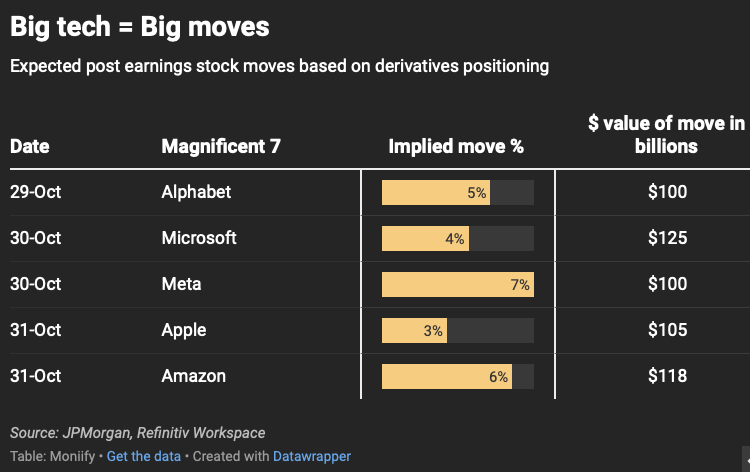

Big Tech earnings szn is back and the moves just keep getting bigger ($100 billion swings are now just the baseline).

Tesla set things on fire last week with a stock move three times bigger than what the market had foreseen after reporting its earnings. Now, the rest of the Magnificent Seven are expected to shake things up with similar-sized swings.

We’ve seen this before.

Big Tech always manages to beat expectations, even when they are sky high. BUT, this time, the stakes are even higher.

When stocks are this pricey, only blowout results will cut it. Just “meh” or even “good” numbers won’t be enough. Anything less than stellar could send the market into a total tailspin. 😱😱

(Just think back to Meta’s epic flop in early 2022, or Nvidia’s 10% slump even after revenue more than doubled last quarter!) The moves could be straight-up wild.

Just too big

- The stakes are high – these seven tech giants represent roughly 30% of the S&P 500’s market capitalization and 45% of the Nasdaq.

- Revenue growth at these companies is slowing and any signs of a further slowdown would only make things worse.

- The average growth expected at these companies, excluding Nvidia, is 12%.

Ads a lot

The first reading on Tuesday will be on ad spending trends, which could also send a signal about Meta, which reports the next day. Analysts at US brokerages WedBush and Piper Sandler say the ad market has been strong due to US elections-related spending.

One good thing about Alphabet is that it’s the cheapest stock among the Mag 7, trading at half the valuation of its peers. There is room for a little cheer here if things go well. In comparison, Meta’s valuation is a bit stretched.

Windows to AI

Investors are closely watching whether the billions of dollars invested in AI are finally making money. Short answer: No (except for Microsoft, where again it’s just a paltry $1 billion a quarter).

At this point, we don’t know conclusively whether, say, Meta’s AI personas on Instagram or Apple Intelligence on iPhones will boost core businesses. Add to that, a slowing cloud business that has long been a cash engine for Microsoft, Amazon and Google.

Apple is all about the demand trends for the iPhone 16, though this quarter only includes two weeks of sales. All eyes are on the outlook for its phones and updates on Apple Intelligence.

At Amazon, shopping is its Achilles’ heel. AWS has done more than its bit to hide the drag on Amazon’s e-commerce business created by Temu.

In a nutshell, it’s not just about beating market expectations – the devil is in the details. Post earnings analyst calls and the outlook for AI or spending matter more than the sheer $$$ in a press release.