Will it go from meh to ouch for markets?

Apple brought down the curtains on a disappointing earnings szn for Big Tech, with some forgettable results and outlook of its own.

And now the focus turns to Friday’s US jobs data – and, again, the forecast isn’t popping. 😵

The expectation is that just 114,000 new jobs were added in October, a steep drop from September’s 254,000 number. These predictions are far from gospel but economist Claudia Sahm says a decline wouldn’t be shocking, thanks to the recent hurricanes and the strike at Boeing: “Jobs day will likely be messier than usual.”

With the numbers dropping days before the US election, the stakes are high. Albert Edwards, a global strategist at Societe Generale, says poor economic data released days before the election “can really hurt the incumbent.”

- The options market is pricing in a move of around 1.4% in either direction for the S&P 500 on Friday.

- The VIX, Wall Street’s “fear index”, has entered the “danger zone”, which hints at a market vulnerable to sharp swings.

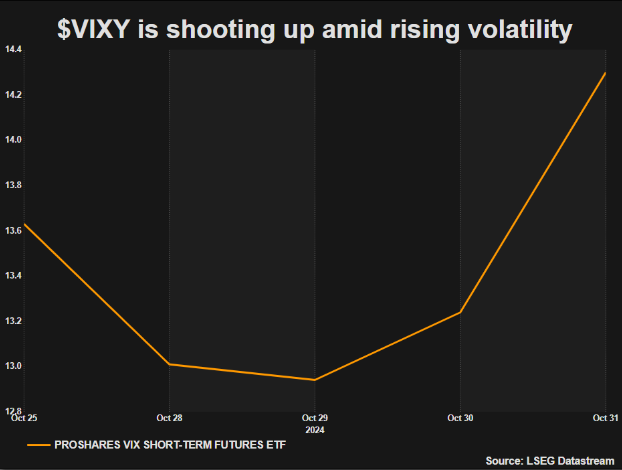

- $VIXY, the ETF flagged earlier this week, is up nearly 10% since Monday, signaling that investors are piling in to hedge against any potential turbulence.

The next meal

Once markets digest Friday’s jobs numbers and the Big Tech earnings week, the focus shifts fully to the US election next week.

It’s still a nail-biter: Kamala Harris holds a slight lead over Donald Trump, though betting markets are tilting towards a Trump win. That means one thing for markets: uncertainty and with it more volatility. Can you see a pattern here?

The good news? This should settle soon. Since 1930, the stock market has averaged 8% returns annually in non-election years, compared to 6.2% in election years, according to JP Morgan Wealth Management.

For the post-election play, we’ve rounded up the ETFs to watch. Here’s your one-stop shop for navigating the months after the ballots are in.