Tech stocks are sitting pretty – maybe too pretty for your pocket.

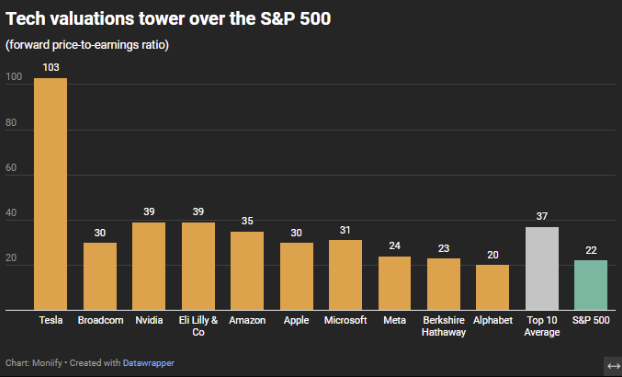

The S&P 500’s top 10 stocks by market cap – mostly tech giants – have an average forward price-to-earnings ratio of 37 times, 68% pricier than the S&P 500. Even after a summer dip, traders are still splurging $$$ and keeping valuations elevated.

But even with solid fundamentals backing some of these names, it’s hard to justify valuations this high when AI spending hasn’t delivered the promised payoffs, and Big Tech’s third-quarter earnings were more of a letdown than a showstopper.

It’s not all bad though. Alphabet looks like a steal, with a forward P/E ratio of 20 – a reasonable price in a sea of sky-high valuations. Then there’s Tesla… one that’s in a galaxy of its own. At a whopping 103x valuation, it’s the priciest tech stock on the board, pumped up by recent hype around Trump and Musk after a mostly flat year.

That bromance is really something, but it doesn’t do much for Tesla’s fundamentals. Third-quarter deliveries and earnings weren’t terrible, but they’re nowhere near what’s needed to justify this kind of valuation.