Swiggy’s IPO served up a hot 17% gain right out the gate — sweet, right? But let’s cool our jets, folks. It’s time for a MONIIFY hype check.

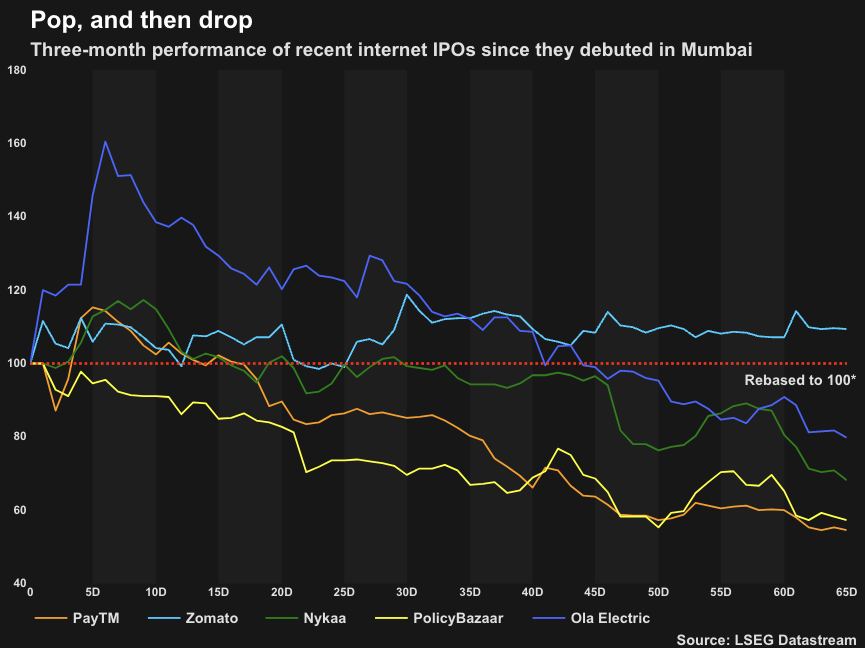

Indian internet stocks are notorious for their post-IPO nosedives — the shares of Ola Electric, Paytm and Nykaa are all trading below their listing prices.

The problem? While IPO pump-and-dump hustlers are busy hyping up India’s digital growth story, the real players — long-term investors who fuel actual bull runs — are eyeing something a little less glamorous in the Indian tech ecosystem: profits.

What’s worse? The broader market’s going through a slump. The Sensex, after peaking in September, has skidded 10% since.

Uphill Battle

Swiggy’s got its work cut out, as it goes head-to-head with market leader Zomato and deep-pocketed Zepto.

Zomato’s valuation has doubled since its 2021 IPO and it’s even turning in profits now. Who would’ve thought? And Zepto just casually raised more than $1 billion earlier this year.

Swiggy? It’s still chasing those elusive profits, after a $283 million loss last financial year (though the bleeding is slowing down).

- Swiggy’s IPO was 3.6 times oversubscribed, but that’s nothing compared to Zomato’s frenzied 38x.

- Plus, most of the IPO cash is lining the pockets of Swiggy’s existing investors, not fueling new growth.

To make matters testier for Swiggy, Zomato is making big money moves again: it’s looking to raise another $1 billion for its war chest.

Who would you choose: Swiggy or Zomato?

Primed for growth?

Swiggy commands 37% of the market, just a hair behind Zomato’s 39%, locking the two into a duopoly that should mean steady growth, and maybe even profits someday, JM Financial analysts say.

Macquarie’s analysts agree. If Swiggy were to tweak the right levers at Instamart, its quick-commerce arm, the stock could shoot up by more than 50% in a best-case scenario.

Price targets for Swiggy are all over the map, so predicting where it’s headed next is like throwing darts blindfolded.

But given the outlook and entry barriers in the business, Swiggy is here to stay, Kranthi Bathini of WealthMills Securities, tells MONIIFY. Profits, if and when they do start rolling in, will decide how smooth its ride is.