If you feel like you’ve missed out on the $$$ after Donald Trump’s win, calm yourself. The real Trump trade might still lie ahead.

Trump’s taste for tariffs, deregulation as well as outright hate for all things “woke” like, um, climate change, will affect how the US economy – the world’s largest – performs over the next four years (and even beyond). His policies will decide how fortunes will be made or lost.

The election win has already triggered wild moves across some stocks and asset classes over the past few weeks, with gains by Tesla stock and DOGE giving major FOMO to anyone who decided to sit this out.

But these trades and early gains were never about fundamentals, and they’re losing steam. It’s the longer plays that matter.

Go long, go small

- Bank deregulation is expected to be a key theme under Trump, making financials the go-to play: think JP Morgan, Bank of America or ETFs like the Financial Select Sector SPDR Fund. In the past four weeks, financial ETFs have seen their biggest inflows since early 2022, BofA data shows.

- Don’t sleep on small caps. Trump’s tariffs on foreign goods could help local companies gain market share. In fact, fund managers in a recent BofA survey said they expected US small caps to be among the top performers globally in 2025.

- Just sticking with the S&P 500 is also a solid move. Even after the recent rally, stronger growth, tax cuts and deregulation could drive more gains in US stocks, Lombard Odier says.

- The SPDR S&P 500 ETF is up 4% since the elections — it’s not flashy but a steadier and less volatile option compared to single stocks that skyrocket and then come crashing down when the hype is over.

Read more: S&P 500 and the bull run that just won’t end.

Holiday vibes

Goldman Sachs’ trading desk sees US stocks rallying this week into the end of the year, with the S&P 500 hitting 6,200 points. Euphoria from retail traders is accelerating across stocks and cryptocurrencies, according to Goldman, and the big gains seen this year may even push this group of investors to increase leverage.

“I don’t think that many will be eating turkey on Thursday and then shorting the S&P,” Scott Rubner, the bank’s managing director for global markets, says in a note to clients.

A wave of $$$ has gone into US stocks in the three weeks since the US elections, and there appears to be “major” FOMO among investors, Rubner says. This has led to increased exposure to financials, industrials, energy and transportation.

Such rallies usually roll into early January during election years, only to fizzle out just before Inauguration Day.

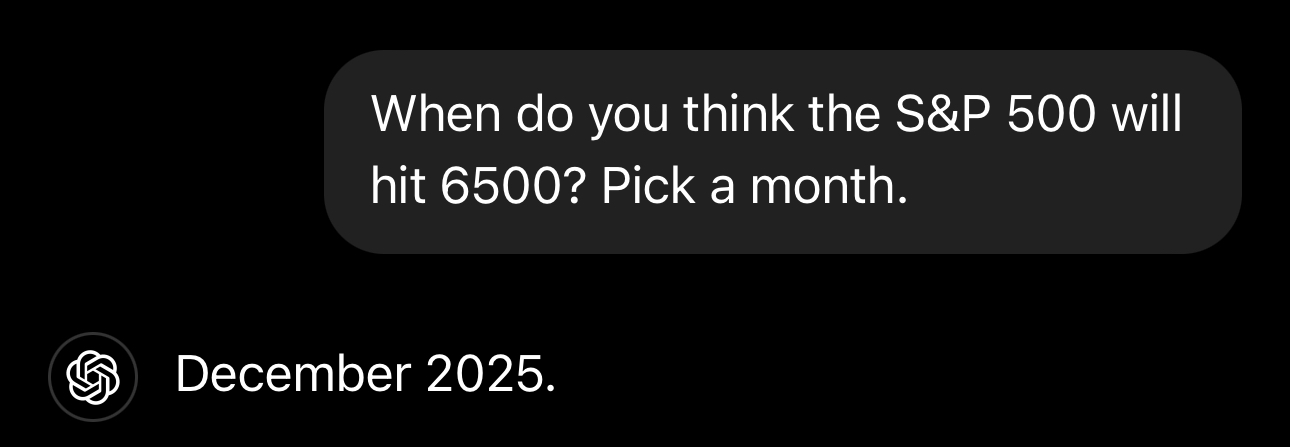

ChatGPT corner