (basically Bitcoin) make up over 80% of its total assets. Oh, and it’s sitting on $4.2 billion in debt. That’s eight times its revenue.

Too hot to handle

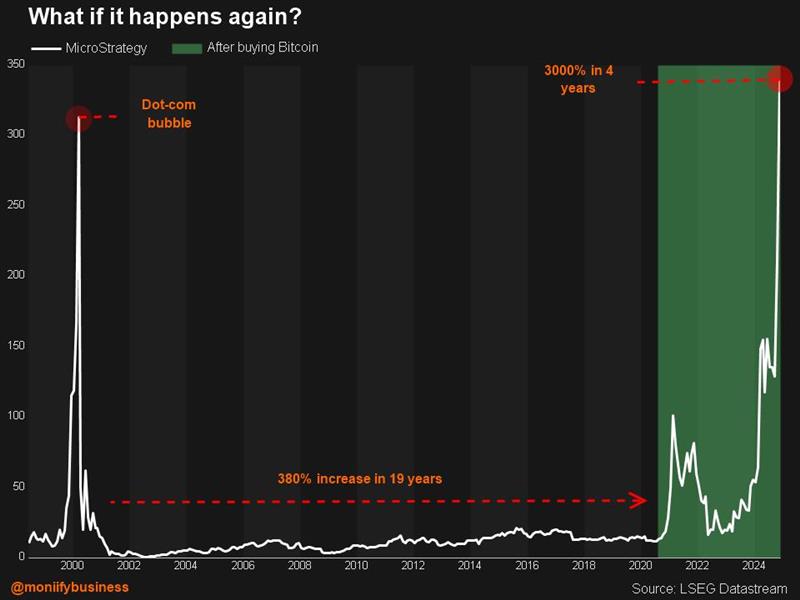

MicroStrategy’s stock closely followed Bitcoin’s performance for years, until it broke out with wild gains earlier this year. No one’s quite sure what sparked the surge, but one thing’s clear: this stock isn’t for the faint-hearted.

Its 90-day volatility sits at 101%, higher than Nvidia’s 56% and Tesla’s 72%. And, honestly, it’s starting to look more volatile than Bitcoin itself.

Even short-seller Citron Research, which used to be one of the biggest bulls re: the stock, flagged last week that $MSTR is now detached from Bitcoin fundamentals. While Citron remains bullish on Bitcoin, “we’ve hedged with a short $MSTR position,” the short-seller says in a post on X.

MicroStrategy didn’t respond to a request for comment on Citron’s statement.

Bitcoin lite? Not really

If Bitcoin’s flying high, so is MicroStrategy. But if the OG crypto tanks? It’s gonna get ugly.

Last year alone, Bitcoin swung between $17,000 and $40,000 (volatile, much?). Still, it helped MicroStrategy squeak out a modest $429 million profit in 2023.

Every year since 2020, MicroStrategy’s been in the red — especially 2022. That year was brutal for crypto, with TerraUSD blowing up and FTX collapsing, taking the whole sector down with it. MicroStrategy? It posted a whopping $1.5 billion loss.

It’s already down more than 25% in the past week, while Bitcoin’s only down 3%! Michael Saylor’s still chilling, it seems… but for how long?

Pick or Pass?

The stock is running so fast that it’s already zoomed past analysts’ 12-month price targets. Which means there are plenty of investors out there who believe in this stock.

One of the highest price targets for MicroStrategy stock is $570 from the San Francisco-based brokerage BTIG, which cites “ease of access, downside protection, access to capital markets” among several factors that make $MSTR the “best vehicle to gain exposure to Bitcoin.”

The brokerage didn’t respond to a request for clarification on how these factors specifically set MicroStrategy apart from other Bitcoin-related investments.

So ATM, with plenty of Bitcoin ETFs around, investing in this particular Bitcoin knockoff is a question of risk appetite. Can you stomach the ride?