Betting aggregator Oddschecker shows Donald Trump has a 55% chance of winning the presidential race next month.

If that happens, stocks could soar given his pro-Big Tech stance, like for fewer regulations and potential tax cuts.

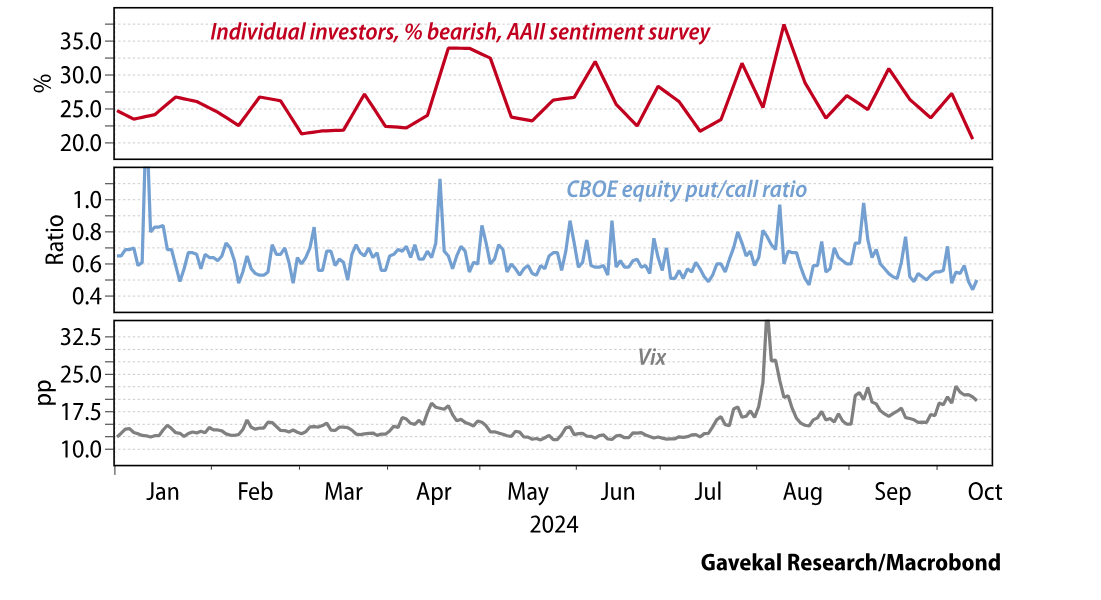

Even Tan Kai Xian, the US analyst at Gavekal Research, says investors seem to be gearing up for a surge in stocks because of that. The market “could be set for a fall should other election outcomes play out.” 🤯

Balance yo’self

- Morgan Stanley says volatility usually spikes through October in election years but tends to settle down by November.

- Cyclical stocks might be your best bet in the months ahead (think industrials like GE or Honeywell, financials like Bank of America or JP Morgan, and energy stocks like Exxon Mobil or Chevron).

- UBS analysts recently cautioned against making any rash moves as the election gets closer. If you’re too tech-heavy, it might be smart to balance that with healthcare or consumer stocks with strong balance sheets.

- Gavekal’s Tan suggests gold and bonds. Gold could rise even higher if US stocks slip, despite its strong two-year run, while short-dated US government bonds might help cushion any stock pullback.

If you don’t take Oddschecker seriously, forex markets are also gearing up for a Trump win. A report suggests that hedge funds are ramping up bearish positions against currencies from the Chinese yuan to the Mexican peso.

These bets suggest markets are readying themselves for potential tariffs.

Our Harris vs. Trump baskets

Since Joe Biden stepped out of the running in July, the stocks in the MONIIFY Kamala Harris basket have mostly taken a hit, especially renewable energy names like First Solar and SolarEdge Technologies.

Over in the Trump basket, stocks saw modest to significant gains during the same period. MONIIFY did a deep dive on each basket last month. Given all this, is it better to be safe than sorry?

The outlook gets murkier if you consider ChatGPT’s prediction: